Akcie společnosti Deckers Outdoor Corporation (NYSE:DECK) prudce klesly poté, co výrobce obuvi zveřejnil slabší než očekávané výhledy na aktuální čtvrtletí, které zastínily lepší než očekávané výsledky za čtvrté čtvrtletí.

Výrobce značek UGG a HOKA oznámil upravený zisk na akcii za čtvrté čtvrtletí ve výši 1,00 USD, čímž překonal odhady analytiků ve výši 0,59 USD. Tržby za čtvrtletí dosáhly 1,02 miliardy USD, což je mírně nad konsensuálním odhadem 1,01 miliardy USD a meziročně o 6,5 % více.

Gold is trading near an all-time high. This year, gold's price performance has been truly impressive: since the beginning of the year, the metal has gained more than 70%, making this year the strongest since 1979. Such growth is driven by heightened demand for safe-haven assets amid ongoing geopolitical tensions and economic uncertainty, as well as strong investment inflows from institutional players.

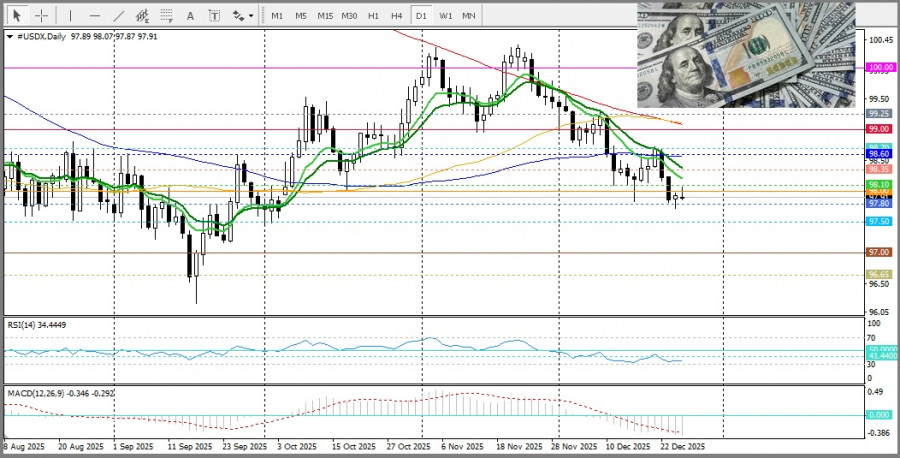

Another significant factor fueling record prices has been the weakening of the U.S. dollar, caused by protectionist rhetoric from U.S. leadership and the easing of monetary policy by the Federal Reserve. In 2025, the Fed cut its key interest rate by 75 basis points. In addition, markets are pricing in two more rate cuts next year. This scenario continues to support strong demand for gold, as low interest rates reduce the opportunity cost of holding non-yielding assets such as precious metals. In the short term, gold may enter a consolidation phase, as the lack of new drivers and year-end profit-taking could put some pressure on the market. However, the primary trend remains upward, suggesting a high probability of continued growth in 2026.

In the short term, gold may enter a consolidation phase, as the lack of new drivers and year-end profit-taking could put some pressure on the market. However, the primary trend remains upward, suggesting a high probability of continued growth in 2026.

Regarding monetary policy, the Fed is expected to keep rates unchanged at its January meeting. Central bank Chairman Jerome Powell noted that the Fed is prepared to wait and assess further developments. The CME FedWatch tool shows only a 13% probability of a rate cut in January. At the same time, by the end of the year the Federal Reserve is expected to resume easing measures due to signs of slowing inflation and weakness in the labor market.

The geopolitical situation remains tense: the ongoing Russia–Ukraine conflict, instability in the Middle East, and rising tensions between the U.S. and Venezuela create additional challenges for the market and support expectations of further gains in the price of the yellow metal.

From a technical perspective, on the daily chart gold is trading in uncharted territory, although the risks of a modest correction are increasing. The RSI (Relative Strength Index) is in overbought territory, showing early signs of fatigue.

The broader bullish structure remains intact, as prices are trading well above key moving averages. On the downside, the $4,430 level could act as the first line of defense, followed by the 9-day EMA and the psychological $4,400 level. On the other hand, gold is poised to set new records.