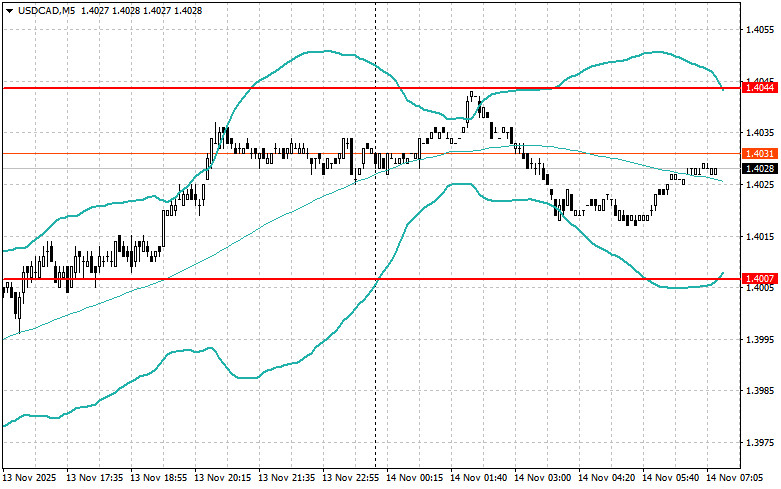

The euro, pound, and other risky assets continued to rise against the U.S. dollar. Confusion among the U.S. Federal Reserve, with significantly differing statements from policymakers, has put pressure on the dollar. Growing uncertainty about the monetary policy trajectory, combined with contradictory statements from members of the Open Market Committee, undermines traders' confidence in the stability of the U.S. currency.

On one hand, there are increasing calls for further tight monetary policy to finally curb inflation, which, although slowing, remains above the target level of 2%. On the other hand, the camp advocating rate cuts is gaining strength, pointing to negative consequences for economic growth and the labor market.

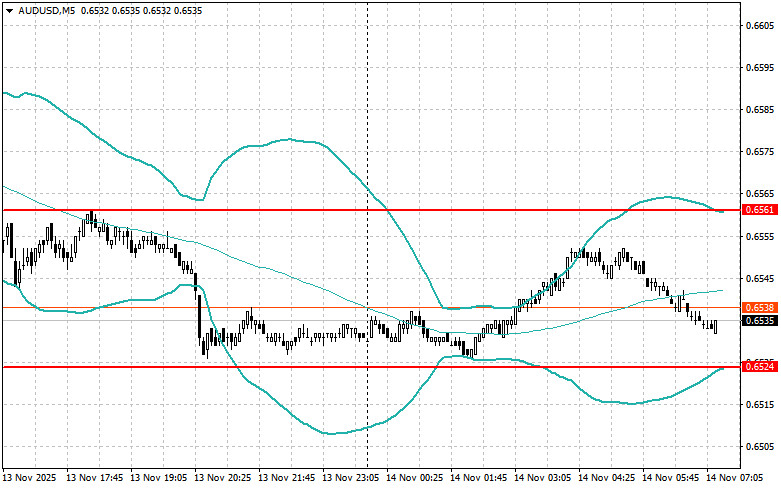

Today, in the first half of the day, the euro may continue to rise, but strong data on Eurozone GDP growth, employment levels, and the external trade balance are needed to support this. Optimistic GDP figures demonstrating resilient growth in the Eurozone economy will catalyze further strengthening of the euro. Positive changes in employment levels will also play a role. A decrease in unemployment and an increase in the number of employed will create a favorable environment for rising consumer spending and business activity, which, in turn, will support the euro. A positive external trade balance reflecting higher exports than imports will be another factor contributing to the euro's growth.

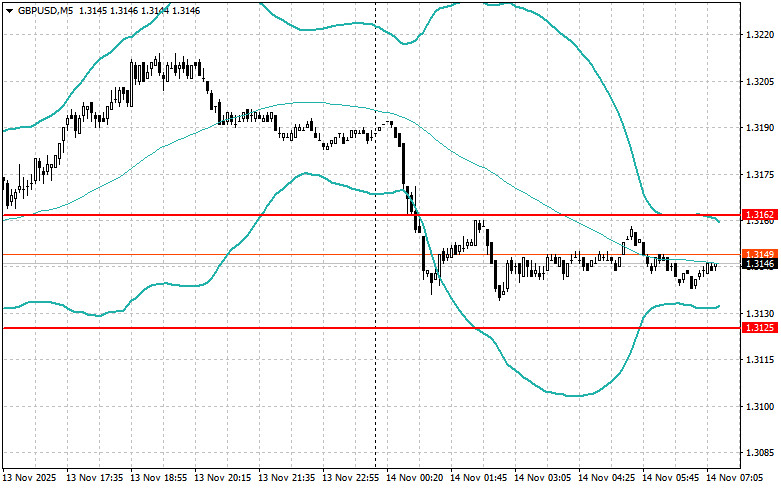

As for the pound, there are no reports today for the UK, so all attention will be on Rachel Reeves' further plans for shaping the country's budget for the next financial year. Her statements about refusing to raise taxes yesterday surprised many, further confusing traders. The situation is complicated by the fact that the Conservative government is under increasing pressure from the opposition and the public. Economic difficulties, inflation, and the rising cost of living undermine trust in the ruling party. Reeves, while presenting the budget, will need to strike a balance between stimulating economic growth and reducing public debt.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use the Momentum strategy.

QUICK LINKS