The euro has slightly declined, while the British pound has maintained its strength. The USD/JPY pair has also somewhat recovered after strong fluctuations.

The lack of reports in the lead-up to the New Year holidays is affecting the situation. Traders, deprived of the usual fuel in the form of economic indicators, are forced to rely on less reliable sources of information, such as market sentiment and speculative forecasts. This leads to increased uncertainty and, consequently, more pronounced fluctuations in currency rates. Many financial institutions and major market players are going on holiday, reducing trading volumes and liquidity. In such conditions, even minor volumes of operations can cause significant price changes.

Today, the only data expected in the first half of the day is the total number of unemployed in France. However, one should not underestimate their potential impact on European markets. In the absence of other important news, even local data can serve as a signal about the overall state of the Eurozone economy, especially given the heightened caution among traders. A surprise in either direction from expected values can lead to short-term but noticeable fluctuations in the euro exchange rate relative to other currencies.

In the afternoon, there will be relative calm in official reports. However, this does not mean the complete absence of market movements. Traders will closely monitor any unofficial comments from central bank representatives and financial regulators.

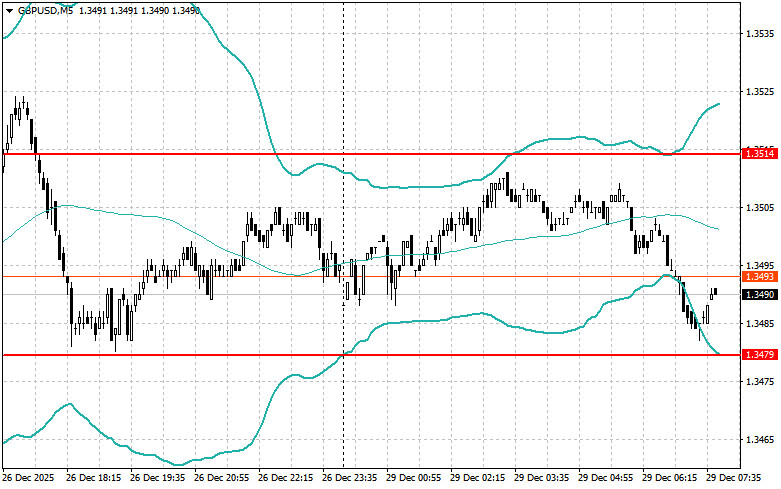

There are also no reports scheduled for the UK today, so significant movement in the GBP/USD pair is also unlikely.

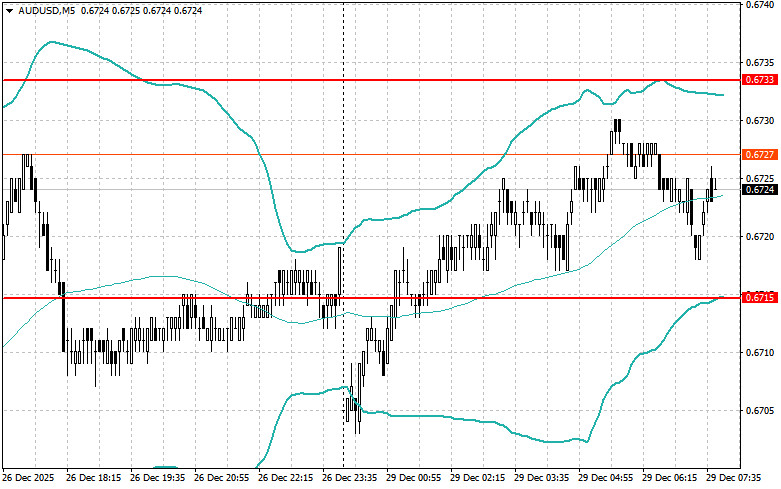

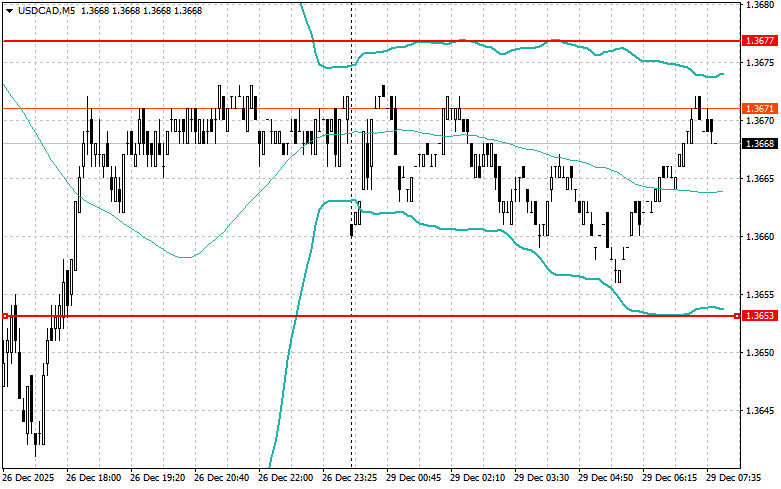

If the data meets economists' expectations, it is best to operate based on the Mean Reversion strategy. If the data comes in significantly above or below the economists' expectations, the Momentum strategy is preferable.

RYCHLÉ ODKAZY