EUR/USD

Higher timeframes

Last week, despite opening with a bearish gap, EUR/USD managed to close above the weekly cloud (1.0882) and beyond the weekly Ichimoku death cross. Now the bulls have to eliminate the cross and consolidate in the bullish territory relative to the weekly cloud. To support the bullish bias, it will be necessary to test the nearest extremes of 1.0916 and 1.1031. Losing the weekly levels (1.0863 - 1.0882) may bring the pair back to support levels in the zone of influence of the monthly short-term trend (1.0829), which may change priorities.

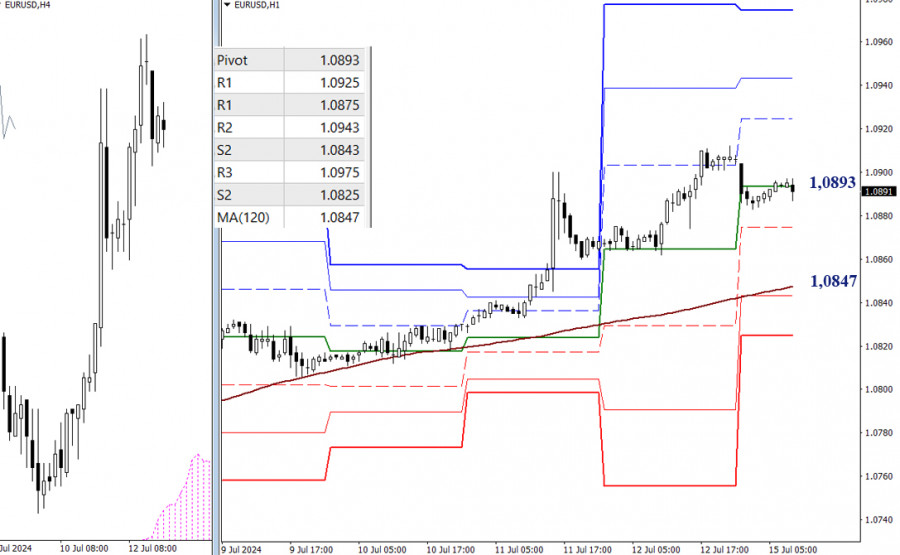

H4 – H1

The bulls currently have the main advantage on the lower timeframes. Today, the bullish targets are the resistances of the classic Pivot levels, which are located at 1.0925 - 1.0943 - 1.0975. The current attraction is now exerted by the central Pivot level of the day (1.0893). In case the pair falls, the main focus will be on the weekly long-term trend (1.0847), along the way the intermediate support may be found at 1.0875 (S1). Other supports of the classic Pivot levels can be found at 1.0843 - 1.0825.

***

GBP/USD

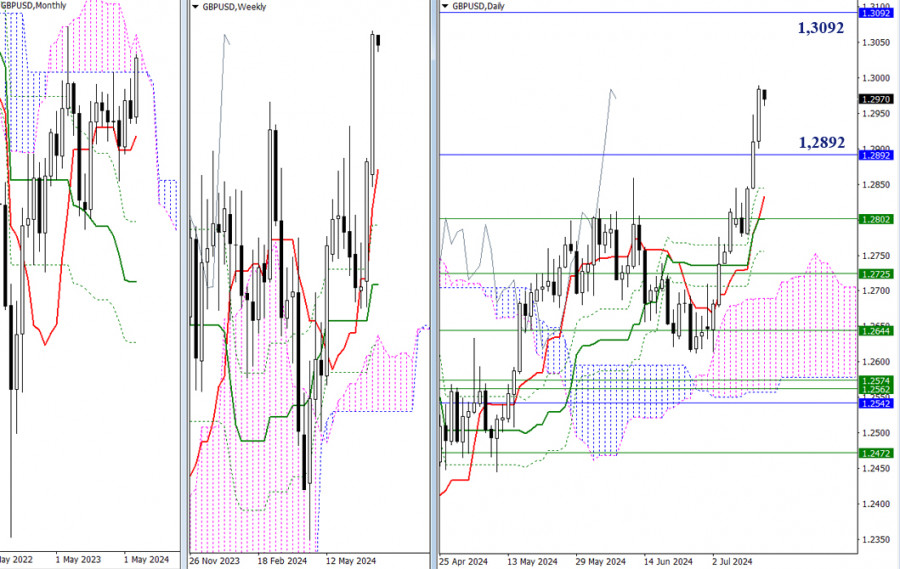

Higher timeframes

Last week, the pair entered the monthly cloud. As a result, now the bulls have to consolidate within the cloud and move towards its upper boundary (1.3092). For the bears, the most important reference point right now is also the boundary of the monthly Ichimoku cloud, but the lower one (1.2892). The market's future progress will be determined by the interaction with the boundaries of the cloud and the ability of either side to overcome them, thereby securing a position either in the bullish or bearish territory relative to the monthly cloud.

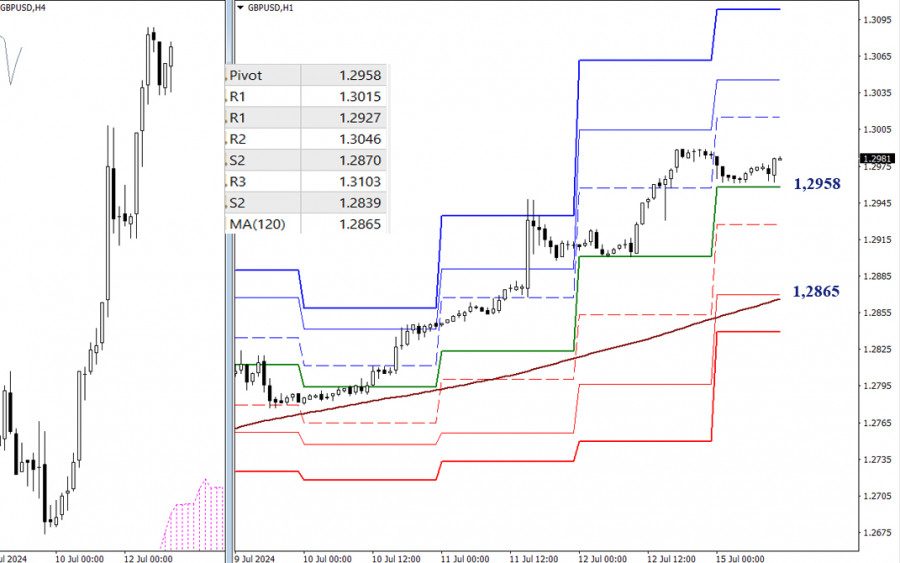

H4 – H1

The bulls currently have the main advantage on the lower timeframes. If GBP/USD continues to rise, they will encounter resistance at the classic Pivot levels of 1.3015 – 1.3046 – 1.3103. If the bulls lose the current support of the central Pivot level (1.2958), the opponent may begin to develop quite a deep downward correction, with the main target being the weekly long-term trend (1.2865). This level is responsible for the current balance of power. A breakthrough and reversal of the trend could serve as a basis for a more prolonged and significant increase in the bearish bias.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)