See also: InstaForex Trading Indicators for EUR/USD

Yesterday marked the beginning of a week packed with scheduled events. Among the most significant reports and upcoming events are the meetings of the central banks of the UK, the Eurozone, and Japan. Market participants will also focus on the release of important macroeconomic data from China, Canada, the UK, Germany, the Eurozone, and the US.

The American economy, meanwhile, shows signs of uncertainty, while the dollar is trading near the 98.00 mark on the USDX index, highlighting ongoing risks of weakening.

Today, delayed labor market data will be released (October/November): unemployment is expected to be around 4.4%, while projections for Non-Farm Payrolls remain unclear. The market expects a slowdown in job creation by the end of autumn. However, this fact has already been factored in by the Federal Reserve during its recent rate-cut decision. Nevertheless, these data could act as a catalyst for changes in the dollar's dynamics.

The first central bank to hold its final meeting of the year this week will be the Bank of England. On the same day, the European Central Bank meeting will take place, and the next day (Friday), the Bank of Japan will hold its meeting.

In this article, we will examine the current situation ahead of the ECB meeting and evaluate the prospects for its monetary policy and the euro.

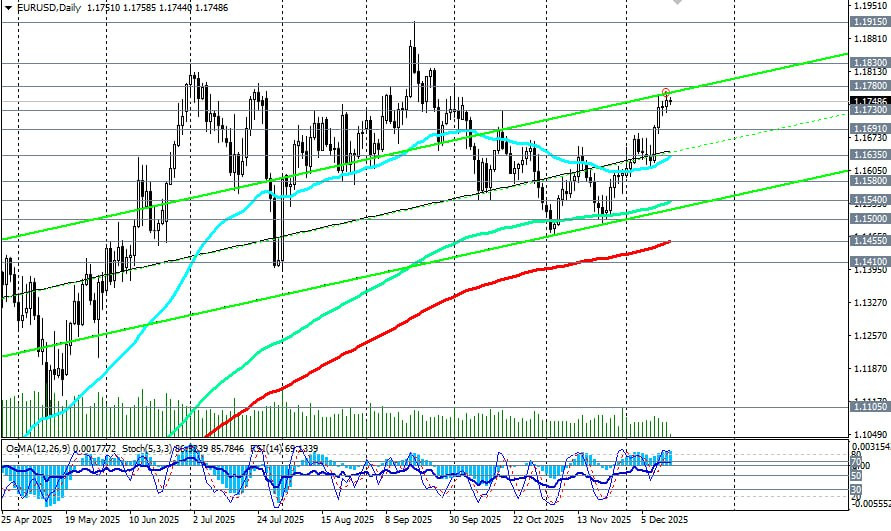

The EUR/USD pair is showing steady gains, recovering from losses and rising to around 1.1750 at the start of today's European session. This rise is due to positive industrial production figures in the Eurozone, which have created favorable trading conditions and strengthened the euro against the US dollar.

Eurostat data showed an unexpected 0.8% increase in October, significantly surpassing market forecasts (+0.1%). The 2% year-on-year increase indicates stable industrial development in the region, which has been a key factor supporting the European currency.

The currency pair is consolidating its gains after a 2% rally over the past three weeks. Investors are supported by the prospect of the US Fed reducing interest rates. While market participants show some caution ahead of important data (US NFP employment reports, CPI), the expectation of replacing Chairman Jerome Powell with a more dovish candidate also weighs on the dollar.

President Donald Trump has made his position clear, emphasizing the need to appoint a new Fed chairman who will consider the president's views when determining the direction of monetary policy.

Ahead of the ECB meeting, preliminary December data on business activity in Germany, France, and the Eurozone will be released today, as well as the final assessment of the European CPI indices on Wednesday.

Economists do not rule out that the manufacturing PMI indices for France and Germany could exceed the forecasted values of 48.2 and 48.5, respectively, while the Eurozone PMI indices may reach 49.9, given that the Eurozone composite PMI previously reached 52.8, remaining in the zone of accelerating business activity (above 50).

It is worth noting that inflation in Germany slowed in November from 0.3% to -0.2%; however, annual growth remained at 2.3%. The harmonized index also showed a decline, dropping from 0.3% to -0.5% month-on-month while rising from 2.3% to 2.6% year-on-year, staying above the ECB's target (2.0%) and deferring potential easing of monetary policy until the end of the first quarter of next year.

On the other hand, the deteriorating growth prospects in Germany (according to the IFO Institute, the country's GDP will shrink to 0.1% in 2025, down from earlier expectations of 0.2%; to 0.8% in 2026 from 1.3%; and to 1.1% in 2027 from 1.6%, influenced by US sanctions on German exports) pose challenges for the ECB in improving business conditions and consequently lowering interest rates.

Increased volatility is expected around the US morning PMI and evening employment data. Overall, the prospects for EUR/USD remain positive due to the ECB's constructive policy and anticipated changes at the Fed.

Opportunities for further strengthening the euro remain, especially amid changing market expectations for future interest rate dynamics. The EUR/USD pair may remain in an upward position, but key data on inflation and employment will determine the direction and outlook of the ECB's and the Fed's monetary policy.