Today, the EUR/USD pair is under pressure, despite comments from former French Prime Minister Sebastien Lecornu, who denied the possibility of new elections and assured that the budget would be approved by the end of the year, thereby easing some of the negative pressure on the euro. Earlier in the day, the euro came under increased pressure from French President Emmanuel Macron, who pushed for early elections amid growing criticism within his own team. Former allies joined the opposition parties' demands for elections or resignation, while rating agencies warned of a possible downgrade of France's sovereign credit rating if the political crisis drags on.

Across the Atlantic, the situation is not much better. Leaders of the Democratic and Republican parties in the U.S. Senate continue to seek ways to restore funding, as the "shutdown" has already lasted into its second week, and the chances of ending it this week have dropped to 23%, according to a Polymarket poll. The lack of progress has started to negatively affect market sentiment, boosting demand for the dollar and other safe-haven assets.

On Wednesday's economic calendar, the key event will be the release of the minutes from the latest Federal Reserve meeting. Comments from Fed officials are also expected during the U.S. session, along with a speech from ECB President Christine Lagarde.

From a technical perspective, oscillators on the daily chart have begun to gain negative momentum. Prices are also moving below the 100-day SMA, currently at 1.1625. If prices fail to hold this level, as well as the round 1.1600 mark, the pair will accelerate its decline toward the next round level at 1.1500. If prices manage to return above the 100-day SMA, then bulls may regain some hope for a positive outlook.

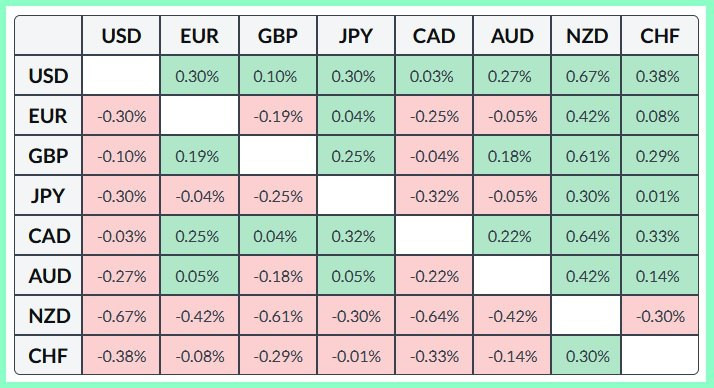

Below is a table showing the percentage change of the euro against major currencies for today. The euro has been strongest against the New Zealand dollar.

QUICK LINKS