Futures on stocks indicate gains in Europe and the U.S., as optimism over increased spending on artificial intelligence (AI) under Donald Trump offsets uncertainty regarding impending tariffs. Futures for the S&P 500 rose by 0.3%, while the tech-heavy NASDAQ climbed 0.5%. The Dow Jones Industrial Average is up 0.1%. Euro Stoxx 50 futures added 0.2%.

The growth followed a rally in Asian tech stocks fueled by Trump's proposed investment boost in the AI sector. Investors eager to seize new opportunities are actively channeling funds into companies focused on developing and implementing artificial intelligence. Expectations of predicted economic growth further intensify interest in this sector. Trump's commitment to significantly increase funding for research and development in technology highlights the strategic importance of AI for the future of the U.S. economy. This initiative creates favorable conditions for investment, driving up stock prices of leading tech giants and startups in the field.

Chinese stocks declined after the U.S. president stated he is still considering a 10% tariff on all goods from China. Divergent forces shaping global financial markets underscore the complex issues investors will need to navigate in the coming months as the Trump administration is expected to implement a series of radical policy changes. His first two days as president have mostly bolstered sentiment, as investors focus on his pro-business agenda.

The yield on 10-year U.S. Treasury bonds remained steady after dropping five basis points during the previous session. The dollar strengthened against riskier assets, while both the onshore and offshore Chinese yuan were among the weakest performers in the Asian currency market.

It is evident that few market participants expected such a calm start after Trump's inauguration, fueling optimism across the markets. This will likely continue to drive buying in stocks and indices.

Chinese and Hong Kong tech stocks largely missed out on the rally. The Hang Seng Tech Index, which includes some of China's largest tech companies, fell as much as 2.8%.

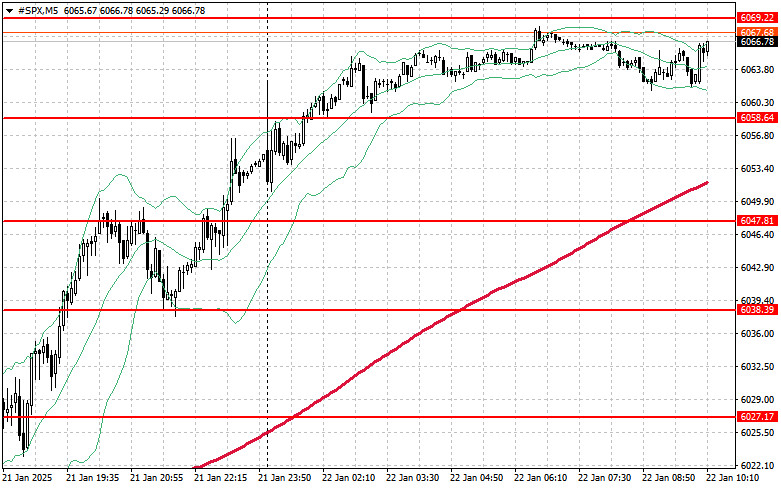

Demand has returned to the market. Buyers' primary objective today will be defending the $6,058 level. This will help sustain the upward trend and open the door for a push to the next level at $6,069. Another critical goal for bulls is maintaining control above $6,079, which will strengthen buyers' positions.

If the index moves downward amid reduced risk appetite, buyers must assert themselves around $6,058. A breach of this level could quickly push the index back to $6,047 and potentially to $6,038.

TAUTAN CEPAT