The upcoming week promises to be quite eventful for the British pound. It is important to note that the bulk of the United Kingdom's key economic data is traditionally released around the middle of each month. The wave count for GBP/USD has also become more complex due to the recent decline in price, and now shows a pattern of three consecutive three-wave structures. In this regard, the wave configurations of the pound and the euro currently align fully, which is a positive development.

We are now observing the third wave taking shape in the current structure. At the same time, recent developments in macroeconomic news have not provided a reason for the broad strengthening of the U.S. dollar, or the market may have ignored them. Therefore, I believe market participants have gathered sufficient rationale to start increasing demand for the pound.

Looking ahead slightly, on Friday, Donald Trump announced a 100% tariff hike on Chinese goods, giving the market another reason to resume flight from the dollar. But returning to British events and data.

Upcoming Economic Events in the UK

In the new week, the UK will publish data on the following:

In addition, a speech is expected from Bank of England Chief Economist Huw Pill. Each of these events carries market relevance. However, GDP and industrial production will be the most critical, both of which are again expected to show weak results. The unemployment rate may also continue to rise. Thus, from a data standpoint, the chances of fundamental support for the pound appear limited.

Huw Pill's remarks may hint at the next round of monetary policy easing from the BoE. Initially, the British central bank planned four rounds of interest rate cuts in 2025, and three have already been implemented. One remains. However, inflation in the UK is rising rapidly and has already doubled the BoE's target level. Therefore, I believe the fourth round may not happen at all, and both Governor Andrew Bailey and Huw Pill will have to clarify whether the central bank intends to continue easing despite elevated inflation.

The American news backdrop will once again take priority in influencing market direction. However, economic data from the U.S. will be limited because the government shutdown is causing delays in major statistical releases until operations officially resume.

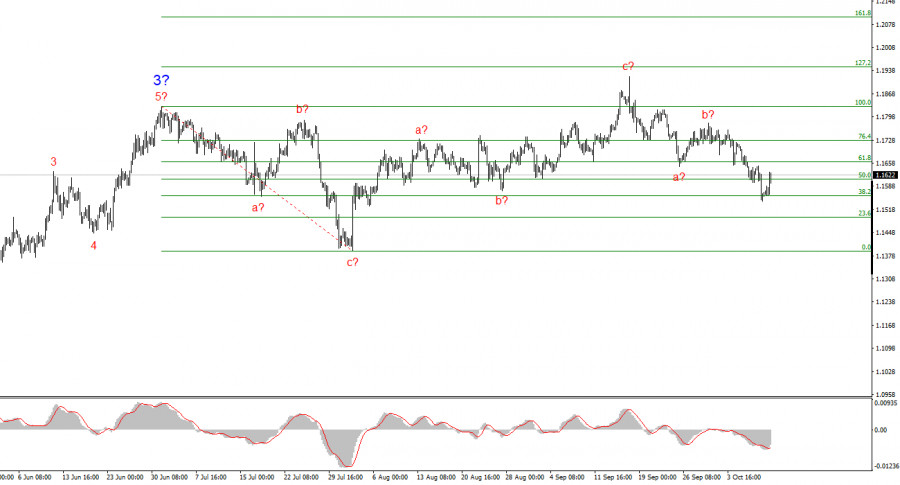

According to the analysis of EUR/USD, the instrument continues to form an upward segment of the trend. The wave structure still entirely depends on the news background, particularly the decisions made by Trump, as well as the domestic and foreign policy of the new White House administration. The targets of the current segment of the trend could reach the 1.2500 range. At present, a complex corrective wave 4 is forming and approaching completion. The bullish wave structure remains intact. Therefore, in the near term, I continue to consider only long positions. By year-end, I expect the euro to rise to the level of 1.2245, which corresponds to the 200.0% Fibonacci level.

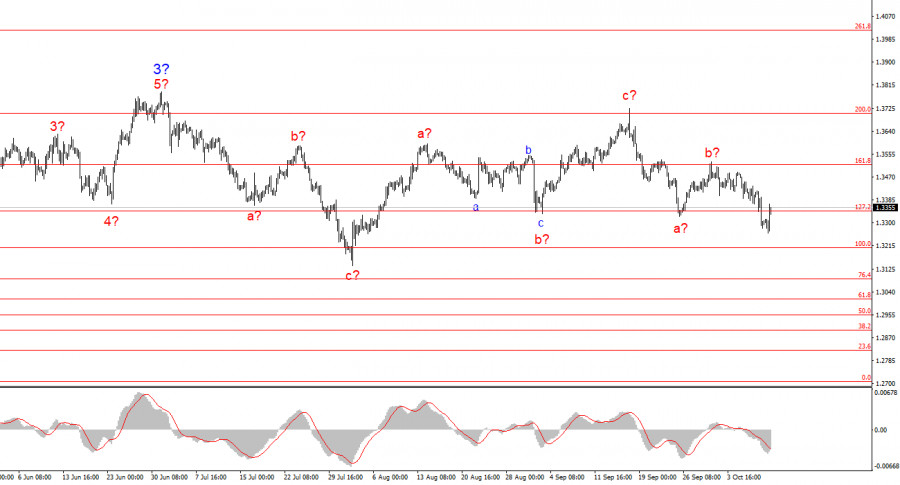

The wave structure of GBP/USD has changed. We are still dealing with an upward, impulsive segment of the trend, but its internal wave formation is becoming more complex. Wave 4 is taking the form of a complicated three-wave correction, and its length is significantly greater than that of wave 2. As we are currently observing the formation of a presumed wave within another corrective three-wave pattern, it may soon be completed. If this is confirmed, the upward movement of the instrument within the global wave framework could resume, with initial targets around the 1.3800 and 1.4000 levels..

1.Wave structures should be simple and easy to understand. Complex structures are difficult to trade and are prone to change.

2.If there is no confidence in the market situation, it is better not to enter the market.

3.One can never have complete certainty about market direction. Always use protective Stop Loss orders.

4.Wave analysis can be combined with other types of analysis and trading strategies.

QUICK LINKS