Trade Review and Tips for Trading the European Currency

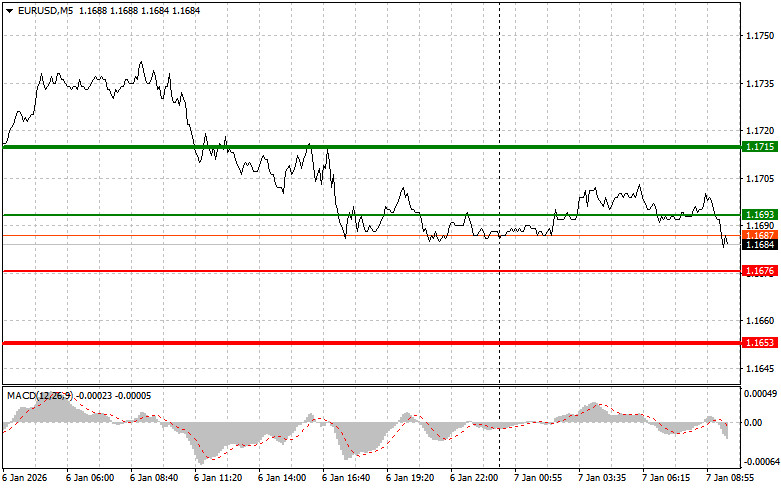

The test of the 1.1704 price level occurred at the moment when the MACD indicator was just beginning to move downward from the zero line, which confirmed a correct entry point for selling the euro. As a result, the pair declined to the 1.1685 level.

Despite the fact that the U.S. services PMI showed a slight decline, the U.S. dollar nevertheless managed to strengthen its position against the euro.

Today, in the first half of the day, data on the change in the number of unemployed in Germany, the unemployment rate, as well as the eurozone Consumer Price Index for December are expected. These figures can significantly affect the balance of power in the market. Such data usually have a noticeable impact on traders, and today will be no exception. A low unemployment rate in Germany, the largest economy in Europe, would signal economic stability and have a positive effect on the euro. Conversely, an increase in the number of unemployed could trigger concerns about slowing economic growth and weaken the euro. As for the eurozone CPI, it is a key inflation indicator. A high CPI (which is unlikely) could push the European Central Bank to keep interest rates unchanged for longer. A low CPI, on the other hand, could raise concerns about deflation and prompt the ECB to introduce stimulus measures, putting pressure on the euro.

In addition to the figures themselves, how the markets interpret them will also be important. For example, if the CPI turns out slightly above expectations but signals emerge that inflation may slow in the future, the market reaction may be muted. Conversely, even a small deviation from forecasts accompanied by negative comments from policymakers could trigger significant market movements.

As for the intraday strategy, I will rely primarily on the implementation of scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: Today, buying the euro is possible if the price reaches the 1.1693 level (green line on the chart), with a target of growth toward 1.1715. At 1.1715, I plan to exit the market and also sell the euro in the opposite direction, targeting a move of 30–35 points from the entry level. A rise in the euro can be expected after strong data.Important: Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1676 price level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1693 and 1.1715 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1676 level (red line on the chart). The target will be 1.1653, where I intend to exit the market and immediately buy in the opposite direction, targeting a 20–25 point move upward from that level. Pressure on the pair may return today only after very weak economic data.Important: Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1693 price level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.1676 and 1.1653 can be expected.

What's on the Chart

Important:Beginner Forex traders should make entry decisions very cautiously. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly—especially if you do not use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based solely on the current market situation is inherently a losing strategy for an intraday trader.