Trade review and advice for trading the euro

The price test at 1.1805 occurred when the MACD indicator had just begun moving upward from the zero mark, confirming the correct entry point for buying the euro—especially after yesterday's Fed decision. As a result, the pair gained more than 45 points.

Despite the absence of important Eurozone statistics, demand for the euro returned. Clearly, the Fed's strong dovish stance yesterday is maintaining demand for risk assets. The current situation reflects broader trends in global financial markets. Investors are showing an appetite for risk, supported by confidence that central banks will continue to backstop the economy. The Fed's dovish monetary policy acts as a catalyst, pushing capital into higher-yielding assets, including European ones.

During the U.S. session, traders will see data on the number of new jobless claims, the Philadelphia Fed manufacturing index, and the leading economic indicators index. These releases will provide an important basis for analyzing the current U.S. economic situation and labor market dynamics. Initial jobless claims are a key barometer of labor market health. A rise in this figure may signal job losses and weaker economic activity. Conversely, a decline points to labor market strength and greater business confidence. A decrease would support the dollar.

The Philadelphia Fed manufacturing index reflects business activity in the region's manufacturing sector. This index is a key gauge for assessing overall U.S. economic conditions, as manufacturing plays a major role in growth. A strong reading will have a positive impact on the dollar. The leading indicators index is a composite measure that tracks ten economic indicators considered predictive of future conditions. Positive movement suggests expansion, while negative movement points to possible recession.

As for intraday strategy, I will be relying more on scenarios #1 and #2.

Buy signal

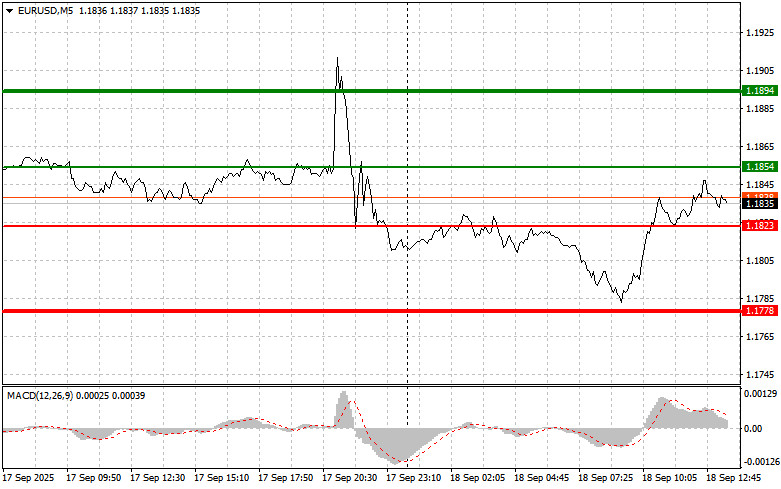

Scenario #1: Today, buying the euro is possible at around 1.1854 (green line on the chart) with a target at 1.1894. At 1.1894, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point pullback from the entry level. Buying can only be considered after weak U.S. labor data.Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1823 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 1.1854 and 1.1894 can be expected.

Sell signal

Scenario #1: I plan to sell the euro after reaching the 1.1823 level (red line on the chart). The target will be 1.1778, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point reversal from the level). Selling pressure will return to the pair if the data comes out strong.Important! Before selling, make sure the MACD indicator is below zero and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1854 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.1823 and 1.1778 can be expected.

What's on the chart:

Important. Beginner Forex traders must be very cautious in making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp volatility. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one outlined above. Spontaneous decisions based on the current market situation are a losing strategy for an intraday trader.

QUICK LINKS