New York (Reuters) – Americký akciový trh, který je rozkolísaný kvůli výrokům prezidenta Donalda Trumpa o zahraničních dovozních clech, čeká v nadcházejícím týdnu zasedání Federálního rezervního systému, na němž investoři hledají náznaky dalšího snižování úrokových sazeb, které by mohlo trhy uklidnit.

Týdny trvající propad akcií se v posledních dnech zrychlil a referenční index S&P 500 ve čtvrtek potvrdil, že se nachází v korekci, když skončil o více než 10 % níže než na svém rekordním maximu z 19. února. Akcie sice zakončily týden pozitivně a index S&P 500 se v pátek prudce zotavil, pokles však vymazal tržní hodnotu více než 4 biliony USD, přičemž některé z největších trháků Wall Street, jako například Nvidia (NASDAQ:NVDA) a Tesla (NASDAQ:TSLA), dostaly na frak.

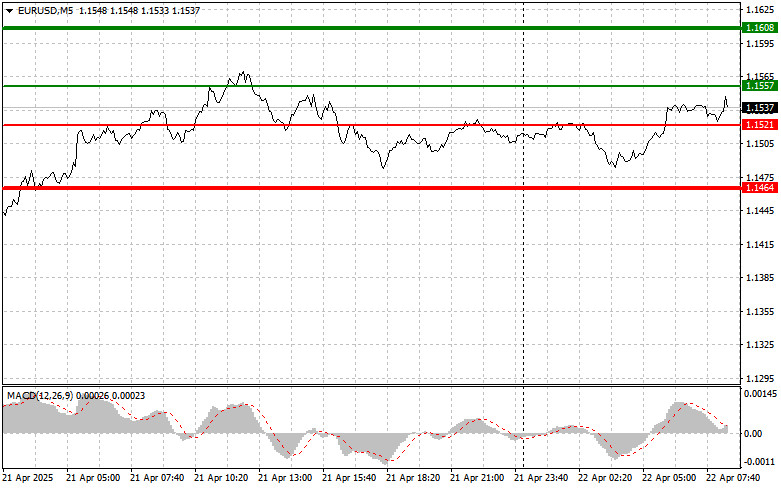

The price test of 1.1521 in the second half of the day coincided with the beginning of a downward movement of the MACD indicator from the zero level, which confirmed a valid entry point for selling the euro. As a result, the pair dropped by 40 pips.

Federal Reserve representative Austan Goolsbee's comments yesterday slightly supported the dollar but didn't significantly affect the overall market picture. Jerome Powell's repeated statements last week merely reiterated the Fed's wait-and-see approach. Therefore, the euro still has the potential for further growth, but this scenario requires strong economic data.

Given that market sentiment continues to reflect concerns about the state of the U.S. economy, this puts pressure on the dollar and contributes to strengthening the euro and other risk assets, including the pound and yen. However, without new positive economic indicators, further appreciation of these currencies will likely be limited.

Today's releases include the Eurozone Consumer Confidence Index and an IMF meeting. Although important, the confidence index is unlikely to trigger a significant rally in risk assets, especially given its relatively limited impact on broad market dynamics. The IMF meeting could provide clarity on global economic prospects, but its effects are usually medium-term, not intraday. As a result, the most likely outcome seems to be market stabilization near current levels with minor intraday fluctuations.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today if the price reaches the entry point around 1.1557 (green line on the chart), to rise to 1.1608. At 1.1608, I intend to exit the long position and open a short trade in the opposite direction, aiming for a 30–35 pip move back.

Important: Before buying, ensure that the MACD indicator is above zero and starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1521 price level while the MACD is in the oversold zone. This will limit the downside potential and lead to an upward reversal. A rise toward 1.1557 and 1.1608 can be expected.

Scenario #1: I plan to sell the euro after reaching the 1.1521 level (red line on the chart), with a target of 1.1464. At that point, I plan to exit the short position and immediately open a long position in the opposite direction (aiming for a 20–25 pip reversal).

Important: Before selling, ensure that the MACD is below zero and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of 1.1557 while MACD is in the overbought zone. This will limit the pair's upside potential and lead to a downward reversal. A decline toward 1.1521 and 1.1464 can be expected.