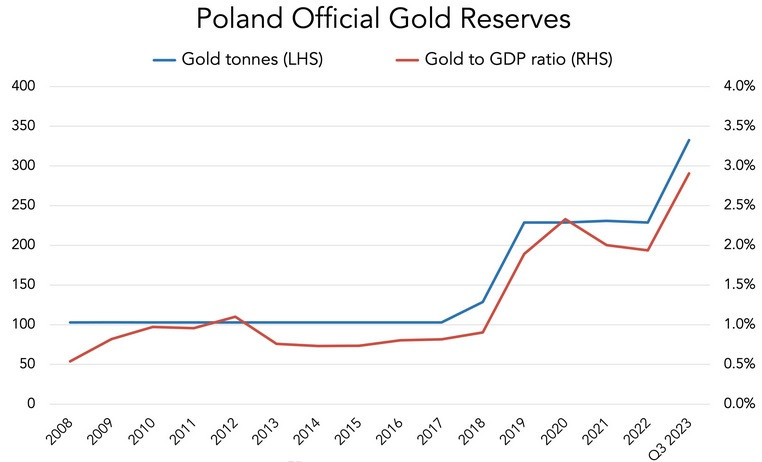

According to the World Gold Council, Poland's central bank has acquired about 300 tons of gold, attempting to gradually normalize the gold-to-GDP ratio, a significant indicator for potential inclusion in the future gold standard of the eurozone.

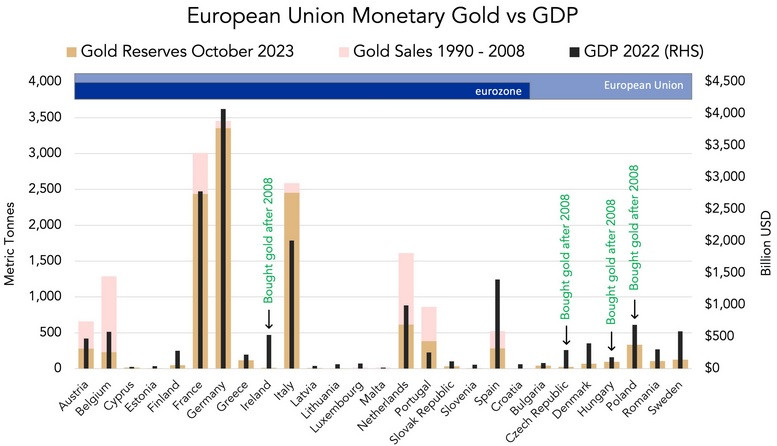

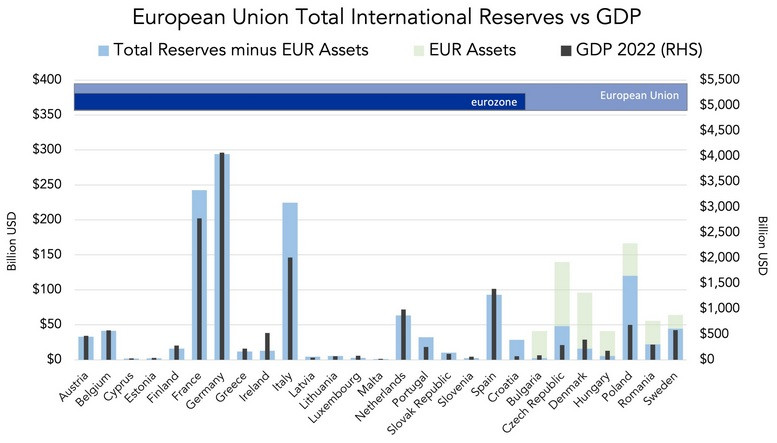

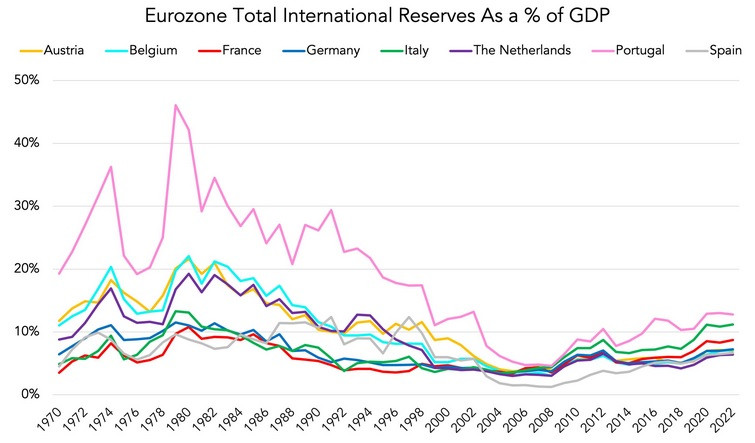

The EU consists of 27 countries, of which 20 are part of the eurozone. For medium and large economies in the eurozone, an equal ratio of monetary gold to GDP is a hidden requirement for countries that should be prepared for the transition to a new gold standard.

European central banks not only slowly and informally disclose their gold strategy but also take actions that confirm this policy.

A recent statement from a representative of the European Central Bank confirmed the implementation of this informal policy of the gold-to-GDP ratio. Last month, a representative of the Dutch central bank (DNB) admitted in an interview that the DNB owns gold equivalent to about 4% of its GDP. The precision with which the central banks of the eurozone aligned their reserves to GDP ratio is remarkable. Obviously, this was carefully planned.

Poland's high pace of gold purchases is an attempt to meet the eurozone's requirement. Until 2017, Poland owned 103 tons of monetary gold, which was only 1% of its GDP. To comply with european partners, Poland needed to significantly increase its gold reserves, and it did so: in 2018, the National Bank of Poland (NBP) began aggressively buying gold. Currently, Poland's gold reserves amount to 334 tons, which is almost 3% of the country's GDP.

According to the schedule, to reach 4% of GDP, Poland will need 450 tons. To acquire euros, the country will also need to transfer gold to the European Central Bank, which would be about 16 tons at the prevailing gold price.

Most likely, most central banks worldwide are aware of this informal policy of harmonizing gold reserves. For each central bank that considers gold its "Plan B," there is an incentive to convince other central banks to do the same and proportionally balance the size of their gold reserves with each other.

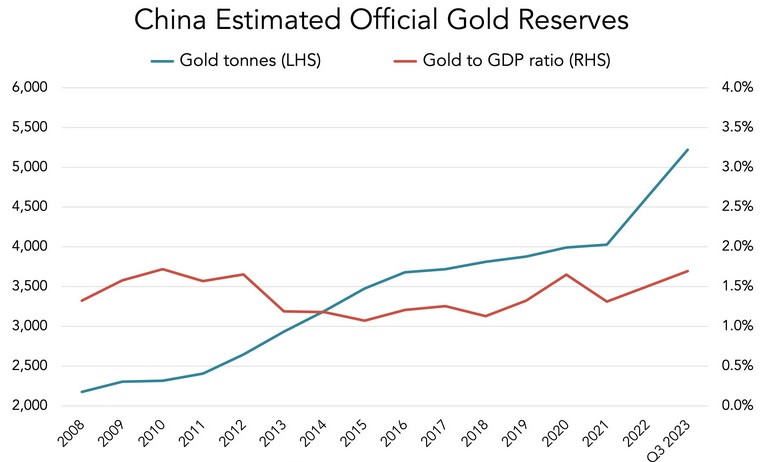

This dynamic goes beyond the eurozone. The People's Bank of China currently owns 5,220 tons of gold, almost 2% of its GDP. The bank is buying gold in huge quantities (about 700 tons per year) as the West freezes Russia's dollar assets. China needs to double its gold reserves. Other financial centers are following suit.

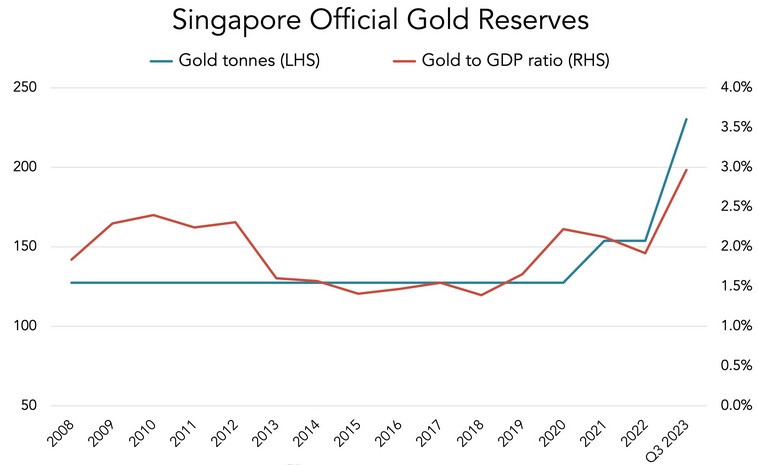

In 2018, Singapore's monetary gold-to-GDP ratio was 1%, and now it is 3%.

It would be interesting to see if Singapore will stop buying gold when it reaches 4%.

QUICK LINKS