Nový generální ředitel společnosti Berkshire Hathaway (NYSE:BRKa) HomeServices of America uvedl, že obavy z dopadu cel na hypoteční sazby tíží kupující i prodávající nemovitostí, ale pravděpodobně výrazně neovlivní prodej stávajících nemovitostí.

„Když hypoteční sazby kolísají kvůli kolísání základní ekonomiky, kupující a prodávající zůstávají v nejistotě,“ uvedl v nedávném rozhovoru Chris Kelly, který 15. dubna převzal největší realitní kancelář v USA.

Vyšší náklady na úvěry přispěly k neočekávanému poklesu prodeje existujících nemovitostí v USA v březnu o 5,9 % na sezónně očištěnou roční míru 4,02 milionu jednotek, přičemž je pravděpodobné další oslabení, protože cla vyvolávají obavy z recese.

„Vysoká míra volatility, kterou jsme zaznamenali v posledních několika měsících, způsobuje kupujícím a prodávajícím určité zdržení,“ uvedl Kelly. „Ale stále existuje 4 miliony lidí, kteří se letos chystají přestěhovat.“

HomeServices je jednotka společnosti Berkshire Hathaway Energy, která je součástí konglomerátu Warrena Buffetta a vlastní nebo franšízuje více než 2 200 realitních kanceláří s více než 82 000 makléři.

The upcoming week will be packed with various events—including the release of important economic data, primarily from the U.S., speeches by influential central bank officials, and the Swiss National Bank's final monetary policy decision.

This week promises to be eventful, featuring key economic reports—especially from the United States—alongside remarks from major central bank figures and the Swiss National Bank's monetary policy decision. Let's assess how these events may influence the markets.

Let's begin with an assessment of key U.S. statistics, which, unsurprisingly, play a leading role in global markets, given the current geopolitical landscape and financial market dynamics where the U.S. remains the central figure of focus and influence.

The main highlight this week will be the release of the Personal Consumption Expenditures (PCE) Price Index report, which many market participants believe could confirm whether the Federal Reserve was right to cut its key interest rate by 0.25% at the last meeting.

As a reminder, the Federal Reserve and its Chair, Jerome Powell, faced unprecedented pressure from President Donald Trump and Treasury Secretary Spencer Bessent, who urged renewed interest rate cuts to stimulate national economic growth—despite annual consumer inflation having accelerated to 2.9% from 2.7%. At the same time, a bleak labor market situation became the main justification for the rate cut, regardless of rising inflation.

How should this indicator's influence on the markets be interpreted? If the PCE data comes in line with expectations or slightly lower—recall that the July figure was 2.6%—investors will view it as a strong confirmation that the Fed may continue lowering interest rates. In that case, two more cuts before the end of the year seem plausible. However, if the overall figure shows an upward trend—rising to 3% or higher—this could push the Fed back into a wait-and-see mode, delaying action until further "nudges" from Trump or new inflation data emerge.

How will the stock markets react, particularly in the U.S.?

Slowing inflation and prospects for further rate cuts will support demand for equities—especially in the U.S. The three major stock indices could resume their upward movement. I explained the underlying reasons for this in more detail in a previous article.

Under this scenario, the dollar may come under pressure again; however, a significant decline is unlikely as the currencies traded against it are under pressure themselves due to negative economic developments in their respective countries—something I've covered earlier.

In addition to inflation data, revised U.S. GDP figures will be released, with growth expected to remain at 3%. Key data on manufacturing and new home sales will also be published. Fed Chair Jerome Powell and ECB President Christine Lagarde are scheduled to speak as well.

And as the cherry on top, the Swiss National Bank will announce its interest rate decision, with expectations pointing to rates remaining unchanged at 0.0%.

Overall, assessing the market picture, we can speak of moderately positive sentiment among market participants.

Daily Forecast:

Gold

Weakness in the U.S. dollar and ongoing global geopolitical tensions, including the risk of escalating existing conflicts, continue to support gold prices. After breaking through and potentially consolidating above the 3702.00 level, gold could resume its growth toward 3748.50. The 3711.36 mark may serve as a buying opportunity for gold.

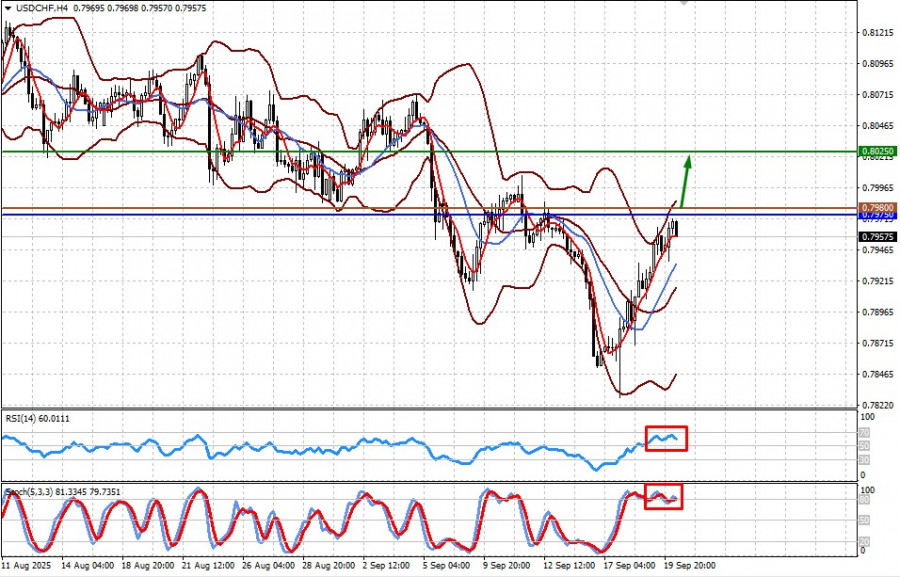

USD/CHF

The pair is trading below the 0.7975 level. The Swiss National Bank's rate decision may put local pressure on the franc, and a rise in the pair above this level could trigger further growth toward 0.8025. The 0.7980 mark may serve as a buy level for the USD/CHF pair.