The test of the 148.06 price occurred when the MACD indicator had already risen far above the zero line, which limited the pair's upside potential. For this reason, I did not buy the dollar, and this decision proved correct as the pair failed to continue rising.

The Japanese yen strengthened against the dollar after last Friday's University of Michigan Consumer Sentiment Index fell to 55.4 points, versus economists' forecast for an increase to 58. This unexpected slump in American consumer sentiment reinforced the market's belief in the need for monetary easing by the Federal Reserve. The dollar, which had previously been supported by high rates, came under pressure as investors began doubting the strength of the US economy. The yen, traditionally viewed as a safe-haven asset, gained support in this environment of uncertainty.

Future pair dynamics will depend on upcoming US economic data, Fed policy decisions, and actions by the Bank of Japan. Investors should closely monitor these factors to make informed decisions.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

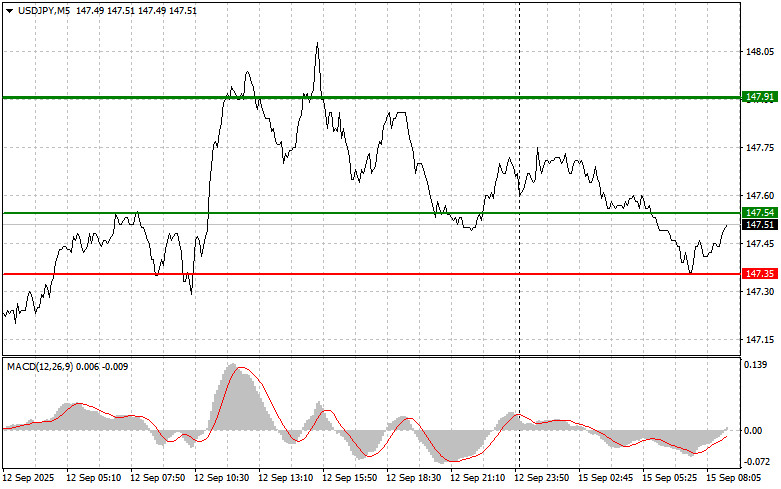

Scenario #1: I plan to buy USD/JPY today if the entry point around 147.54 (green line on the chart) is reached, targeting a rise to 147.91 (thicker green line on the chart). Around 147.91, I plan to exit from longs and open shorts in the opposite direction (expecting a 30–35 pip counter move from the level). The best opportunities to buy the pair will be on corrections and notable dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 147.35 level with the MACD indicator in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth to the opposite levels of 147.54 and 147.91 can be expected.

Scenario #1: I plan to sell USD/JPY today only after a move below 147.35 (red line on the chart), which should quickly push the pair lower. The key sellers' target will be 147.05, where I plan to exit shorts and immediately open longs in the opposite direction (expecting a 20–25 pip counter move). It's better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to drop from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 147.54 level with the MACD indicator in the overbought area. This will limit the pair's upside potential and trigger a reversal downward. Declines to the opposite levels of 147.35 and 147.05 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.