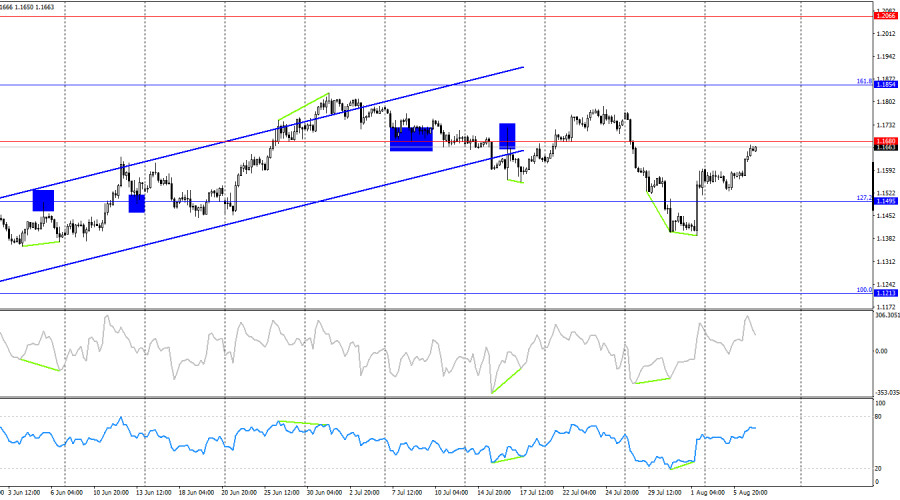

On Wednesday, the EUR/USD pair continued its upward movement and consolidated above the resistance zone of 1.1637–1.1645. The euro is recovering quickly after a month-long decline, and there are plenty of reasons supporting this rebound. Thus, the upward movement may continue today toward the 76.4% Fibonacci retracement level at 1.1695. A consolidation above this level would allow for a further rise toward the resistance zone of 1.1789–1.1802.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave broke above the previous wave's peak, while the last downward wave broke below the previous low. This makes the current trend technically bearish, but it has frequently shifted due to the changing news background. Donald Trump has managed to sign several favorable deals, which boosted bearish sentiment, as did Jerome Powell's statements following the latest Fed meeting. However, the latest labor market data and the shifting outlook for the Fed's monetary policy now support the bulls.

On Wednesday, it was revealed that Donald Trump once again moved from threats to action. The U.S. president had long warned India of additional import tariffs unless New Delhi halted imports of Russian oil and gas. Trump also insisted that India increase its purchases of American energy products and weapons. India declined this "lucrative" offer—to pay double for the same goods from the U.S.—and on Wednesday, tariffs were raised by another 25%. The total tariff now stands at 50%. Trump thus continues to exert strong pressure on U.S. trading partners, essentially forcing them to trade according to his own rules. In addition, Trump is engaging in a geopolitical reshaping of the world. As a result, the bears are forced to retreat again, as trade war tensions have once again become a key factor working against the dollar.

On the 4-hour chart, the pair reversed in favor of the euro and rose to 1.1680 after two bullish divergences formed. A rebound from this level would favor the U.S. dollar and a potential decline toward the 127.2% Fibonacci level at 1.1495. A breakout above 1.1680 would increase the likelihood of continued growth toward the next Fibonacci level of 161.8% at 1.1854. No fresh divergences are currently observed on any indicators, and a break below the ascending channel does not yet indicate the formation of a bearish trend.

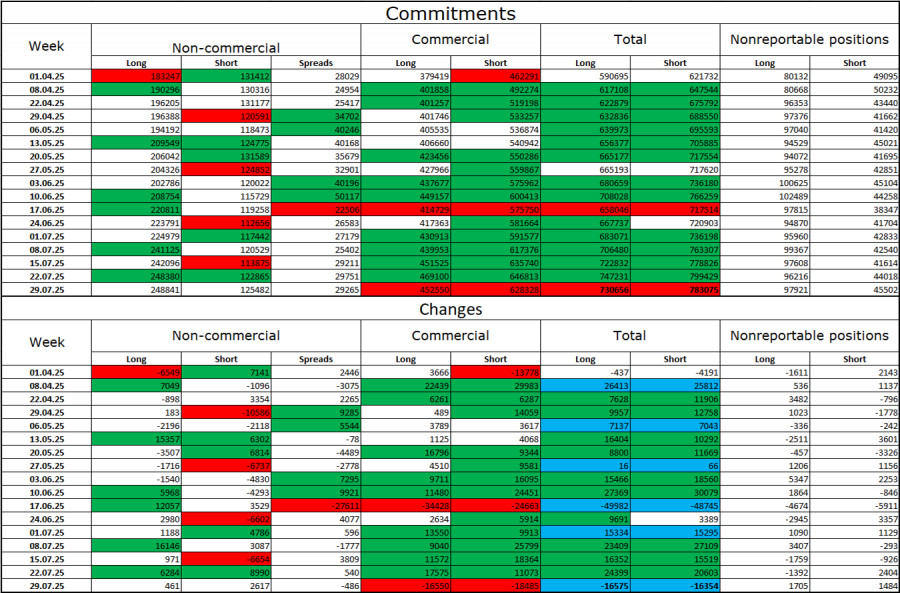

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders opened 461 long positions and 2,617 short positions. The sentiment among the "Non-commercial" group remains bullish, thanks to Donald Trump, and continues to strengthen over time. The total number of Long positions held by speculators is now 248,000, compared to 125,000 Short positions—a more than twofold gap. Also note the number of green cells in the table above. They reflect strong accumulation of positions in the euro. In most cases, interest in the euro is rising, while interest in the dollar is declining.

For 25 consecutive weeks, large players have been reducing Short positions and increasing Longs. Donald Trump's policy remains the most significant factor for traders, as it can create numerous problems with long-term and structural consequences for the U.S. Despite the signing of several important trade deals, some key economic indicators continue to show weakness.

News Calendar for the U.S. and Eurozone:

The economic calendar for August 7 includes two entries that are not particularly significant. The impact of the news background on market sentiment is expected to be very limited on Thursday.

EUR/USD Forecast and Trader Recommendations:

Selling the pair is not recommended today—bullish traders are pressing confidently, and the news background favors them, not the bears. Long positions can be held with targets at 1.1695 and 1.1789, as long as no clear sell signal appears.

Fibonacci grids are drawn from 1.1789 to 1.1392 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.