U.Today – Ethereum právě během několika hodin prolomilo několik úrovní odporu a rozvířilo trh s kryptoměnami ohromujícím 31% nárůstem. 200denní klouzavý průměr, který často rozlišuje mezi býčím momentem a medvědím pokračováním, se nachází těsně pod hranicí 2 300 USD, kterou rally ETH překonalo.

The GBP/USD pair traded completely illogically on Friday. From the very morning, the market had decent grounds for buying the British currency, which would have been fully supported by the current technical picture and the global fundamental backdrop. In the UK, business activity indices for the services and manufacturing sectors for October, as well as retail sales data, were published. All three reports exceeded analysts' expectations, providing substantial reasons for buying. Yet we did not observe any market reaction, even a minimal one, to the relatively positive UK reports.

In the U.S., the inflation report was released, which logically prompted a drop in the dollar that lasted... 5 minutes. Subsequently, the dollar rose more sharply, seemingly out of nowhere, than it had fallen, driven by strong conditions. It is hard to argue that the positive S&P business activity indices are more significant reports than the inflation and consumer sentiment indices, which did not favor the dollar. Thus, we again saw weak and illogical movements that contradict everything.

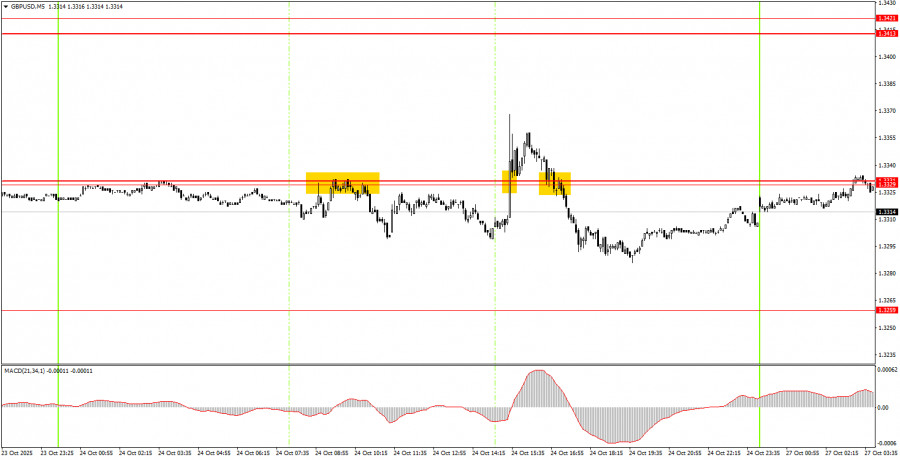

On the 5-minute timeframe, several trading signals formed on Friday, but all proved false. We have been discussing the illogical movements for several weeks now, so this is not surprising. Beginner traders may attempt to act on the forming signals, but they should remember that movements are currently weak and illogical, as the daily timeframe remains in a sideways trend.

On the hourly timeframe, the GBP/USD pair has begun forming a new upward trend, which could mark the start of a new phase in the global upward trend. However, for over a week now, the quotes have only declined. As previously mentioned, there are no grounds for prolonged dollar growth, so we anticipate only upside movements in the medium term. Presently, market volatility has dropped to near zero, and the price is still slow to move upwards.

On Monday, the GBP/USD pair may attempt to resume its upward movement, but no significant news is expected today. To open long positions, a breakout above the 1.3329-1.3331 range is required. A rebound from this area from below will allow for short positions targeting 1.3259. It should be noted that movements based on any signals may be very weak.

On the 5-minute timeframe, trading can currently occur at the following levels: 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3682, 1.3763. On Monday, no important reports or events are scheduled in either the UK or the U.S.

Support and Resistance Levels: These levels serve as targets when opening buy or sell positions. Take Profit levels can be placed around these areas.

Red Lines: These represent channels or trend lines that illustrate the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): This consists of a histogram and a signal line; it is a supplementary indicator that can also be used as a source of signals.

Important speeches and reports (always included in the news calendar) can significantly impact the movement of currency pairs. Therefore, during their release times, it is crucial to trade with caution or exit the market to avoid sharp reversals against previous movements.

Beginner traders in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and effective money management are essential for long-term success in trading.