The wave situation has once again turned "bullish" after the completion of the sideways movement. The last completed downward wave did not break the previous low, while the new upward wave managed to break the previous peak. The news background for the pound has been weak in recent weeks, but the news background in the U.S. also leaves much to be desired. For a week, bulls and bears were locked in a tug-of-war and remained in relative balance, but a week before the New Year the bulls launched a new offensive.

There was no news background on Wednesday, but December news from the U.S. allowed bullish traders to begin a new advance. Due to the holidays, their momentum and activity have slightly faded, but after the New Year the offensive may resume. Much has already been said about reports on the labor market, inflation, and unemployment, so I will draw traders' attention to the GDP report and the FOMC's monetary policy. As everyone knows, the U.S. economy grew by 4.3% quarter-on-quarter in the third quarter, which was significantly higher than market expectations. However, this report provided virtually no support to the dollar. The Fed's monetary policy in January may remain at its current level, but this factor also does not support the bears. In my view, the problem is not that the market fails to see positive factors for the dollar, but that these factors are not actually positive. Economic growth is good when it is accompanied by growth in other economic indicators. In the U.S., however, unemployment is rising, the labor market is weakening, and business activity indices are declining. The fact that the FOMC may leave rates unchanged in January merely indicates that rates will remain unchanged. This is not policy tightening, but simply a pause. Thus, I believe the dollar will continue its downward trend.

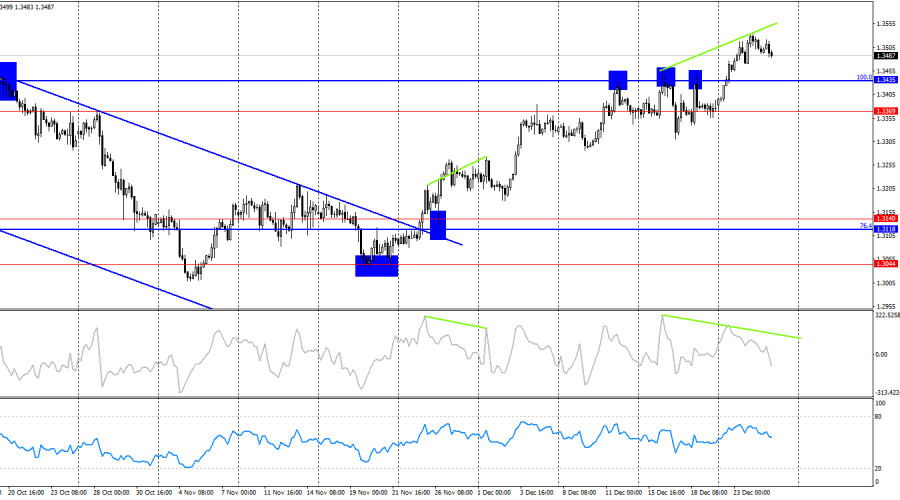

On the 4-hour chart, the pair has consolidated above the 100.0% corrective level at 1.3435, which allows expectations of continued growth toward the next Fibonacci level at 127.2% — 1.3795. A "bearish" divergence is forming on the CCI indicator, which may trigger a reversal in favor of the U.S. dollar.

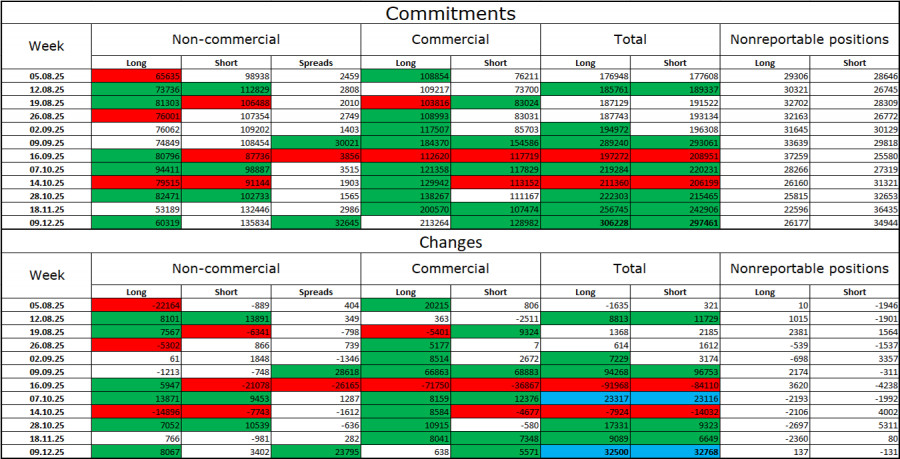

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week. The number of long positions held by speculators increased by 8,067, while the number of short positions increased by 3,402. The gap between the number of long and short positions now stands at roughly 60 thousand versus 135 thousand. As we can see, bears dominated in early December, but the pound appears to have exhausted its downward potential. At the same time, the situation with euro contracts is exactly the opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency periodically enjoys demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp decline in the labor market, and the Fed is forced to pursue monetary easing to curb rising unemployment and stimulate the creation of new jobs. For 2026, the FOMC does not plan significant monetary easing, but at the moment no one can be sure that the Fed's stance will not shift to a more "dovish" one during the year.

Economic calendar for the U.S. and the UK:

On December 26, the economic calendar contains no events. The impact of the news background on market sentiment on Friday will be absent.

GBP/USD forecast and trader advice:

Selling the pair was possible on a rebound from the 1.3533–1.3539 zone on the hourly chart with a target of 1.3470. If this level is broken, short positions can be held with targets at 1.3437 and 1.3362. I can recommend buying on a rebound from the 1.3437–1.3470 level with a target of 1.3533–1.3539.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.