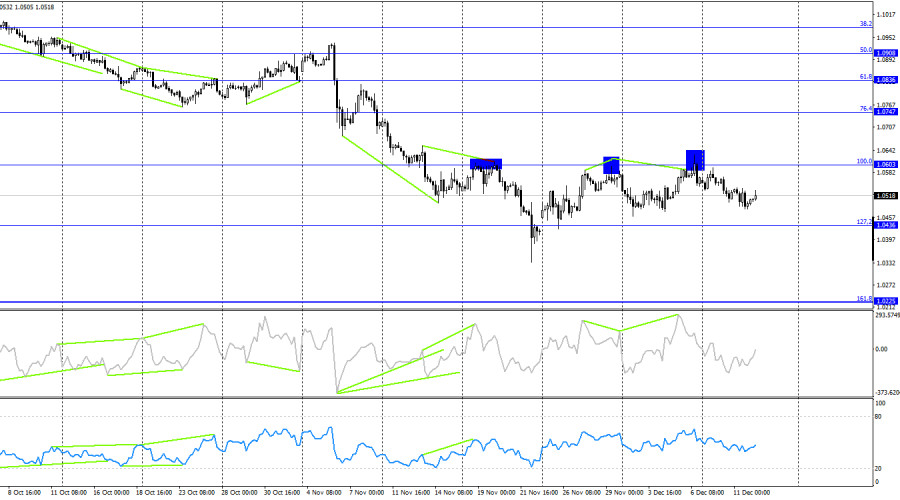

On Wednesday, the EUR/USD pair tested the 323.6% Fibonacci retracement level at 1.0532 twice and then fell slightly. However, on Thursday morning, the pair returned to this level. A new rebound from 1.0532 will favor the U.S. dollar, potentially pushing the pair down toward 1.0420. Consolidation above 1.0532 could signal a slight upward movement toward the next Fibonacci level of 261.8% at 1.0662. It's worth noting that the pair has been trading horizontally in recent weeks.

The wave structure is straightforward. The last completed downward wave did not break the previous low, while the last upward wave barely surpassed the previous high. Thus, the pair has initiated a "bullish" trend that looks very weak and could (or might have already) end this week. A break below 1.0461 would confirm the end of the current "bullish" trend.

On Wednesday, the fundamental background was significant in its headlines. The U.S. inflation report remains one of the most critical data points for traders. However, it turned out to be disappointing. Inflation in the U.S. rose to 2.7%, exactly as most traders expected. As a result, market activity did not change after the report, and the EUR/USD pair failed to show any notable movements. Today, traders are eagerly awaiting the ECB meeting, but I fear it may face the same outcome as yesterday. I don't expect any surprises from the ECB, and traders may once again be left wanting more. Will the ECB lower rates? That's what the market expects. The only question revolves around Christine Lagarde. In her recent interviews, she repeatedly spoke about the slowdown in the European economy. If she reiterates this today, the market might interpret it as a sign of further monetary easing from the ECB.

On the 4-hour chart, the pair rebounded twice from the 100.0% Fibonacci retracement level at 1.0603. This has initiated a new downward movement toward the 127.2% Fibonacci level at 1.0436. A bearish divergence in the CCI indicator also supports the downward movement. Consolidation above 1.0603 could lead to further growth in the euro toward the next retracement level of 76.4% at 1.0747, but my primary scenario remains bearish.

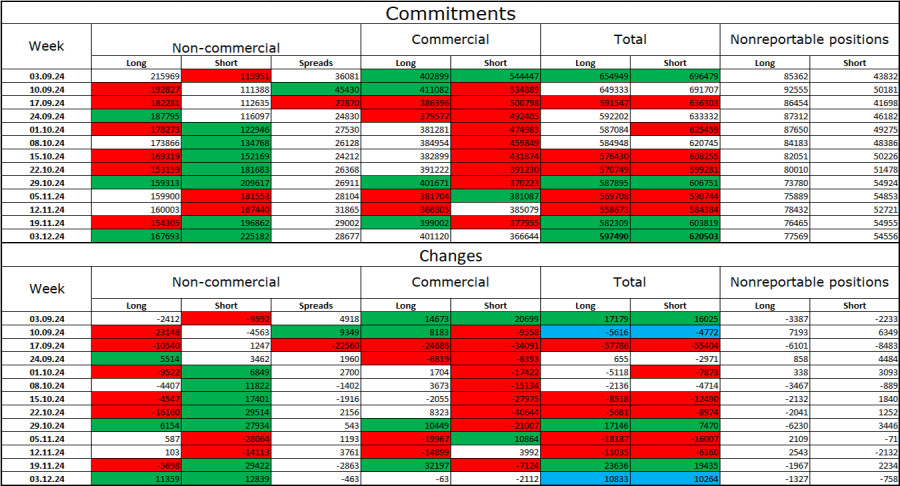

In the last reporting week, speculators added 11,359 long positions and 12,839 short positions. The sentiment of the Non-commercial group remains bearish, signaling further potential declines for the pair. The total number of long positions held by speculators is now 168,000, while short positions stand at 225,000.

For twelve consecutive weeks, major players have been offloading the euro. In my view, this indicates the emergence of a new "bearish" trend. The primary factor for the dollar's previous weakness—expectations of FOMC monetary easing—has already played out, and the market no longer has strong reasons to sell the dollar en masse. While such reasons may arise in the future, the continued strength of the U.S. dollar appears more likely. Technical analysis also points to the start of a long-term bearish trend. Hence, I am preparing for a prolonged decline in the EUR/USD pair.

The economic calendar for December 12 features several significant events. The fundamental background may have a strong influence on market sentiment throughout the day.

Fibonacci levels are drawn from 1.1003 to 1.1214 on the hourly chart and from 1.0603 to 1.1214 on the 4-hour chart.