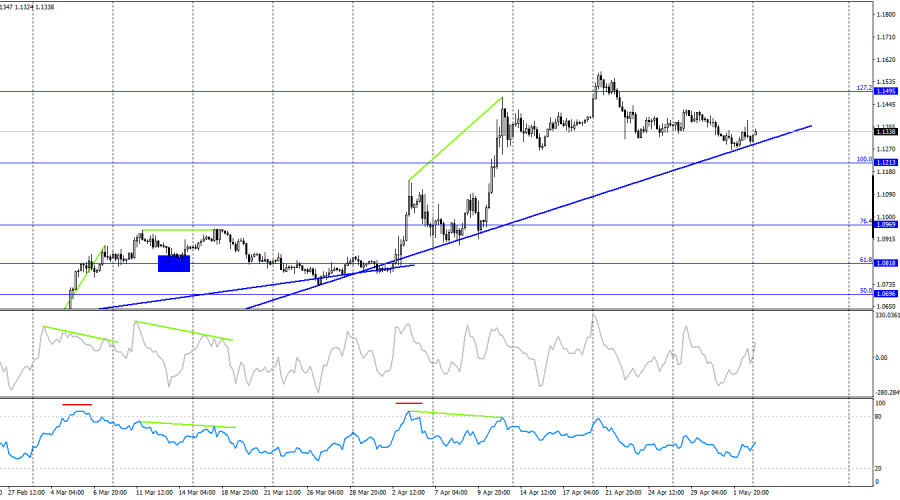

The wave situation on the hourly chart is evolving. The last completed upward wave broke the high of the previous wave, while the new downward wave failed to break the previous low. This suggests that the bullish trend is still valid. Donald Trump has not imposed any new tariffs for several weeks, so traders have stopped selling the dollar. Recently, reports have surfaced about potential tariff reductions for several countries, including China. This news could support the bears, but they are in no hurry to go on the offensive.

The news background on Friday threatened new problems for the U.S. dollar. Almost all U.S. reports this past week—on business activity, job openings, employment, and unemployment—showed weak results, yet the dollar somehow continued to grow. On Friday, the Nonfarm Payrolls report and unemployment rate could have delivered another blow to the dollar. However, quite unexpectedly, the number of new jobs reached 177K, well above much lower expectations, and the unemployment rate remained unchanged. Thus, the bears have received yet another chance to attack while there is still a foundation for it.

Last week, the U.S. dollar managed to improve its position slightly—but certainly not because of economic data. I believe the market is slowly starting to turn, realizing that Trump is unlikely to introduce new tariffs, especially considering the U.S. economic contraction in Q1. However, the bullish trend is still in place, and Trump remains highly unpredictable.

On the 4-hour chart, the pair fell toward the upward trendline. A rebound from this line would favor the euro and a renewal of the uptrend toward the 127.2% Fibonacci corrective level at 1.1495. A consolidation below the trendline would suggest a continuation of the decline toward the next Fibonacci level at 1.1213. Currently, no indicators are showing any developing divergences.

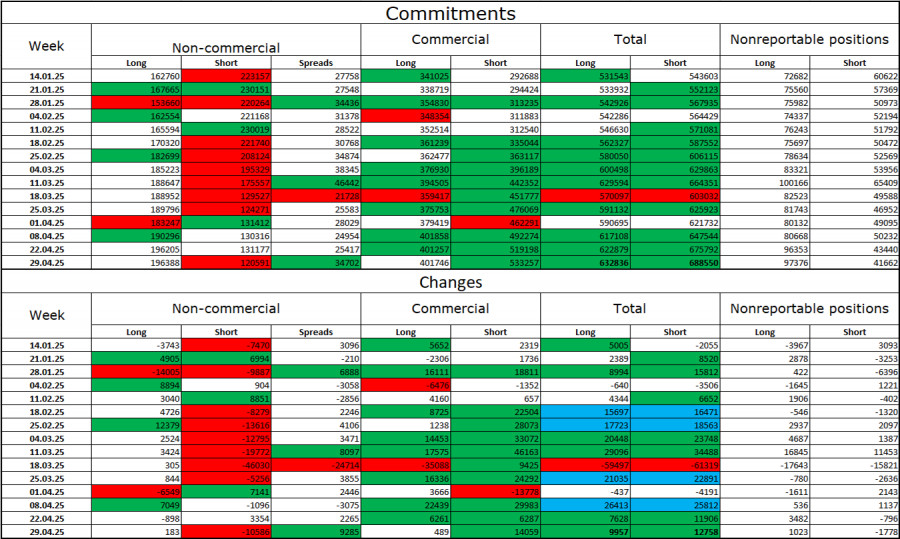

Commitments of Traders (COT) Report

During the last reporting week, professional traders opened 183 long positions and closed 10,586 short positions. The sentiment among the "Non-commercial" group has long since turned bullish—thanks to Donald Trump. The total number of long positions held by speculators now stands at 196,000, while short contracts are at 120,000. A few months ago, the situation was the opposite, and nothing indicated trouble ahead.

For twenty weeks straight, large players had been selling off the euro, but now they've been reducing shorts and increasing longs for twelve weeks in a row. The divergence in monetary policy approaches between the ECB and the Fed still favors the dollar due to the interest rate differential. However, Donald Trump's policy is a heavier influence, as it may lead to a dovish shift in the FOMC's stance and even cause a recession in the U.S. economy.

News Calendar for the U.S. and Eurozone – May 5

Monday's calendar includes two U.S. entries. However, the market impact of economic data may remain muted as traders have recently shown little enthusiasm for statistics.

EUR/USD Forecast and Trading Tips

Fibonacci grids are built between 1.0957–1.0733 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.