The U.S. dollar resumed its decline yesterday after Republicans and Democrats once again failed to reach a budget agreement, prolonging the government shutdown.

In the first half of the day, euro sellers did everything they could, leveraging France's political problems. However, later in the day, buyers regained control.

The atmosphere of uncertainty—driven by snap elections in France—continues to weigh on the euro. Traders fear potential changes in the country's economic policy, which could hurt France's financial stability and eventually affect the entire eurozone.

This morning, some important data will be published for the eurozone. German factory orders and France's trade balance will attract traders' attention. Also notable is a speech by Bundesbank President Joachim Nagel.

German factory orders are expected to show modest growth. Following recent volatility in the manufacturing sector, any signs of recovery will be closely examined for clues of stabilization in the German economy. Analysts believe that an increase in orders could signal improved output in the coming months.

France's trade balance will offer insight into the competitiveness of the French economy. An increase in surplus indicates stronger export potential and, in turn, signals accelerating economic growth.

Nagel's speech will be a key event. The markets will closely monitor his comments regarding inflation, monetary policy, and the eurozone's economic outlook.

In the UK, the Halifax House Price Index will be released in the first half of the day. This report traditionally garners attention as one of the most trusted indicators of the UK's housing market health. Given the current macroeconomic backdrop, these figures are especially critical. A drop in prices may suggest a cooling market due to higher borrowing costs and reduced consumer purchasing power.

If the data match economists' expectations, it's better to use the Mean Reversion strategy. If the data deviate considerably from expectations (either much stronger or weaker), the Momentum strategy is preferred.

Buying on a breakout above the 1.1720 level may lead to a rise in the euro toward the 1.1745 and 1.1777 areas.

Selling on a breakout below the 1.1685 level may lead to a decline in the euro toward the 1.1654 and 1.1611 areas.

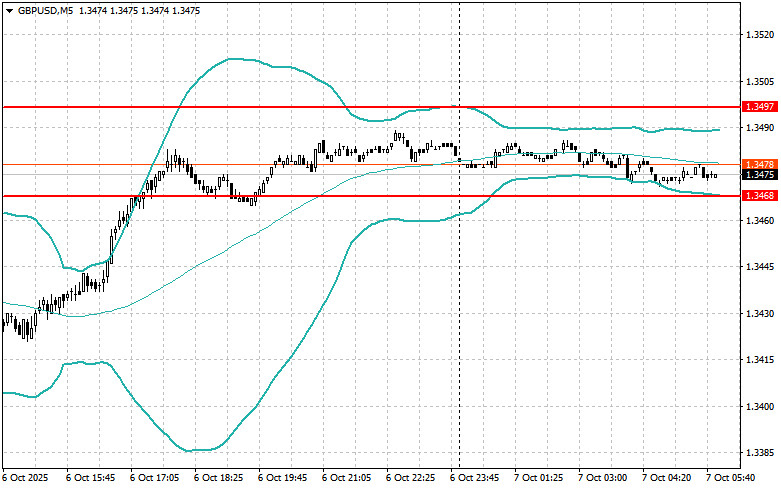

Buying on a breakout above the 1.3500 level may result in a rise in the pound toward the 1.3525 and 1.3556 areas.

Selling on a breakout below the 1.3465 level may result in a decline in the pound toward the 1.3425 and 1.3390 areas.

Buying on a breakout above the 150.60 level may lead to a rise in the dollar toward the 150.99 and 151.30 areas.

Selling on a breakout below the 150.35 level may result in a decline in the dollar toward the 150.10 and 149.80 areas.

I will look to sell after a failed breakout above the 1.1728 level, followed by a return below it.

I will look to buy after a failed breakout below the 1.1694 level, followed by a return above it.

I will look to sell after a failed breakout above the 1.3497 level, followed by a return below it.

I will look to buy after a failed breakout below the 1.3468 level, followed by a return above it.

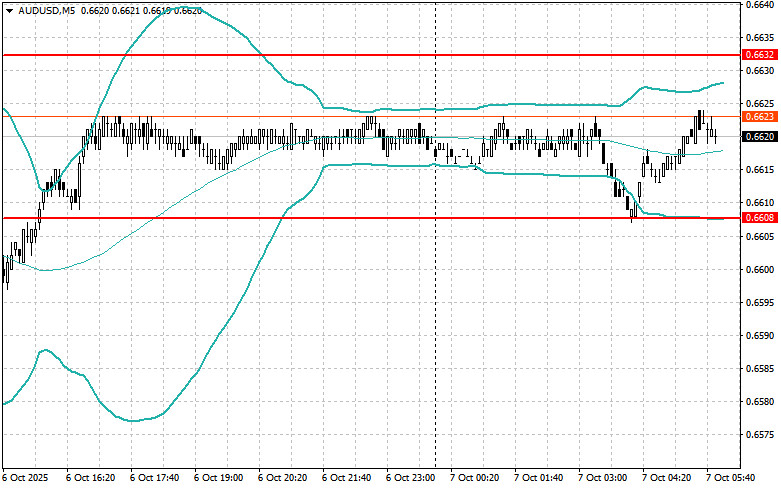

I will look to sell after a failed breakout above the 0.6632 level, followed by a return below it.

I will look to buy after a failed breakout below the 0.6608 level, followed by a return above it.

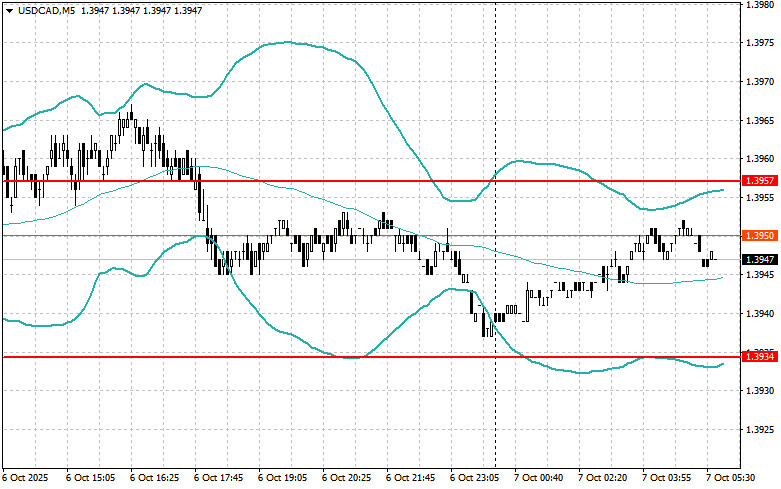

I will look to sell after a failed breakout above the 1.3957 level, followed by a return below it.

I will look to buy after a failed breakout below the 1.3934 level, followed by a return above it.

QUICK LINKS