The S&P 500 achieved its 23rd record high of 2025, fueled by Oracle's stunning performance and an unexpected drop in US producer prices in August. The odds of aggressive monetary easing from the Federal Reserve have increased, helping US equities sustain their stellar run.

US equity index performance

Oracle shares surged 36% in a single day, highlighting the company's best session since 1992 and a remarkable move for a 48-year-old tech giant. This leap added $247 billion to Oracle's market value, propelling it to become the 10th-largest S&P 500 constituent by market capitalization, surpassing JP Morgan. Market chatter is already likening Oracle to the next NVIDIA, as investors are dazzled by its results.

In the second quarter, Oracle's contract revenue soared to $455 billion, more than double the previous year's figure. More eye-catching was Oracle's statement that it has massive multi-billion-dollar deals in the pipeline that could push this number even higher. Notably, the company inked a $300 billion agreement with OpenAI.

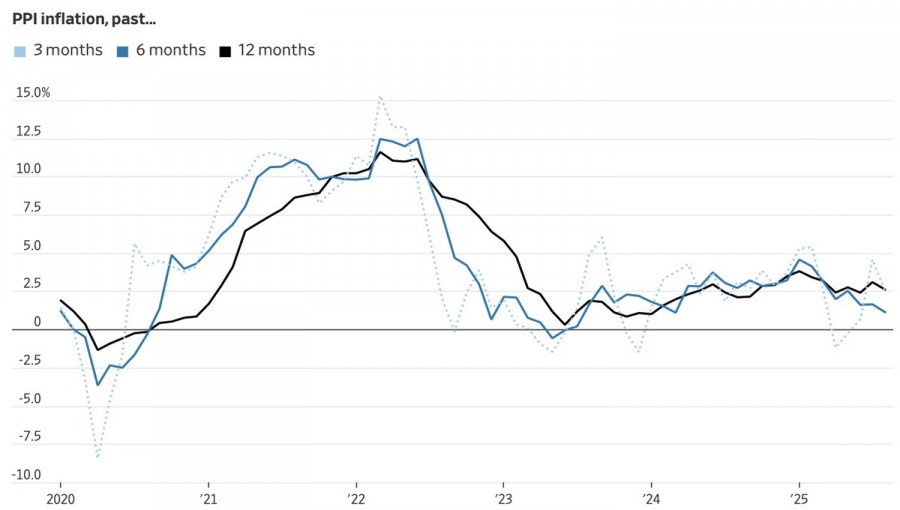

There was additional good news as US producer prices fell on a monthly basis in August, suggesting companies are absorbing White House tariffs rather than passing them on to consumers. Following the report, Donald Trump declared there is "no inflation" in the US and urged the Fed to cut rates as soon as possible. Expectations for renewed monetary expansion are pushing the S&P 500 higher.

US inflation dynamics

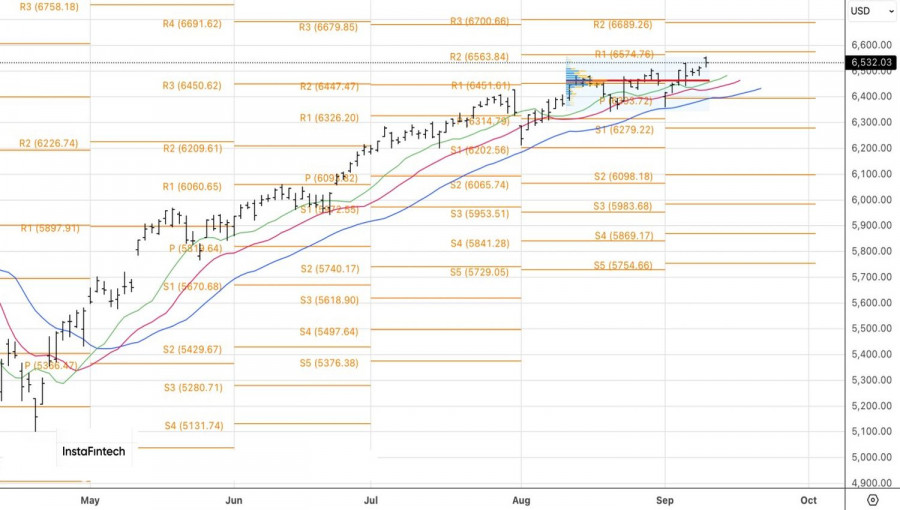

It is no surprise optimism is building. Deutsche Bank raised its year-end target for the S&P 500 to 7,000, citing a weaker dollar, better-than-expected economic growth, favorable positioning, and an assessment that half the impact of tariffs has already fed into inflation. Seaport Research Partners sees the S&P 500 reaching 6,700 by the end of 2025 and 7,300 by year-end 2026, on the back of continued US leadership in artificial intelligence. Wells Fargo predicts the broad index will rise another 11% next year. As long as AI-related capital expenditures continue to rise, equities should maintain their upward momentum.

A potent combination of Fed rate cut expectations and AI innovation continues to drive the S&P 500 to new all-time highs. While the US has lost its singular edge in economic growth, it remains unrivaled in other domains. At the same time, declining inflation has reduced the threat of stagflation, long a concern for the broader index. With those fears receding, the market is free to rally.

From a technical point of view, on the daily chart, the S&P 500 has come within striking distance of the first two previously cited upside targets—6,565 and 6,700. The sensible approach remains to keep buying on dips.

QUICK LINKS