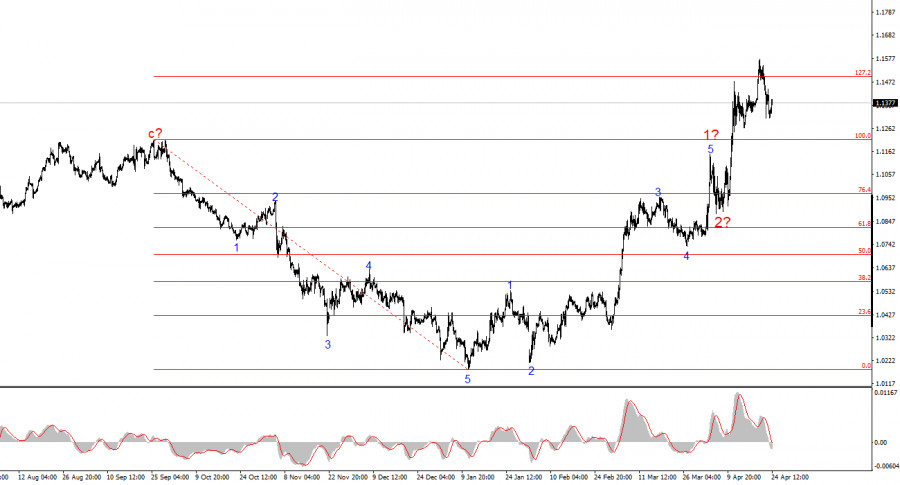

The wave pattern on the 4-hour chart of EUR/USD has transformed into an upward, impulsive structure. I believe there is little doubt that this transformation occurred solely due to the new U.S. trade policy. Before February 28, when the sharp decline of the U.S. dollar began, the wave pattern represented a convincing downward trend, constructing corrective wave 2. However, Donald Trump's weekly announcements of various tariffs did their job. Demand for the U.S. currency began to plummet, and the entire trend segment starting on January 13 has now taken the form of a five-wave impulse.

Moreover, the market failed to form a convincing wave 2 within the new upward segment. We only saw a minor pullback, smaller than the corrective waves within wave 1. However, the U.S. currency may continue to decline unless Donald Trump completely reverses his adopted trade policy. We've already seen how the news background has previously changed the wave layout—another such instance is possible.

The EUR/USD pair rose by 60 basis points on Thursday, though market movement remained subdued. On Monday, the market reacted to news that Jerome Powell might be dismissed by Trump, and on Tuesday to news that Trump had changed his mind. There was also talk of halving tariffs on China to 50–60%, although the White House has yet to clarify if or when this will happen.

On Wednesday and Thursday, there were plenty of economic reports from both Europe and the U.S., but the market showed little interest. Business activity indices for the services and manufacturing sectors drew no significant attention. There was some hope for the U.S. durable goods orders report, but even that turned out to be a letdown. Although orders surged by a record 9.2% (well above the expected +2% m/m), demand for the U.S. dollar didn't budge. It neither rose nor fell — it simply remained unchanged.

This suggests that the market continues to ignore all economic data, focusing solely on news from the White House. Although there were no new announcements today, Trump has a habit of shaking the markets almost daily through interviews and public comments. The day is not over yet, and new information regarding the trade war may still emerge.

Based on the analysis of EUR/USD, I conclude that the pair is continuing to build a new upward trend segment. Donald Trump's actions reversed the downward trend. Therefore, for the time being, wave structure will be entirely dependent on the position and actions of the U.S. president. This should be constantly kept in mind.

Based solely on the wave pattern, I initially expected a three-wave correction as part of wave 2. However, wave 2 has already completed in the form of a single wave. The construction of wave 3 in the upward trend has begun, and its targets may extend up to the 1.25 area (the "25th figure"). Whether this happens will depend entirely on Trump. The internal structure of wave 3 is already looking rather erratic.

On the higher wave scale, the pattern has also shifted to a bullish trend. We are likely entering a long-term upward wave cycle, although Trump-related news has the potential to completely reverse the trend at any moment.

Core Principles of My Analysis: