The first test of the 1.2160 level in the second half of the day coincided with the MACD indicator being significantly below the zero line, which limited the pound's downside potential. For this reason, I decided not to sell. Shortly after, another test of the 1.2160 level occurred when the MACD entered the oversold area, allowing me to implement Scenario #2 for buying. As a result, the pair rose by over 40 pips.

At this point, the pressure on the pound has indeed weakened, but this should not be interpreted as market participants exiting their positions. It's more likely a rebalancing as traders reassess their strategies ahead of significant U.S. economic data releases. Such fluctuations are a normal phase in financial markets, especially before key events. Major U.S. data can significantly affect currency exchange rates, prompting traders to reduce risks, which leads to decreased pressure on certain assets, including the British pound.

Today's UK Consumer Price Index (CPI), along with the Producer Price Index and retail price index, will significantly influence economic policy. Economist forecasts vary, and any deviation from expected figures could sway investor sentiment. For instance, if the CPI exceeds expectations, it might prompt discussions about a slower pace of interest rate cuts. Conversely, if the data indicate falling prices, it could boost optimism regarding consumer spending and economic growth. It's essential to remember that economic indicators do not operate in isolation; they dynamically interact with other factors, such as unemployment levels and GDP.

For intraday strategies, I will primarily focus on implementing Scenarios #1 and #2.

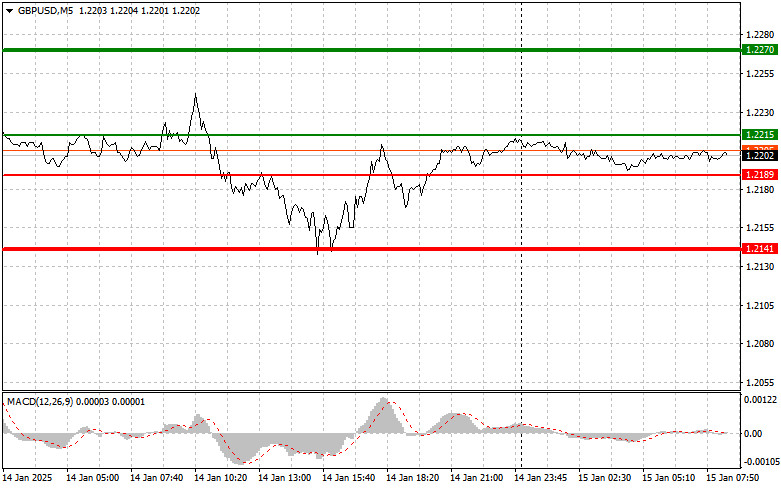

Scenario #1: Plan to buy the pound today upon reaching the entry point around 1.2215 (green line) with a target of 1.2270 (thicker green line on the chart). At 1.2270, I plan to exit the long position and open a short position, expecting a 30-35 pip pullback from this level. Pound growth can be expected after weak inflation data. Important: Before buying, ensure that the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.2189 level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 1.2215 and 1.2270.

Scenario #1: Plan to sell the pound after breaking below 1.2189 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.2141, where I plan to exit the short position and immediately open a long position, expecting a 20-25 pip pullback from this level. It is better to sell the pound as high as possible, continuing the forming bearish trend. Important: Before selling, ensure that the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2215 level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. Declines can be expected toward the opposite levels of 1.2189 and 1.2141.