Gold prices have fallen from a new all-time high amid a strengthening U.S. dollar, following the Federal Reserve's announcement of an anticipated interest rate cut after months of intense White House pressure to reduce borrowing costs.

This decision, made despite lingering concerns about persistent inflation, triggered a wave of selling in gold, which is traditionally seen as a safe-haven asset during periods of economic uncertainty and currency weakness. Although the rate cut was expected, some analysts saw it as a sign of the Fed's vulnerability to political pressure. Investors fear that further concessions could lead to runaway inflation and undermine confidence in the U.S. economy. This anxiety was reflected in the dollar's rebound, as traders shifted focus to more conservative assets.

However, the decline in gold prices may prove to be a temporary phenomenon. Geopolitical instability, debt concerns in several countries, and ongoing fears of recession could once again spur demand for the precious metal.

At his press conference after the meeting, Fed Chair Jerome Powell pointed to mounting signs of labor market weakness and acknowledged the need to manage the risk posed by persistent inflation. His comments were less dovish than his speech last month at the Jackson Hole Symposium, which fueled expectations for further rate cuts.

"Labor demand has declined, and the pace of job creation recently appears to be below the breakeven level needed to keep unemployment steady," Powell stated. He added, "I can no longer say that the labor market is 'very stable."

Following Powell's remarks, the dollar rebounded, causing gold prices to drop 1.2% before partially recovering. For context, gold briefly hit a new record of $3,707.57 per ounce after the Fed decision to cut rates, as a lower interest rate environment usually benefits this safe-haven asset.

Clearly, gold is reversing as sentiment shifts across various asset classes—including stocks and bonds—as investors locked in profits after the anticipated Fed rate cut. So far this year, gold has already surged nearly 40%, outperforming the S&P 500 index and other assets, and earlier this month, it surpassed its inflation-adjusted 1980 peak. Ongoing trade and geopolitical uncertainties, as well as central bank purchases and strong ETF inflows, continue to support the bullish momentum.

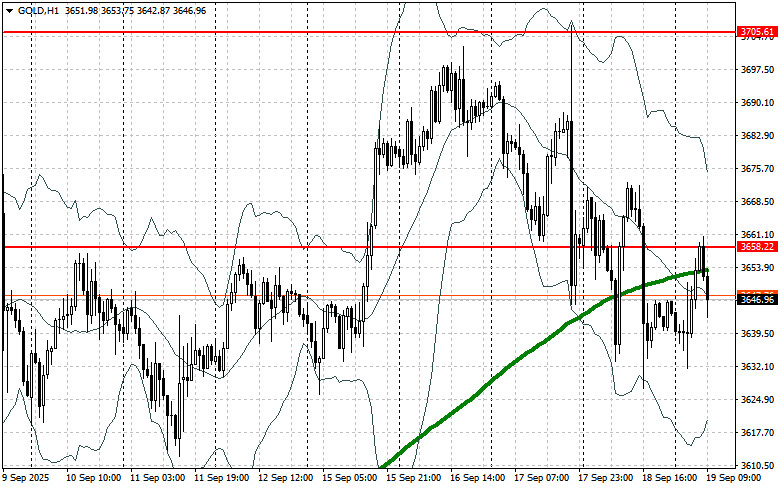

As for the current technical picture for gold, buyers need to break through the nearest resistance at $3,658, which would allow a retest of $3,705—a level that will be quite difficult to overcome. The next major target is $3,813. On the downside, if gold falls, bears will try to seize control at $3,600. A break of this area would deal a serious blow to the bulls, pushing gold toward $3,562, with the prospect of a further decline to $3,526.