Americký Úřad pro kontrolu potravin a léčiv (FDA) schválil lék na astma od britské farmaceutické společnosti GSK k léčbě některých pacientů s chronickým onemocněním plic, které je běžně známé jako „kuřácké plíce“, oznámila společnost ve čtvrtek.

Schválení rozšiřuje použití léku Nucala jako doplňkové léčby pro pacienty s určitým typem chronické obstrukční plicní nemoci.

K léčbě tohoto onemocnění, které postihuje plíce a způsobuje omezení průchodnosti dýchacích cest a dýchací potíže, jsou schváleny také blockbusterový lék Dupixent od společností Sanofi (NASDAQ:SNY) a Regeneron (NASDAQ:REGN) a inhalační terapie Ohtuvayre od společnosti Verona Pharma (NASDAQ:VRNA).

Nucala od GSK je monoklonální protilátka, která inhibuje interleukin-5, který pomáhá regulovat eozinofily, typ bílých krvinek, které při nadprodukci způsobují zánět plic.

Regulační orgán stanovil termín pro rozhodnutí o tomto léku na 7. května. Schválení však přišlo o dva týdny později.

Jedná se o nejnovější případ, kdy regulační úřad pro léčiva nedodržel termín po hromadném propouštění v rámci rozsáhlé reorganizace federálních zdravotnických agentur pod vedením ministra zdravotnictví a sociálních služeb Roberta F. Kennedyho Jr.

Schválení bylo založeno na pokročilé fázi klinických studií, v nichž pacienti léčení přípravkem Nucala a inhalační udržovací terapií po dobu až 104 týdnů vykazovali ve srovnání s placebem významné snížení exacerbací o 21 %.

„Těžké exacerbace a následná hospitalizace představují velmi velkou zátěž. Cílem je, aby pacienti nemuseli být hospitalizováni, aby byli stabilizovaní a mohli zůstat doma,“ uvedl před schválením Luke Miels, obchodní ředitel společnosti GSK.

Yesterday, stock indices closed lower once again. The S&P 500 fell by 0.16%, while the Nasdaq 100 decreased by 0.59%. The Dow Jones Industrial Average slid by 0.09%.

The US stock market declined as investors reduced risk ahead of the release of key economic data expected to prodive insights into potential future changes in interest rates. Asian indices dropped by 1.5%, as did futures on the S&P 500 index, with traders refraining from taking further action ahead of US jobs data for October and November, expected to indicate weakness in the labor market. The upcoming publication is anticipated to be a defining factor for market sentiment. Weaker-than-expected figures are likely to heighten expectations for further monetary policy easing.

Chinese stocks plummeted to key technical levels as slowing growth in the tech sector and renewed concerns about the country's economic growth fueled a sharp sell-off. European indices are also preparing for a weak opening.

Bitcoin crashed to around $85,000. Oil remains near its lowest level since 2021, and gold declined after five days of gains.

Maybank Securities noted that they were observing a clear trend toward reducing risk. They also mentioned concerns regarding asset valuations, adding that with important macroeconomic statistics, such as jobs data, some funds seemed to be reducing their beta or locking in profits.

The Asian currency markets were also in focus. The yen strengthened against the dollar, falling below 155 ahead of the widely anticipated decision by the Bank of Japan on Friday to raise the key interest rate to its highest level in three decades. The Indian rupee fell to record low levels, with an increasing number of officials advocating for a stronger yuan to help stabilize the Chinese economy.

The yield on 10-year Treasury bonds stabilized around 4.17% after a slight decline on Monday amid speculation that the Fed will cut rates twice next year to support the labor market, despite signs of persistent inflation.

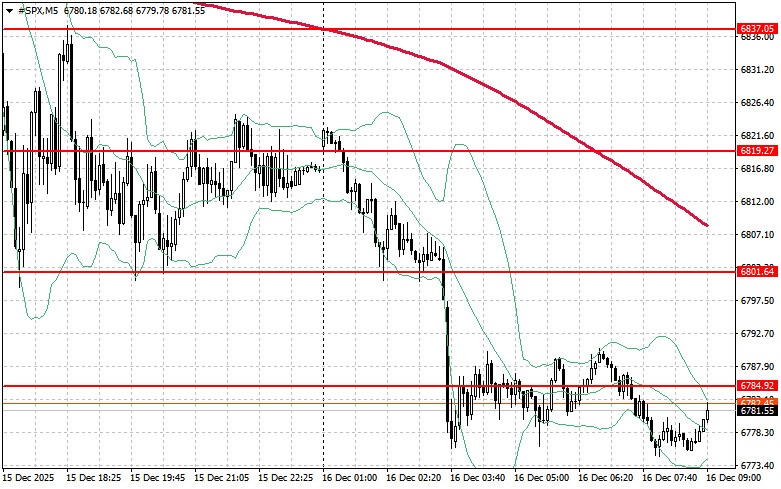

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,784. This will help the index gain ground and pave the way for a potential rally to a new level of $6,801. Another priority for bulls will be to maintain control over $6,819, which would strengthen buyers' positions. In the event of a downward movement amid reduced risk appetite, buyers must assert themselves around $6,769. A break below that level would quickly drive the trading instrument back to $6,756 and open the path to $6,743.