The price test at 1.1483 aligned with the MACD indicator's upward movement from the zero mark, confirming a valid entry point for buying the euro. As a result, the pair rose toward the target level of 1.1537.

Today, in the first half of the day, the euro may continue to rise, but this will require the release of strong data on the German business climate indicator. The euro will receive an additional boost if strong macroeconomic figures are published from Germany. Investors will interpret this as a sign of the German economy's resilience, the eurozone's engine. This may strengthen confidence in the European Central Bank's ability to control inflation and support economic growth. However, if the data falls short of expectations or Christine Lagarde expresses concerns about the economic outlook, the euro could come under pressure. A much stronger bullish impulse could also come from developments in the Middle East, where the intensity of the military conflict gradually decreases. An announcement of a ceasefire would be good news.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

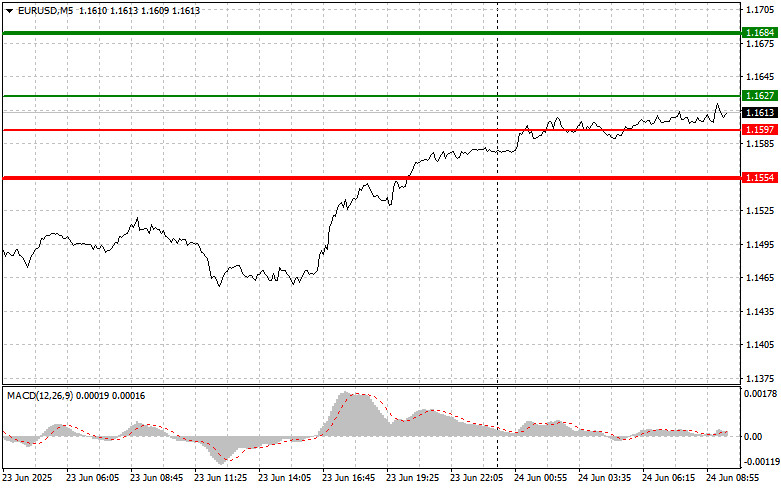

Scenario #1: Today, buying the euro is possible when the price reaches around 1.1627 (green line on the chart), with a target of rising to 1.1684. I plan to exit the market at 1.1684 and sell the euro in the opposite direction, targeting a 30–35 pip move from the entry level. A bullish euro move today is expected following good economic data.

Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1597 price level at a time when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.1627 and 1.1684 can be expected.

Scenario #1: I plan to sell the euro after it reaches the 1.1597 level (red line on the chart). The target will be 1.1554, where I intend to exit the market and buy immediately in the opposite direction (expecting a 20–25 pip move in the opposite direction from this level). Pressure on the pair is likely to return in the case of weak data.

Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1627 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. A drop toward the opposite levels of 1.1597 and 1.1554 can be expected.