The Bank of Japan raised its key interest rate this morning from 0.50% to 0.75%, marking the highest level in 30 years. As a result, the yield on 10-year government bonds crossed 2% for the first time since 1999, leading to a sell-off in bonds.

The Bank of Japan adopted a relatively hawkish tone, indicating its readiness to continue tightening monetary policy as part of normalization efforts.

Meanwhile, data released just before the BoJ meeting showed that the Consumer Price Index (CPI) for November indicated that annual inflation remained nearly unchanged from October, decreasing from +3.0% to +2.9% for the core index, while the base index (excluding fresh food) remained at +3.0%. The preferred inflation indicator for the Bank of Japan (excluding fresh food and energy) fell from +3.1% to +3.0%.

Overall, the situation differs little from the previous month, and considering the persistently high inflation, the Bank of Japan finally made its long-awaited decision regarding rates, aiming to find a balanced solution. The BoJ also stated that real interest rates are expected to remain significantly negative, as inflation has been above the target level for 44 consecutive months.

The BoJ anticipates that core inflation will fall below the target by the middle of next year, which will help alleviate pressure on real wages, which have been declining for the past 10 months due to high inflation.

The rate hike comes amid economic challenges, as revised GDP data for the third quarter showed a year-on-year decline of 2.3%. However, the Bank of Japan hopes that corporate profits will remain high, enabling wage increases next year.

The decision to raise rates was necessary due to high inflation, and even economic issues could not prevent it from happening. Rising yields above historical norms, combined with a significant debt burden, will increase the cost of servicing that debt and could provoke a crisis, given that the debt-to-GDP ratio stands at nearly 230%. With GDP shrinking, this ratio will increase further, suggesting that Japan may be headed for challenging times.

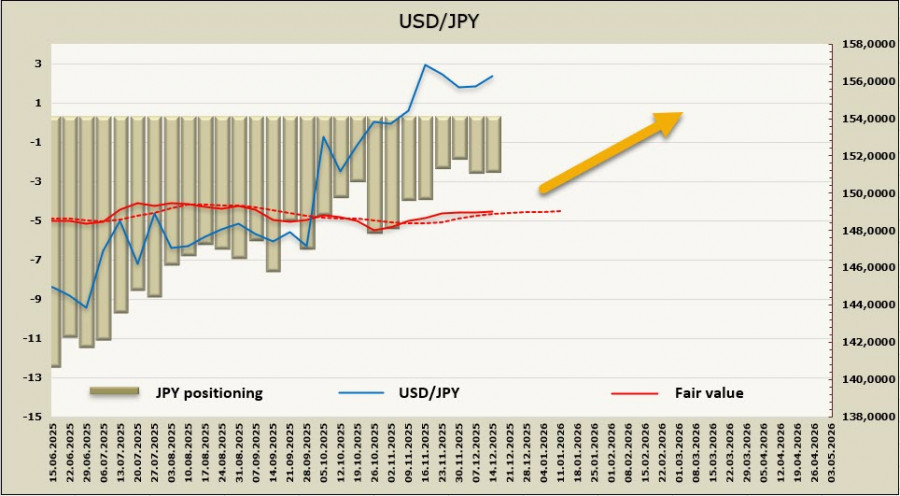

The yen weakened slightly following the BoJ's decision, as it was expected and already priced in. The future path will depend on how the balance of interests is managed. Since Japan's government debt is largely domestic, a strengthening yen could complicate government operations. With the next rate hike unlikely before the middle of next year, representatives of the BoJ believe that the downward pressure on the yen will continue. At the same time, yields are rising, which could push the yen up. Amid a weakening dollar, the yen may begin to strengthen; however, this is unlikely to occur until there are signs of economic growth.

The expected price is close to neutral, with a weak bullish direction. We need to monitor how major players respond to changes in monetary policy.

Last week, we considered the priority scenario to be a decline in USD/JPY to the support level of 153.67, but the drop was weaker than expected, and after the BoJ's rate decision was announced, the pair moved higher instead. Investors may assume that the decision to raise rates will expedite Japan's slide into recession. We do not see long-term prospects for the dollar, at least in the coming months, and therefore expect that the growth will peak near the local maximum of 157.89. There is a risk that this level will be breached, which would shift resistance to 158.89. For stronger growth, additional reasons will be needed. In the medium term, we anticipate a reversal of USD/JPY to the downside.