Akcie společnosti Vishay Intertechnology (NYSE:VSH) ve středu pokračovaly v růstu již druhý den po sobě poté, co se pozitivně vyjádřil analytik Ming-Chi Kuo. Společnost byla označena za významného příjemce v rámci dodavatelského řetězce společnosti Nvidia (NASDAQ:NVDA) pro servery s umělou inteligencí a nadcházející grafické karty řady RTX 50. Zapojení společnosti Vishay zahrnuje dodávku klíčových komponent, jako jsou MOSFET/DrMOS, kondenzátory vPolyTan, proudové bočníky, tlumiče přechodových napětí a Schottkyho bariérové diody.

Gold surged to historic highs on Friday for the first time in a month, closing above the $2,000 level. Positive inflation data and dovish comments from Federal Reserve members contributed to this.

According to the latest weekly gold survey, retail investors maintain an optimistic outlook for the current week, while a slight majority of market analysts also optimistically assess the short-term prospects of the yellow metal. Adrian Day, President of Adrian Day Asset Management, maintains a neutral position, expecting prices to remain unchanged during the week.

Adam Button, head of currency strategy at Forexlive.com, believes that as rate cuts approach and the influence of the U.S. dollar on gold is strong, a dollar pullback should support the rally in the precious metal.

Mark Leibovit, publisher of the VR Metals/Resource Letter, remains optimistic about gold due to the weakness of the U.S. dollar. On the other hand, Ole Hansen, head of commodity strategy at Saxo Bank, expects gold prices to decline this week, adding that a correction to the 2010 level should occur before a year-end rally.

According to Everett Millman, Chief Market Analyst at Gainesville Coins, gold prices will still seasonally rise due to the recent rally. Colin Cieszynski, Chief Market Strategist at SIA Wealth Managemen, believes that gold will lose some of its recent gains this week.

Darin Newsom, Senior Market Analyst at Barchart.com, remains optimistic about the prospects for gold.

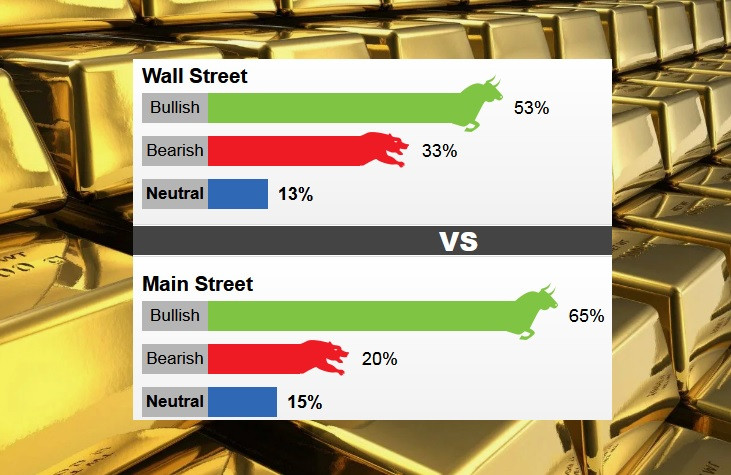

This week, 15 Wall Street analysts participated in a survey. Eight analysts, or 53%, anticipate an increase in gold prices, while five analysts, or 33%, predict a decline, and two analysts, representing 13%, remain neutral.

In an online poll with 763 votes, market participants remain as optimistic as in the past two weeks. 495 retail investors, or 65%, expect prices to rise. Another 155 investors, or 20%, anticipate a decline, while 114 investors, or 15%, are neutral.

This week, employment data will dominate, with ADP private sector job vacancy data scheduled for Tuesday, the weekly report on unemployment claims on Thursday, and non-farm employment data for November on Friday. Additionally, attention should be paid to the University of Michigan's consumer sentiment survey and the ISM services PMI.