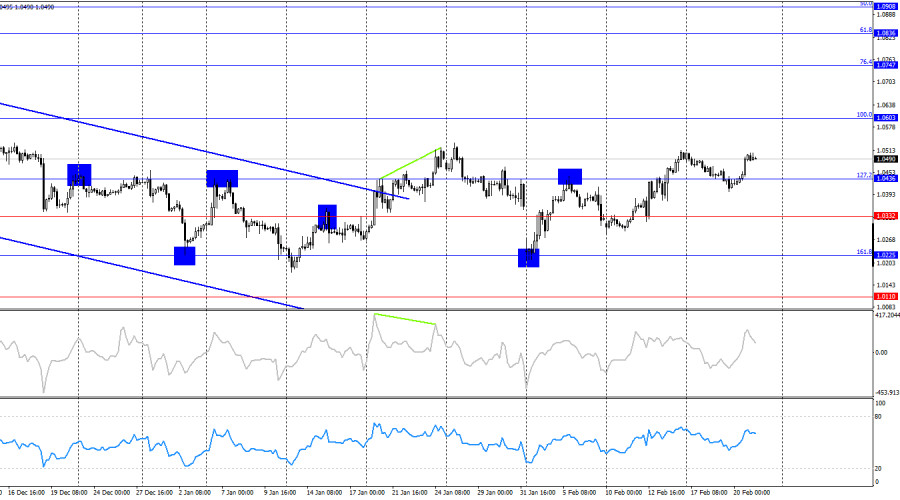

On Thursday, the EUR/USD pair continued its upward movement following a rebound from the 61.8% Fibonacci retracement level at 1.0411. By the end of the day, the pair climbed towards the previous peak near 1.0513. The uptrend may continue towards the 100.0% Fibonacci retracement level at 1.0533 today, but the fundamental backdrop could alter this scenario. With a high volume of economic data releases, bearish traders may also become more active.

The wave pattern on the hourly chart has become less straightforward. The last completed downward wave failed to break the previous low, while the latest upward wave surpassed the prior peak. This suggests that the trend has shifted bullish once again, or that the pair is in a complex sideways range, which is more evident on the 4-hour chart. The inconsistent size of recent waves raises doubts about the presence of a clear trend.

Thursday's economic calendar was largely empty, leaving traders to operate based on market sentiment and speculation. Two key U.S. reports—the Philadelphia Fed Business Activity Index and Initial Jobless Claims—were weaker than expected, but they were not considered crucial for traders.

Today, however, differs significantly from the previous four trading sessions as high-impact economic reports are scheduled for release. February PMI indices for Germany and the Eurozone are expected to show modest growth. The manufacturing sector will likely remain below the 50.0 threshold, but any improvement in Eurozone economic indicators is considered positive news. Given the scarcity of bullish catalysts for the euro, even slight improvements in PMI figures could fuel further demand for the currency.

Thus, the euro has a solid chance of continuing its rise today, though approximately 80% of the movement will depend on data from the Eurozone.

The pair retraced to the 127.2% Fibonacci retracement level at 1.0436 and consolidated above it. However, on the 4-hour chart, it's evident that 2025 has been characterized by a predominantly sideways trend. This suggests that EUR/USD may resume its decline towards the 161.8% Fibonacci level at 1.0225. No developing divergences are currently visible on any indicators.

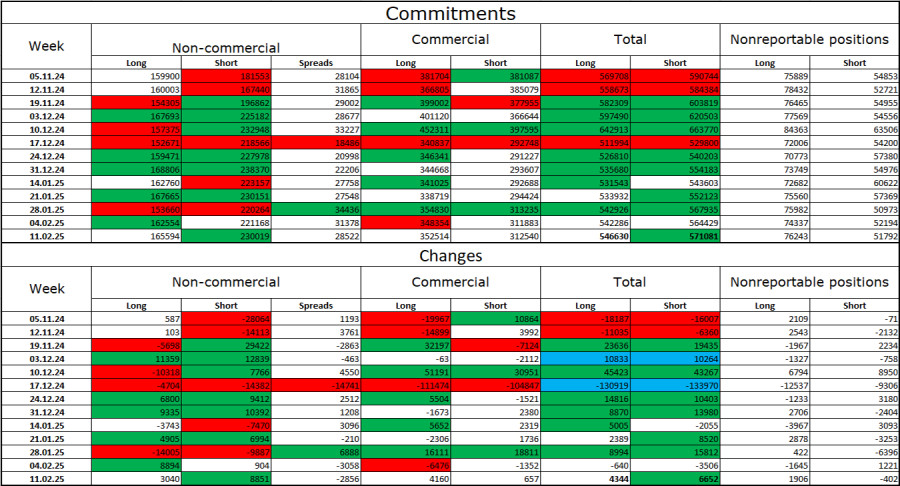

The latest COT report indicates that institutional traders continue to reduce their euro holdings. 3,040 new long positions were added and 8,851 new short positions were opened. The overall sentiment of non-commercial traders remains bearish, suggesting further downward potential for the pair. Total long positions among speculators now stand at 165,000, while short positions total 230,000.

For 21 consecutive weeks, major traders have been offloading euro positions, reinforcing a long-term bearish trend. Occasionally, bullish activity dominates for brief periods, but these are exceptions rather than the norm.

The key driver for dollar weakness—expectations of monetary policy easing by the Federal Reserve (FOMC)—has already been priced in. With no new bearish catalysts for the USD, the likelihood of a continued dollar rally remains high. Technical analysis also supports the long-term bearish trend, so I anticipate further EUR/USD declines in the medium term.

Eurozone Data Releases:

U.S. Data Releases:

With a packed economic calendar, PMI indices could significantly influence both the euro and the dollar. The fundamental backdrop on Friday may have a moderate yet sustained impact on market sentiment throughout the day.

Short positions were viable upon a rebound from 1.0458, targeting 1.0435 and 1.0411—both of which have already been reached. New short entries could be considered at 1.0533, with downward targets below. Long positions were previously valid from 1.0411, but all immediate bullish targets have already been met.

TAUTAN CEPAT