The dollar continues to face issues. As statistics indicate, the number of initial jobless claims in the US has sharply increased, exceeding economists' forecasts, leading to another decline of the dollar against several risk assets. Although this news was not particularly new to the Federal Reserve or market participants, who are well aware of the challenges currently facing the US labor market, it has negatively impacted those betting on a short-term rise in the dollar. Economists link the increase in unemployment benefit claims to a slowdown in the American economy's growth rate, which, in turn, puts pressure on the Fed. Conversely, Europe is experiencing relative stability. Despite ongoing geopolitical risks, the European economy is showing signs of resilience, making the euro a more attractive asset for investors.

Today, traders will focus on the consumer price index data from Germany, France, and Italy. These indicators will serve as a sort of compass, indicating the direction of short-term currency flows and determining the movement vector for the European currency. The publication of German inflation data is particularly anticipated. As the largest economy in the Eurozone, Germany sets the tone for the entire regional economy. Any surprises in German reports could trigger sharp fluctuations in currency markets, affecting not only the euro but also other related currencies. France and Italy, the second and third-largest economies in the Eurozone, respectively, will also contribute to the overall picture. Overall, the upcoming consumer price index data will be a key driver for the euro in the short term.

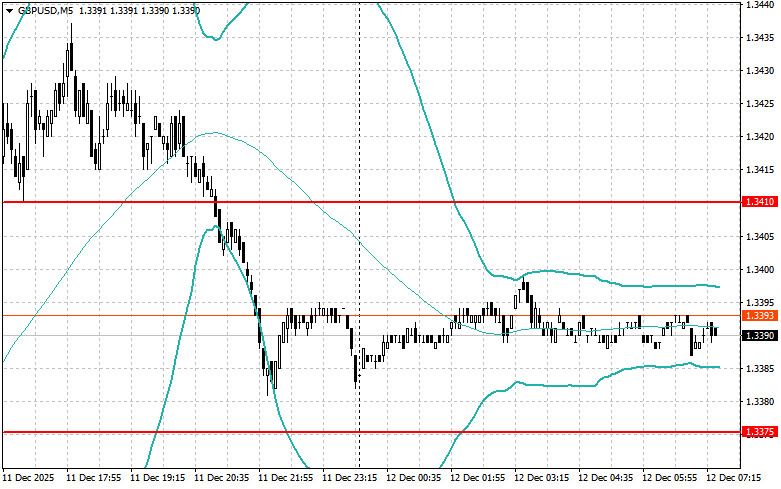

Regarding the pound, today's data will include changes in UK GDP, industrial production, and the trade balance of goods. This triplet of economic indicators promises to be a true barometer of the British economy, capable of influencing trader sentiment and the British pound's exchange rate. GDP data, as a cornerstone of the economy, will provide insights into growth rates or, conversely, slowdowns, which is critical for forecasting the country's further prospects. Changes in industrial production are another key indicator reflecting the state of the manufacturing sector, which plays a vital role in GDP and job creation. A decline in this indicator may adversely affect the positions of British pound buyers.

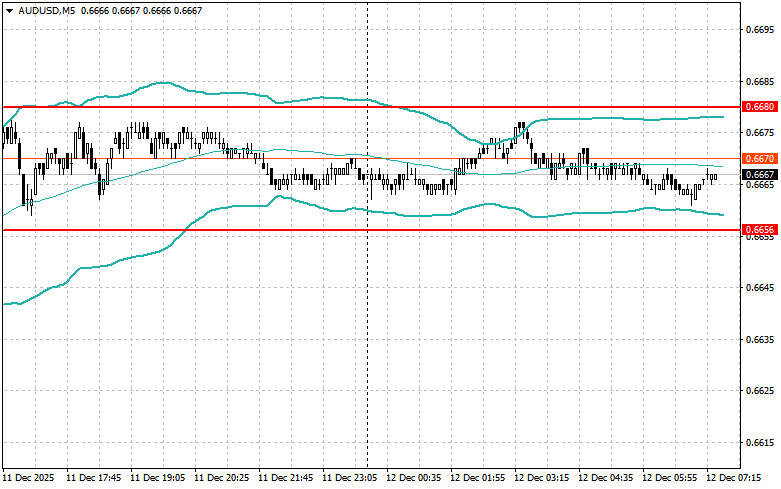

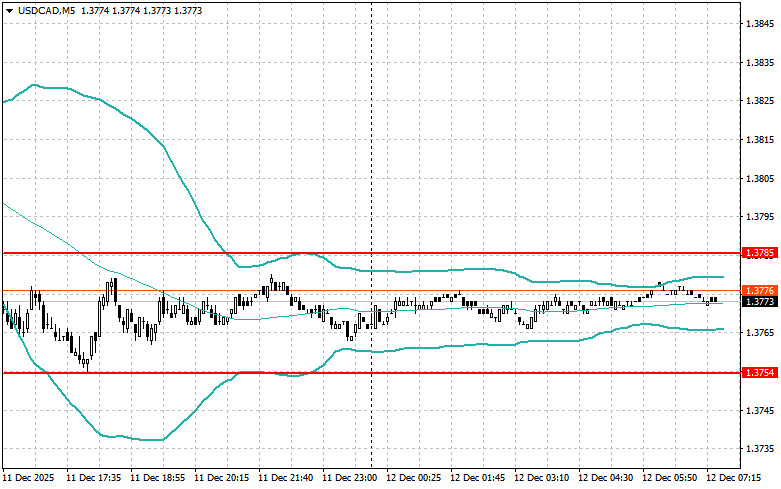

If the data aligns with economists' expectations, it is better to operate based on the Mean Reversion strategy. If the data significantly exceeds or falls short of economists' forecasts, the Momentum strategy would be most effective.