People want to invest in the US equity market, but they are looking at other sector groups — those that offer relative value versus yesterday's leaders. As a result, while the Dow Jones managed to record a Santa Claus rally, the best since 2021-2022, the S&P 500 failed to do so for the third year running.

S&P 500 Santa Claus Rally Dynamics

Goldman Sachs calls 2026 a year of micro?rotation due to extreme concentration and the evolving trade in artificial intelligence technologies. According to the bank, the top 10 stocks accounted for 41% of market capitalization and 53% of the S&P 500's return in 2025. At the same time, the giants continue to move the market: NVIDIA's statement of more optimistic revenue forecasts allowed the broad index to hit new records. In October, the world's largest company projected revenue of about half a trillion dollars.

Despite the S&P 500 missing the Santa Claus rally, investors look to the future with optimism, especially at the start of the year. Since 1929, the US stock market has risen in January about 60% of the time.

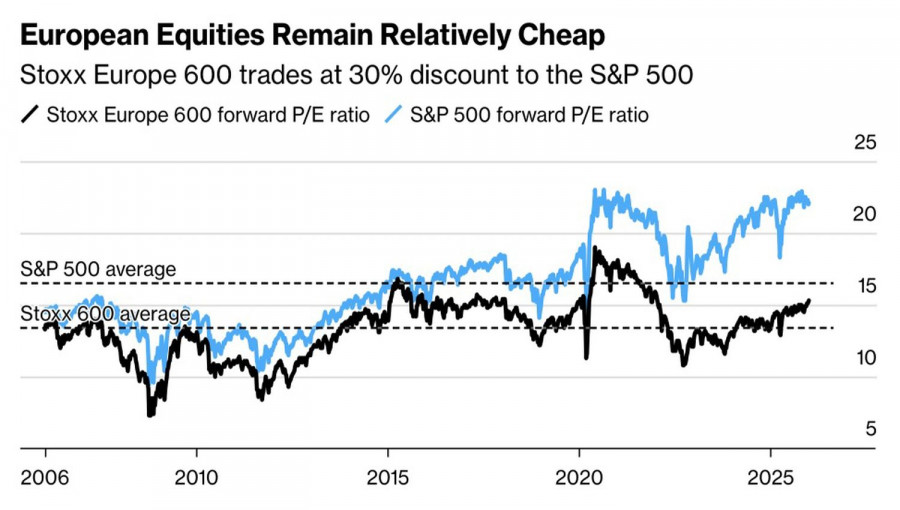

At the same time, Goldman Sachs expects Europe to outshine the United States again next year. The bank forecasts a rally in the EuroStoxx 600 to 625, about 4% above current levels.

P/E Dynamics of European and US Equity Indices

A flow of capital from the more richly valued US equity market to Europe would be an obstacle to the S&P 500 reaching new record highs, especially against the backdrop of a potential slowdown in the US economy and a prolonged pause in the Fed's easing cycle. According to Richmond Fed President Thomas Barkin, current monetary policy is close to neutral — neither stimulating nor restraining the economy. That means it is still too early to return to cutting the federal funds rate.

However, investors remain optimistic about the outlook, particularly at the start of the year, when there is much talk of a transfer of capital from money market funds holding $7.6 trillion into US equities. If that happens, the seasonally strong January factor will be fully in play. The S&P 500's rally may continue, supported by low volatility in equity indices. The VIX fear index is trading at its lowest levels since late 2024.

It is quite likely the S&P 500 will move in a "two steps forward, one step back" mode in 2026. The external backdrop looks less favorable than before. Nevertheless, greed tends to visit the market more often than fear.

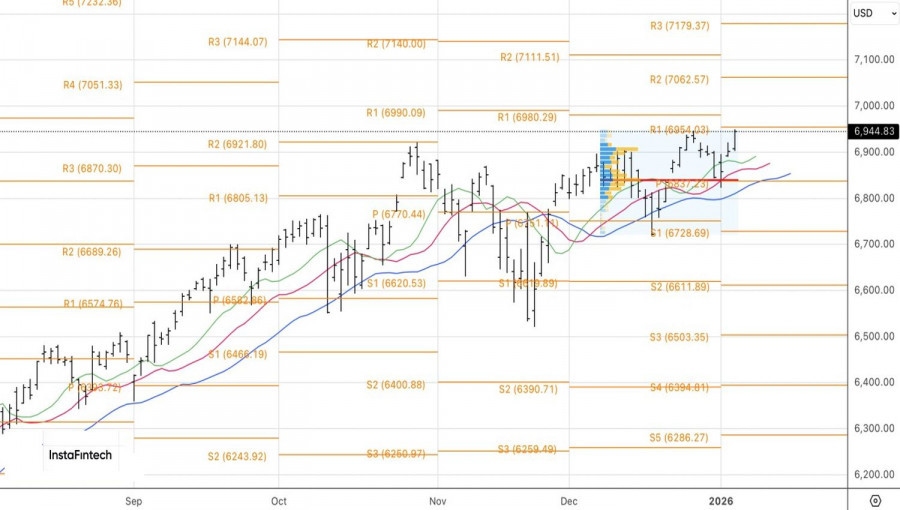

Technically, the daily chart shows that the broad index is regaining its upward trend. Long positions opened at 6,840 and above in the S&P 500 should be held and periodically increased. Target levels are 7,050 and 7,150. At the same time, the bulls' inability to push quotes above the resistance level of 6,980 would signal their weakness and activate the Three Indians pattern.