Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

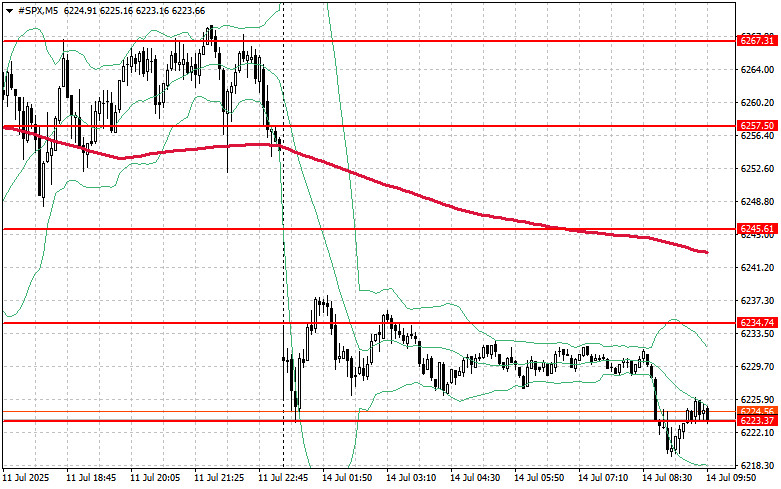

As of yesterday, the US benchmark stock indices closed lower. The S&P 500 fell by 0.33%, while the Nasdaq 100 declined by 0.22%. The industrial Dow Jones lost 0.63%.

Today, futures on US and European stock indices continued their fall after President Donald Trump escalated trade tensions late last week by announcing a 30% tariff on goods from the European Union and Mexico.

This move sparked a wave of concern among investors, who fear a full-scale trade war that could seriously undermine global economic growth. Trump's decision was clearly a response to recent statements from European and Mexican authorities about their intentions to impose retaliatory measures on US goods. Such an escalation risks turning into a spiral of protectionist measures that could ultimately harm all parties involved in global trade.

Moreover, the growing trade tension adds further risks to the global economy, which is already facing multiple challenges, including slowing growth, high inflation, and geopolitical instability.

Futures contracts on the S&P 500 index and European stocks fell by 0.6%. Asian stock indices remained flat. Silver reached a new 14-year high. Bitcoin surpassed the $122,000 mark for the first time, gaining nearly $16,000 this month. The euro recovered its losses, while the US dollar rose by 0.1%. Japanese long-term bonds continued to decline amid concerns about fiscal policy ahead of local elections.

Trump's latest tariff threats are testing market resilience after the US leader tightened trade measures last week against a range of countries, from Canada to Brazil and Algeria. Despite warnings against complacency, investors are so far acting as if they expect the president to back down, noting previous policy reversals by his administration. The current start date for the new tariffs is set for August 1 of this year.

Meanwhile, the EU is trying to reach a preliminary agreement with the US to prevent the tariff hikes, but Trump's letter has undermined recent optimism in Brussels. However, the US president left room for further adjustments. Rumors suggest the EU is now preparing to step up coordination with other countries affected by Trump's tariffs.

This week, the main focus will be on a series of economic data releases, including China's Gross Domestic Product report and inflation data from both Europe and the US. The second-quarter earnings season is also expected to begin this week, with Wall Street anticipating the weakest earnings season since mid-2023.

As for the technical picture of the S&P 500, the main goal for buyers today will be to overcome the nearest resistance at 6,234. This would support further gains and open the way for a push to the next level at 6,245. An equally important task for the bulls will be holding control above 6,257, which would strengthen the buyers' position. In the event of a pullback due to waning risk appetite, buyers must assert themselves around the 6,223 area. A breakdown below that level would quickly push the index back to 6,211 and potentially open the path to 6,200.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.