Trade Analysis and Recommendations for Trading the Japanese Yen

The test of the 154.17 price occurred at a moment when the MACD indicator had already moved significantly upward from the zero mark, which limited the pair's upward potential. For this reason, I did not buy the dollar and skipped the move.

In the second half of the day, we will only see U.S. factory orders data, which is unlikely to significantly help the dollar rise against the Japanese yen. Investors' attention is currently focused on other factors that determine currency-pair dynamics. The key factor is the anticipation of signals from the Federal Reserve regarding future monetary policy. The market is pricing in the possibility of a softer approach by the regulator, which puts pressure on the dollar. The Japanese yen, on the contrary, is receiving support amid speculation that the Bank of Japan may revise its ultra-loose monetary policy. Technical analysis also points to the continuation of the downtrend in USD/JPY, and the morning rally can quite realistically be used for building new short positions on the dollar in the second half of the day.

As for the intraday strategy, I will rely primarily on the execution of Scenarios #1 and #2.

Buy Signal

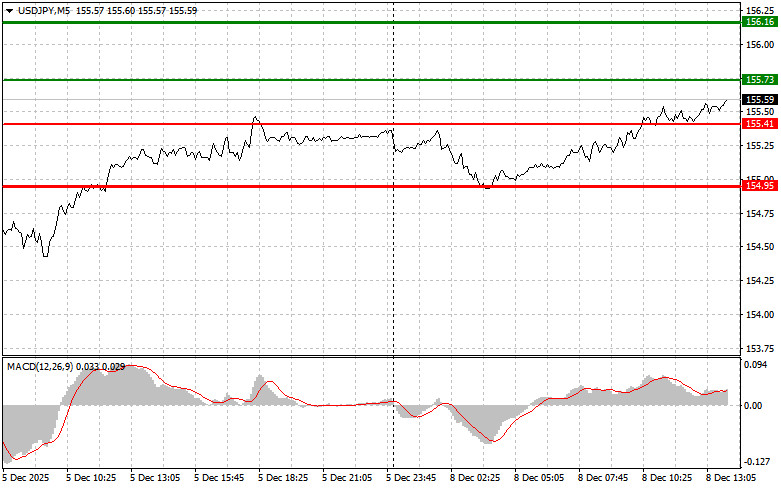

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 155.73 (green line on the chart) with a target of rising to 156.16 (the thicker green line on the chart). Around 156.16, I will exit buy positions and open sales in the opposite direction (expecting a 30–35 point move downward from that level). Counting on a rise of the pair is possible only after strong U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 155.41 price at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth towards the opposite levels of 155.73 and 156.16 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after the price breaks below the 155.41 level (red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be the 154.95 level, where I will exit and immediately open purchases in the opposite direction (expecting a 20–25 point rebound upward). Pressure on the pair will return only in the event of very weak U.S. data. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to move downward from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 155.73 price at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 155.41 and 154.95 can be expected.

Chart Explanation

Important

Beginner Forex traders must make entry decisions with great caution. Before important fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for an intraday trader.

QUICK LINKS