Evropská unie zintenzivňuje úsilí o zvýšení konkurenceschopnosti svých podniků a francouzská vláda a Komise EU předkládají nové návrhy, jejichž cílem je snížit regulační zátěž, podpořit inovace a řešit vysoké náklady na energie.

Analytici Jefferies ve čtvrteční poznámce zhodnotili důsledky těchto změn a nabídli pohled na jejich potenciální dopad na evropské podniky.

Francouzská vláda navrhla „dalekosáhlé zjednodušení“ vykazování udržitelnosti, které zahrnuje dvouletý odklad směrnice o náležité péči o udržitelnost podniků (CSDDD) a směrnice o vykazování udržitelnosti podniků (CSRD).

Jefferies vysvětluje, že tyto odklady spolu s mírnějšími oznamovacími povinnostmi v rámci taxonomie EU o poměru zelených aktiv by „do budoucna snížily náklady“, zejména pro kótované společnosti v EU, kde dodržování CSRD může stát až 1 milion EUR.

Trade Analysis and Tips for Trading the Euro

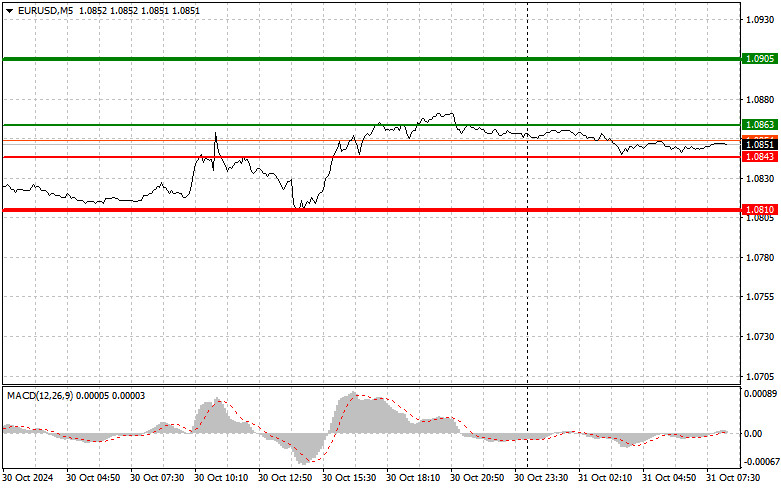

The test of the 1.0820 price level occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the euro. ADP data on the labor market pushed the pair downward, but the GDP report disappointed, so the pair remained within its range. Today, it's worth looking at the German retail sales report and the more critical data on the Eurozone's Consumer Price Index and unemployment rate. A drop in inflation and unemployment may influence the European Central Bank's plans to lower rates, helping the euro rise today. Poor results could put pressure on the pair. For the intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Buy the euro today if it reaches the 1.0863 level (green line on the chart) with a target of 1.0905. At 1.0905, I plan to exit the market and sell the euro in the opposite direction, aiming to move 30-35 pips from the entry point. Expect the euro to rise today in the morning session if positive Eurozone data is released. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0843 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Expect growth to the opposite levels of 1.0863 and 1.0905.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0843 level (red line on the chart). The target will be 1.0810, where I plan to exit the market and immediately buy in the opposite direction (expecting a move of 20-25 pips in the opposite direction from the level). Pressure on the pair will return if it fails to break beyond the daily high and if the Eurozone data is particularly weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0863 level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. Expect a decline to the opposite levels of 1.0843 and 1.0810.

Chart Indicators:

Thin Green Line – Entry price to buy the instrument.

Thick Green Line – Suggested price level for setting Take Profit or manually taking profits, as further growth beyond this level is unlikely.

Thin Red Line – Entry price to sell the instrument.

Thick Red Line – Suggested price level for setting Take Profit or manually taking profits, as further decline beyond this level is unlikely.

MACD Indicator – When entering the market, consider overbought and oversold zones.

Important: Novice traders should exercise caution when entering the market. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always set stop orders to minimize losses. You may quickly lose your entire deposit without stop orders, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear plan, like the above example. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for an intraday trader.