Společnost Atos ve čtvrtek vykázala pokles příjmů za první čtvrtletí, který byl ovlivněn nižším počtem zakázek v roce 2024 v důsledku výrazného omezení aktivit v oblasti outsourcingu podnikových procesů ve Velké Británii, ale signalizovala více zakázek od klientů.

Tržby IT skupiny dosáhly 2,07 miliardy eur (2,35 miliardy USD), což je o 15,9 % méně než před rokem.

Její divize cloudových služeb i divize kybernetické bezpečnosti byly zasaženy snížením objemu ve Velké Británii i dokončených zakázek, přičemž tržby se snížily o 14 %, resp. 17,5 %.

Objem zakázek skupiny k 31. březnu však vzrostl na 1,7 miliardy eur z 1,6 miliardy před rokem.

Poměr zakázek k počtu vyřízených zakázek, který vyjadřuje počet přijatých zakázek k počtu vyřízených zakázek, činil 81 % oproti 64 % před rokem. Vyšší poměr naznačuje větší pravděpodobnost, že podnik pokryje nové zakázky.

„Zatímco horní linie zůstala pod tlakem, naše obchodní aktivita se v průběhu čtvrtletí nadále zotavovala, což svědčí o důvěře a angažovanosti našich klientů,“ uvedl generální ředitel Philippe Salle.

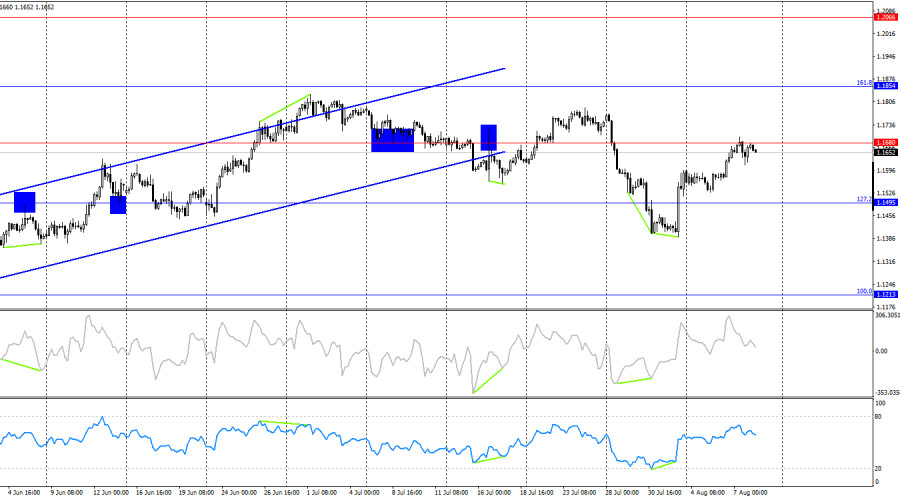

On Thursday, the EUR/USD pair rebounded from the 76.4% retracement level at 1.1695, reversed in favor of the U.S. dollar, and fell below the support zone of 1.1637–1.1645. Today, the decline may continue toward the 50.0% Fibonacci level at 1.1590. A rebound from the 1.1637–1.1645 support zone would favor the euro and a resumption of growth toward 1.1695 and the resistance zone of 1.1789–1.1802.

The wave pattern on the hourly chart remains straightforward. The last completed upward wave broke the high of the previous wave, while the last downward wave broke the previous low. At present, the trend can be considered bearish, but it has been changing frequently due to the news background. Donald Trump managed to sign several beneficial agreements, which strengthened the bears, as did Jerome Powell's statements following the latest Fed meeting. However, recent labor market data and the revised Fed monetary policy outlook now support the bulls.

On Thursday, there was no economic news background, but traders have not lacked important developments this week. These include new tariffs, a possible truce between Ukraine and Russia, the resignation of Adriana Kugler (FOMC member), and the dismissal of U.S. Bureau of Labor Statistics Director Erica McEntarfer. Today, I want to focus traders' attention on the "restructuring" of the Fed. Since Adriana Kugler decided to step down (the true reasons can only be speculated on), Trump will soon appoint her successor. It is safe to assume this will be someone supportive of a dovish policy stance. In the near future, Trump may also name Jerome Powell's successor, as Powell will leave his post in nine months. Trump was unable to dismiss Powell outright, so he will have to wait three more quarters. These developments indicate that Trump has initiated a Fed restructuring—aimed solely at pushing the U.S. central bank to cut interest rates. In my view, this is another significant reason for dollar weakness. From now on, the Fed will make decisions not based on its mandates but under Trump's direction.

On the 4-hour chart, the pair reversed in favor of the euro and rose toward 1.1680 after two bullish divergences formed. A rebound from this level would favor the U.S. currency and a decline toward the 127.2% retracement level at 1.1495. A close above 1.1680 would increase the likelihood of continued growth toward the next Fibonacci level at 161.8% – 1.1854. No emerging divergences are observed today on any indicator, and a move below the ascending channel does not necessarily mean a bearish trend will form.

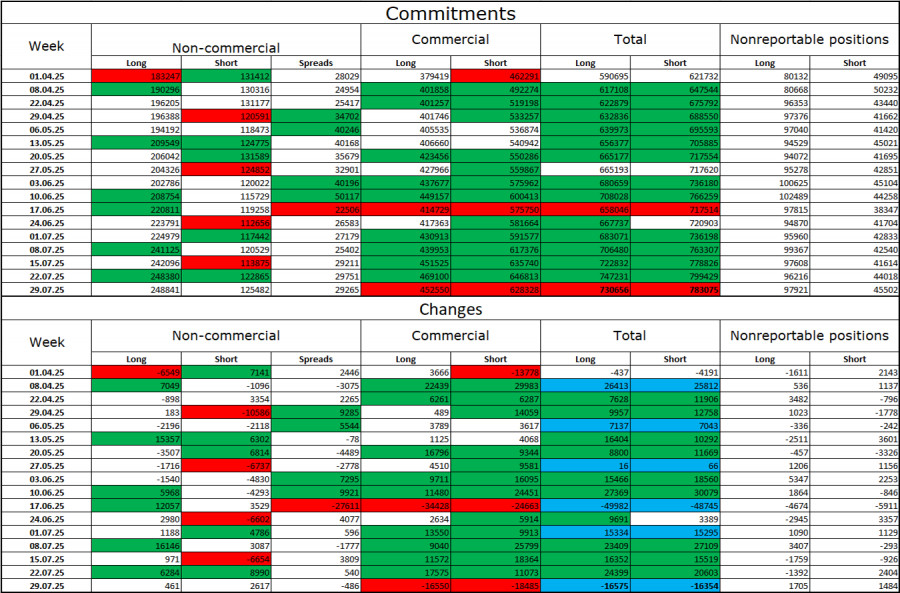

Commitments of Traders (COT) Report:

In the last reporting week, professional traders opened 461 long positions and 2,617 short positions. The "Non-commercial" group's sentiment remains bullish, supported by Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators now stands at 248,000, compared to 125,000 short positions—a gap of more than two to one. Additionally, the large number of green cells in the table above indicates a strong build-up of positions in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar is falling.

For 25 consecutive weeks, large market participants have been reducing short positions and increasing longs. Donald Trump's policies remain the most significant factor for traders, as they could create numerous long-term structural problems for the U.S. Despite the signing of several important trade agreements, some key economic indicators continue to decline.

News calendar for the U.S. and the EU:

On August 8, the economic events calendar contains no notable entries. The news background will not affect market sentiment during Friday's trading.

EUR/USD forecast and trading advice:

Selling the pair is possible today if the hourly close occurs below the 1.1637–1.1645 zone, with targets at 1.1590 and 1.1544. Long positions can be held with targets at 1.1695 and 1.1789 if there is a rebound from the 1.1637–1.1645 zone.

The Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.