OAKLAND, Kalifornie (Reuters) – OpenAI a Elon Musk se dohodli na urychleném soudním procesu ohledně ziskového přechodu OpenAI, což je poslední obrat v souboji mezi nejbohatším člověkem světa a generálním ředitelem OpenAI Samem Altmanem, který se odehrává veřejně před soudem.

Miliardář Elon Musk a společnost OpenAI společně navrhli soudní řízení v prosinci, jak vyplývá z pátečního podání federálního soudu.

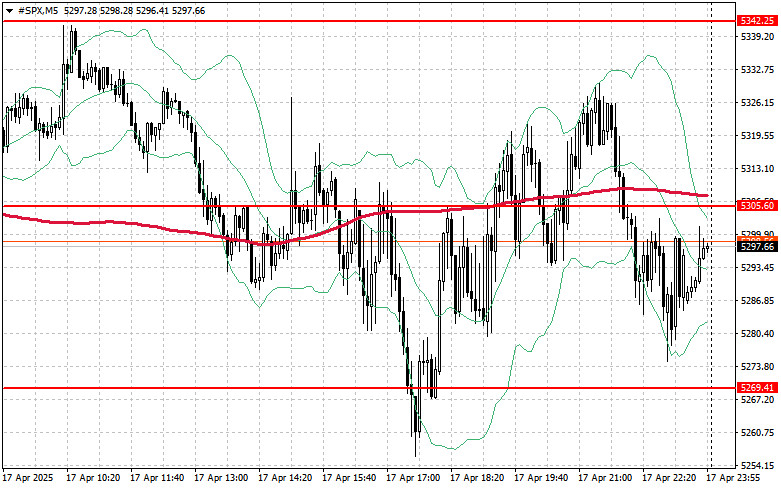

At the close of the previous regular trading session, U.S. stock indices ended mixed. The S&P 500 rose by 0.13%, while the Nasdaq 100 fell by 0.13%. The industrial Dow Jones lost 1.33%.

Asian indices gained slightly today as investors mostly adopted a wait-and-see approach, anticipating further news related to tariff negotiations. Uncertainty in trade policy—especially between the world's largest economies—is exerting significant pressure on the markets. As a result, companies are postponing major investment decisions, fearing that new tariffs could significantly affect their profitability and competitiveness. This cautious stance by investors is also reflected in trading volumes, which remain relatively low. Many prefer to maintain liquidity to respond quickly to any shifts in the situation.

Japan's Nikkei-225 rose by 0.8%, while indices on mainland China fell by 0.4% after the U.S. introduced tariffs on Chinese vessels docking at American ports. Given that most other markets in the region are closed today due to Good Friday, volatility is expected to remain relatively low.

However, as noted above, traders will stay focused on the progress of negotiations with specific countries, looking for clues as to how tariff policy will evolve going forward. Following what Trump called "major progress" in talks between Japan and the U.S., similar progress is expected in discussions with the European Union. However, no details have been released, meaning it may all remain just loud rhetoric from Trump.

The yen remained largely unchanged on Friday after weakening in the previous session. Japan's lead negotiator stated that currencies were not discussed during the bilateral meeting, which eased concerns that a stronger exchange rate would become part of the U.S. demands.

While Trump did not provide specifics about any agreement with the EU, he was adamant about the importance of a U.S.-Ukraine deal on minerals, claiming it would be signed next week. Claims like these have been circulating since February this year, limiting their informational value. The U.S. president also said he doesn't want to keep raising tariffs on China, which could halt trade between the two countries.

But words are one thing—actions are another. Immediately after saying he didn't want to escalate tariffs, the administration imposed duties on Chinese ships entering U.S. ports, threatening to disrupt global shipping routes and intensify the trade war between the world's two largest economies. As a result, shares of shipping companies in Japan and South Korea—such as Kawasaki Kisen Kaisha Ltd. and HMM Co.—reacted sharply to the news with losses.

Yesterday, Trump even criticized Federal Reserve Chair Jerome Powell on social media, stating that removing him from office could happen fairly quickly and that the central bank should have already lowered interest rates this year. Later, Trump told reporters he could force Powell to resign if he wanted to.

As for the S&P 500 technical picture, the key task for buyers today will be to break through the nearest resistance at $5305. This would support continued growth and open the way toward $5342. Maintaining control over $5399 is another top priority for the bulls, as it would strengthen their position. If risk appetite fades and the index starts moving lower, buyers must defend the $5296 level. A breakdown of this area would quickly push the instrument back to $5226 and open the path toward $5195.

TAUTAN CEPAT