Banco BPM ve čtvrtek vyzval zájemce UniCredit, aby upustil od své nabídky na odkup, protože banka vedená generálním ředitelem Andreou Orcelem sdělila úřadům, že nemůže splnit podmínky, které Řím stanovil pro schválení převzetí BPM.

UniCredit ve středu získal od regulátora trhu Consob 30denní odklad své nabídky na odkup Banco BPM, protože se snaží přesvědčit vládu, že podmínky nelze splnit v jejich současné podobě.

Vládní zdroj ve středu agentuře Reuters sdělil, že vláda nemá v úmyslu své požadavky měnit.

Banco BPM uvedla, že UniCredit investorům jasně nesdělila, co sdělila orgánům v Římě, což znamená, že podmínky, které Itálie uložila z důvodu národní bezpečnosti, nelze splnit.

Taková situace, „kterou UniCredit nikdy nezveřejnila na trhu, by sama o sobě měla vést k neplatnosti nabídky“, uvedla banka.

Yesterday, stock indices closed higher. The S&P 500 rose by 0.67%, while the Nasdaq 100 strengthened by 0.33%. The Dow Jones Industrial Average jumped by 1.05%.

The rally in the stock market, driven by the Federal Reserve's interest rate cuts, has come to a halt as disappointing results from Oracle Corp. exerted pressure on tech stocks. Investors are also reassessing their positions in light of the reality of a more cautious approach to future rate cuts.

Oracle's earnings report, which fell short of expectations, raised concerns about the overall resilience of the technology sector, which has been the primary driver of market growth in recent months. The decline in Oracle's shares triggered a chain reaction, affecting other major tech companies such as Microsoft, Apple, and Amazon. Investors fear that current interest rates, despite the potential for future cuts, are already negatively impacting corporate earnings, particularly in interest-sensitive sectors like technology.

Futures for the Nasdaq 100 dropped by more than 1.5%, and the sell-off of tech stocks in Asia neutralized earlier gains in the regional stock index. S&P 500 futures fell by 0.8%. Shares of Oracle, whose fate is closely tied to the AI boom, plummeted by more than 10% in after-hours trading in the US after second-quarter cloud service sales came in slightly below analyst estimates.

As noted earlier, the Fed lowered interest rates for the third consecutive time, and Chairman Jerome Powell expressed optimism about the strengthening economy as the inflationary impact of Trump's tariff policy eases. This marked the first instance since 2019 in which three representatives voted against the monetary policy decision, with opinions divided across the political spectrum. The Fed chair also suggested that the central bank has taken sufficient measures to stabilize the labor market while keeping interest rates high enough to continue exerting pressure on prices. He emphasized the importance of upcoming economic reports, advising caution when assessing labor market data due to technical distortions arising from the government shutdown and data outages.

In Japan, demand for bonds reached its highest level since 2020. Yields across the curve hit multi-year highs amid renewed concerns about fiscal policy and rising expectations for a rate hike by the Bank of Japan at its upcoming meeting next week.

In the commodities market, oil prices were in focus after the US seized a sanctioned tanker off the coast of Venezuela, deterring further supplies from the South American country and raising the risk of conflict.

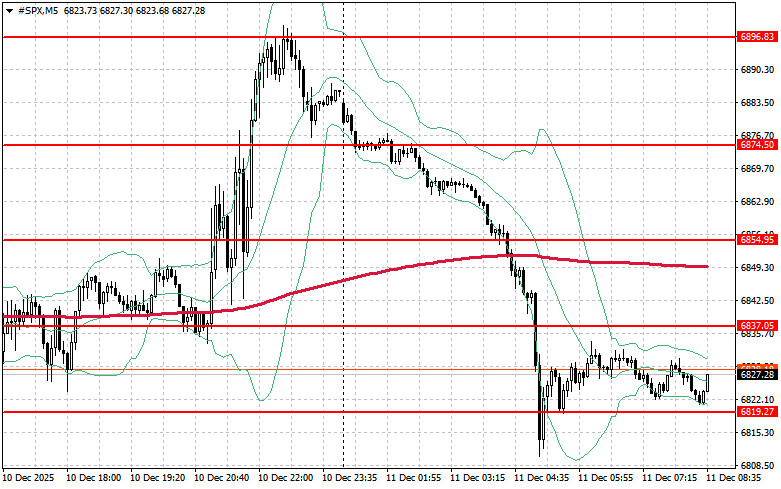

Turning to the technical analysis of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,837. This will help the index gain ground and pave the way for a potential rally to a new level of $6,854. Another priority for bulls will be to maintain control over $6,874, which will strengthen buyers' positions. In the event of a downward movement amid reduced risk appetite, buyers must assert themselves around $6,819. A break below that level would quickly drive the trading instrument back to $6,792 and open the way to $6,772.