The test of the 155.69 price level coincided with the MACD indicator moving significantly below the zero mark, which, in my view, limited the pair's downward potential. For this reason, I did not sell the dollar and missed the entire downward movement.

The strong growth of Japan's leading economic indicators, combined with the Central Bank's promise to continue raising interest rates, helped the yen regain dominance against the U.S. dollar. However, such a significant sell-off of USD/JPY was largely unexpected. The rise in Japan's leading economic indicators indicates economic recovery amid global uncertainty. The yen's strengthening came as a surprise, as many analysts had predicted further weakening of the Japanese currency. However, the Bank of Japan's confidence in the need for rate hikes added to the volatility. These ongoing changes in Japan's monetary policy could attract new investment flows into the country. Increased rates, along with positive economic signals, could inspire investors, adding pressure on USD/JPY.

Today, the only notable U.S. data is the report on new home sales. Weak figures could add further downward pressure, leading to another sell-off of USD/JPY. Conversely, strong data could help the pair recover.

For intraday strategies, I will rely more on implementing Scenario #1 and Scenario #2 in continuation of the downward trend.

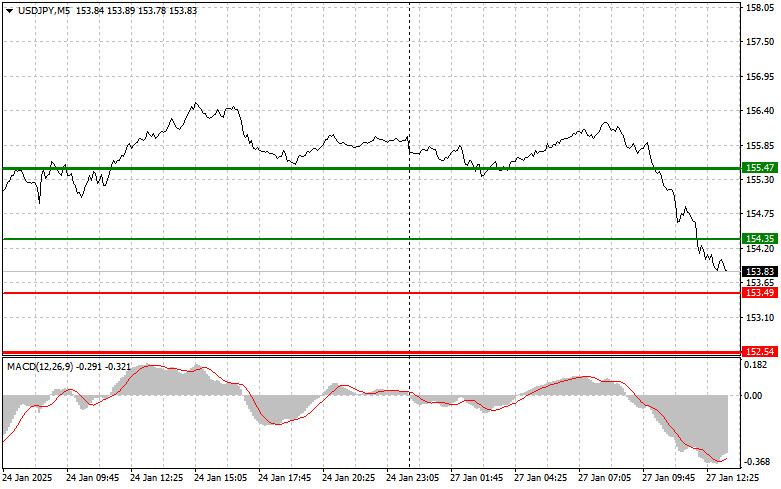

Scenario #1: Today, I plan to buy USD/JPY at the 154.35 level (green line on the chart) with a target of rising to 155.47 (thicker green line on the chart). At the 155.47 level, I plan to exit purchases and open short positions in the opposite direction, aiming for a movement of 30-35 points in the opposite direction. Counting on the pair's growth is possible only with strong U.S. statistics.Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY in case of two consecutive tests of the 153.49 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected to the opposite levels of 154.35 and 155.47.

Scenario #1: I plan to sell USD/JPY after breaking below the 153.49 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 152.54 level, where I plan to exit sales and immediately open long positions in the opposite direction, aiming for a movement of 20-25 points in the opposite direction. Further pressure on the pair is possible today, but it will require a news trigger.Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell USD/JPY in case of two consecutive tests of the 154.35 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 153.49 and 152.54 can be expected.

Beginner traders should exercise extreme caution when making market entry decisions. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you trade large volumes without proper money management.

Remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

TAUTAN CEPAT