The market got what it wanted. The Fed executed a hawkish cut, lowering the federal funds rate to 3.75% and signaling a pause in the cycle of monetary easing. However, the central bank did not close the door on further easing. Moreover, Jerome Powell's emphasis on labor market weakness and the Fed's decision-making dependence on data make monetary expansion in 2026 quite likely. This was well received by US stock indices, with the S&P 500 registering its strongest reaction to an FOMC meeting since March, while the Russell 2000 reached a new record high.

S&P 500's Reaction to Fed Meetings

The stock market benefited from a triple advantage provided by the Fed. Not only did the central bank raise its GDP forecast for 2026 from 1.8% to 2.3% and lower inflation estimates from 3% to 2.6%, but it also did not rule out further monetary easing. Jerome Powell spoke about productivity growth driven by artificial intelligence technologies. According to the Fed chair, the employment declines due to AI are not fully felt yet; otherwise, jobless claims would be rising substantially faster.

The acceleration of the economy against the backdrop of slowing inflation creates a kind of Goldilocks environment for US stocks. According to Navellier & Associates, when the Fed lowers rates and the S&P 500 is within 2% of record highs, it has risen 100% of the time over the next 12 months.

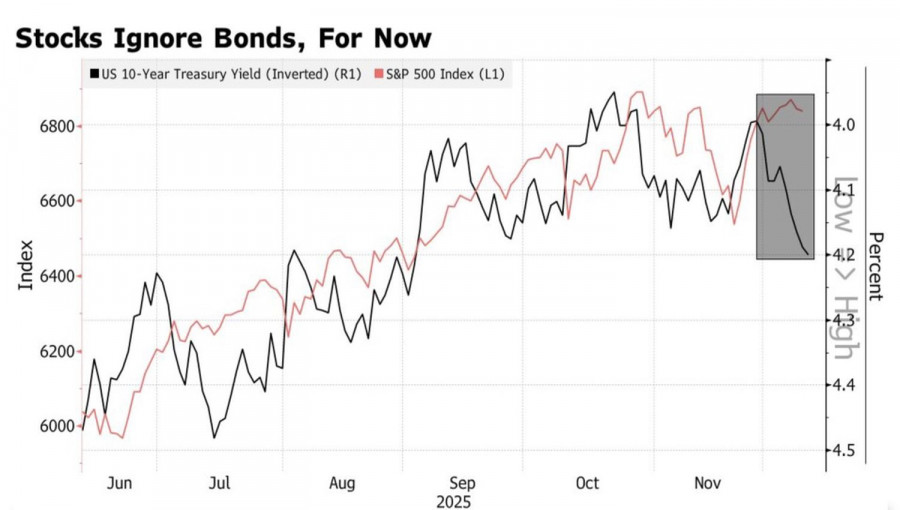

The hawkish rate cut followed by a dovish surprise from Jerome Powell led to a decline in Treasury yields. For a long time, the broad stock index has ignored the rally in Treasury rates, but this could not continue indefinitely. The S&P 500 would either fall, or bond yields would. Fortunately, investors chose the latter option.

Dynamics of S&P 500 and US Treasury Yields

In the latest FOMC forecasts, there is one act of monetary expansion projected for 2026, whereas the futures market is banking on two. Everything will depend on the data regarding the American economy. However, the lack of a safety cushion in terms of expectations for further decreases in the federal funds rate may make the S&P 500 vulnerable to sell-offs in technology stocks.

Thus, the disappointing results from Oracle, which did not meet Wall Street's expectations, echoed in a drop in S&P 500 futures. It is likely that the broad stock index will open lower on December 11. Nonetheless, retail investors, who have acclimated to buying the dips, only need this. They are eagerly awaiting the Christmas rally in the US stock market, and a pullback in the broad stock index would present an excellent opportunity to purchase at a lower price.

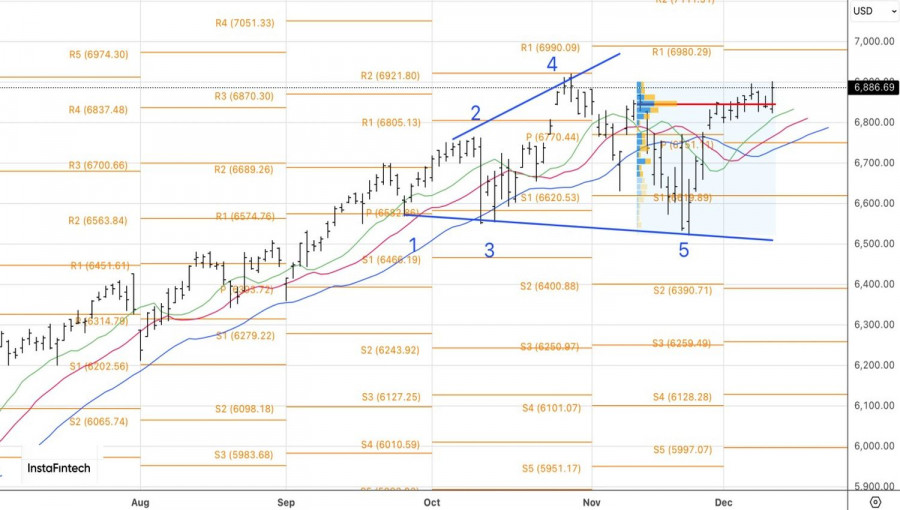

Technically, the daily chart of the S&P 500 shows the price consolidating above fair value at 6,845, with bulls in control of the situation. As long as the market trades above this important level, the focus should remain on buying the broad stock index, targeting the levels of 7,000 and 7,100.