Will the French government's resignation spark upheaval in financial markets? Will Jerome Powell hint at a pause in the Federal Reserve's monetary policy easing cycle? These two questions are weighing on investors, causing EUR/USD to consolidate within a narrow trading range. The main currency pair is coiling like a spring, ready to surge even before the release of the U.S. November employment report.

French President Emmanuel Macron has urged lawmakers not to topple the government, appealing to them not to prioritize personal ambitions over the nation's interests. However, both the left and right factions in parliament claim that Prime Minister Michel Barnier and his administration are out of touch with the French public. With just moments left before a vote of no confidence, the prime minister warns that such a move could spark turmoil in financial markets. For now, the yield spread between French and German bonds is narrowing, helping EUR/USD to stabilize.

Yield Spread Dynamics Between French and German Bonds

Should the government be ousted, it would mark the shortest tenure for a French administration since the founding of the Fifth Republic in 1958. France would enter uncharted territory politically and economically. Investors would then grapple with the possibility of the yield spread—already at its highest since 2012—widening further. If that happens, parity in EUR/USD would draw closer.

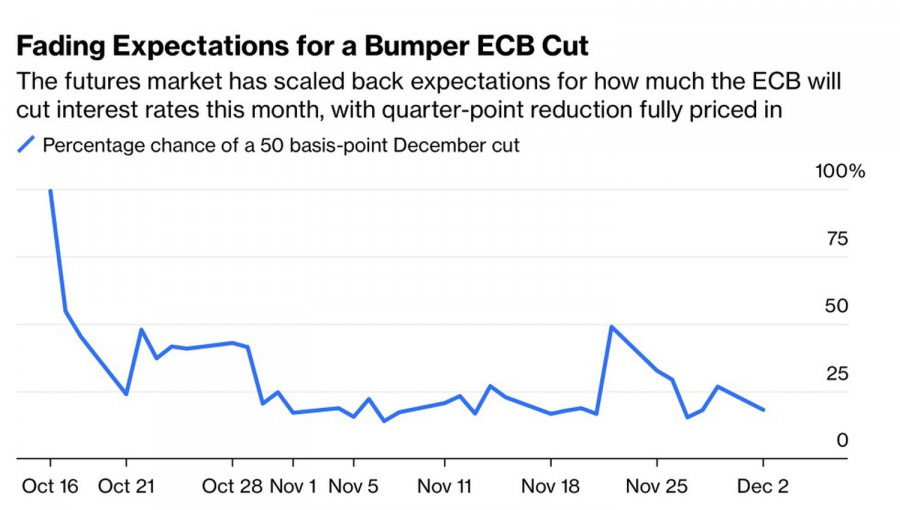

The euro is holding its ground due to reduced expectations of a 50-basis-point deposit rate cut by the European Central Bank in December. According to Croatian National Bank Governor Boris Vujcic, monetary easing must be cautiously approached, as the road is treacherously slippery. His Finnish counterpart, Olli Rehn, also advocates leaving room for maneuvering within the ECB.

Probability of ECB's 50 b.p. Rate Cut in December

Pressure on the dollar comes from receding "Trump trade" momentum and a drop in the likelihood of a Fed pause in the monetary policy easing cycle in December, from 44% to 26%. Investors are skeptical about whether Donald Trump's plans can be realized. Moreover, some of his statements are controversial. Why defend the U.S. dollar with threats of tariffs against BRICS nations when the dollar's strength is already unquestioned?

There are risks that Jerome Powell could reverse course, as he did at the end of the first quarter. Back then, markets had priced in a dovish Fed pivot for late 2023, but accelerating inflation forced the Fed Chair to rethink. Now, CPI and PCE growth rates are rising again. Is history repeating itself?

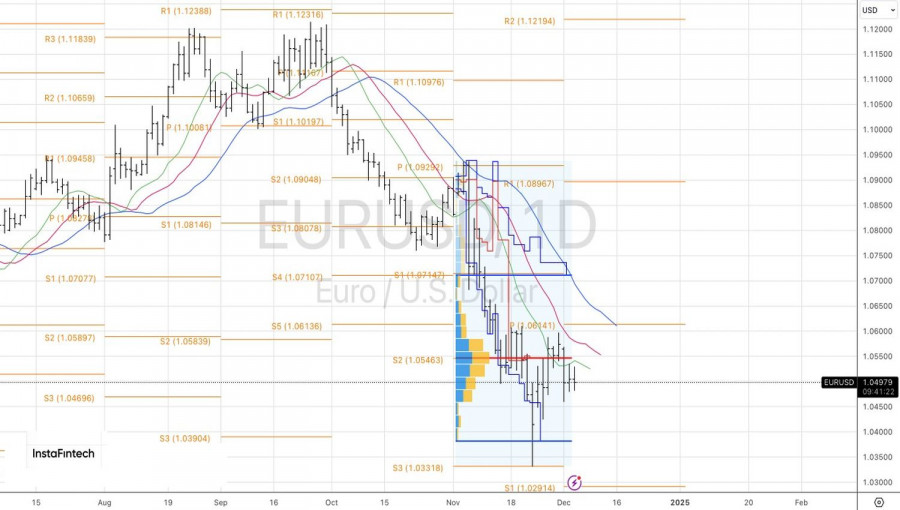

Two inside bars have formed on the daily EUR/USD chart, signaling significant uncertainty. It may be prudent to set pending orders: buy the euro against the dollar at $1.0535 and sell at $1.0480.

QUICK LINKS