Francouzská společnost Hermes zvýší ceny ve Spojených státech, aby plně kompenzovala náklady způsobené celní politikou prezidenta Donalda Trumpa, uvedla společnost, která v prvním čtvrtletí vykázala tržby pod očekáváním trhu, což je vzácný projev slabosti.

Hermes sází na svou cenovou sílu a hodlá od května přidat přirážku ke všem svým výrobkům prodávaným v zemi, což doplní pravidelné úpravy cen, které se letos pohybovaly kolem 6-7 %.

„Dopad těchto nových cel budeme plně kompenzovat zvýšením našich prodejních cen ve Spojených státech od 1. května, a to ve všech našich obchodních liniích,“ uvedl finanční ředitel Eric du Halgouet a dodal, že společnost stále dokončuje přesné sazby.

Společnost známá svými kabelkami Kelly a Birkin, jejichž cena se pohybuje kolem 10 000 USD, vykázala za tři měsíce končící březnem tržby ve výši 4,1 miliardy eur (4,66 miliardy USD), což představuje 7% nárůst na bázi konstantní měny.

The TACO strategy — "Trump Always Chickens Out" — may not always work in favor of the U.S. stock market. Investors believed that the White House had won the trade war by successfully avoiding it. However, the concessions made by the U.S. administration regarding chip supplies to the European Union, automobiles to Japan, and orange juice to Brazil suggest otherwise. Donald Trump may have achieved trade peace, but how long will it last?

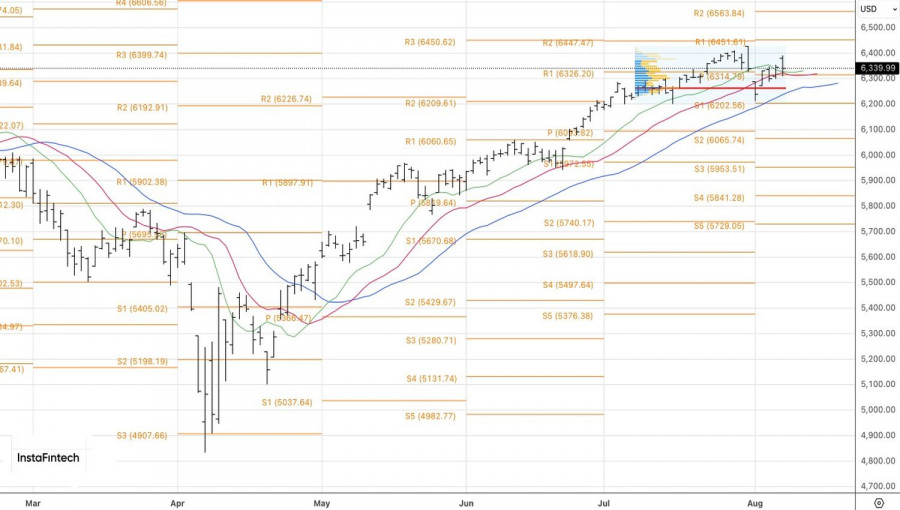

TACO allowed the S&P 500 to rise by 27% from its April lows and to post 12 record highs. The VIX fear index declined. Investors eagerly bought the dips in the broad equity index—even after a disappointing U.S. employment report revealed signs of a cooling economy. The foundation supporting the stock market began to shake.

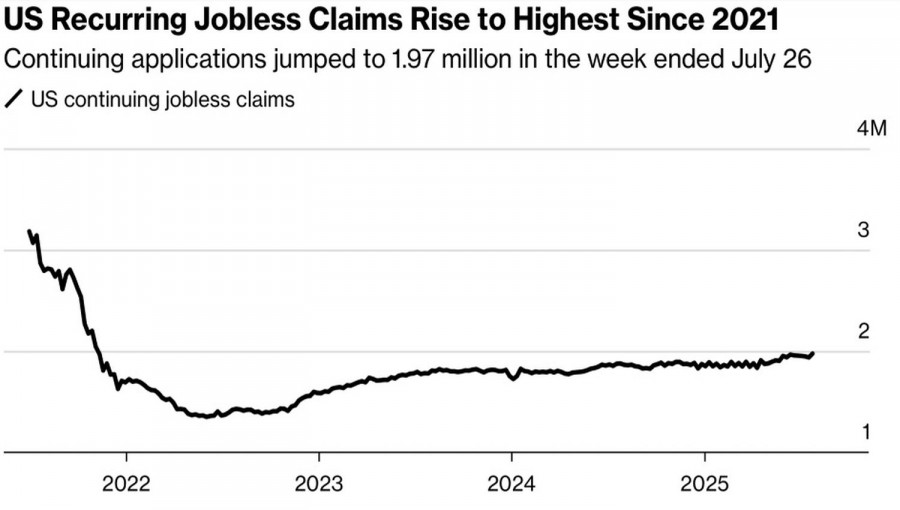

And it didn't stop there. Continuing jobless claims have reached their highest level since 2021. Inflation expectations tracked by the New York Fed are rising. Bloomberg experts forecast that consumer prices could accelerate to 2.8% in July. All of these point to a stagflationary development scenario — bad news for the S&P 500.

When a recession hits the U.S. economy, the Fed typically acts swiftly with rate cuts and large-scale quantitative easing programs, helping the broader equity index recover—as it did during the pandemic. When the economy is booming, the central bank can stand aside, and the S&P 500 will still rise.

But stagflation is a different story. The Federal Reserve is uncertain about its next steps. If it keeps rates high, the economy will suffer more. If it lowers borrowing costs, inflation may accelerate. Tariffs further complicate the situation. While FOMC member Christopher Waller believes that price increases due to tariffs are temporary, Raphael Bostic from the Atlanta Fed holds the opposite view. According to him, tariffs could raise inflation expectations, and high prices might become entrenched in the U.S. economy.

The broad market index is struggling to reach new all-time highs, a sign of bullish weakness. There are also signs that so-called "smart money" is pulling back. According to Goldman Sachs, hedge funds have been selling U.S. stocks for five consecutive weeks. UBS suggests that trend-following funds will soon start reducing their long positions. The previous activity of these institutions has left them with little room to buy more.

Technically, the daily S&P 500 chart is showing the formation of a 1-2-3 reversal pattern. To confirm this pattern in a conservative scenario, the index would need to fall below 6205. However, traders might try their luck selling on the break of key support levels — namely the pivot level at 6315 and the fair value level at 6265.