Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Fitch Ratings revidoval výhled pro Volkswagen AG (OTC:VWAGY) (VW) z „stabilního“ na „negativní“, přičemž dlouhodobý rating emise (IDR) zůstal na „A-“. Změna výhledu je způsobena zhoršujícími se tržními podmínkami v USA a rostoucími náklady, které vyplývají z tarifů uvalených na automobilový sektor.

Agentura predikuje, že EBIT marže VW klesnou o 100-150 bazických bodů na přibližně 5 % a marže volného peněžního toku (FCF) zůstanou v následujících 12 měsících negativní, což klesne pod jejich citlivostní limity pro rating. I když se očekává střednědobé oživení díky nižším nákladům na restrukturalizaci a novým modelům, Fitch vidí omezený prostor pro zlepšení ratingu kvůli riziku implementace a dalším ekonomickým tlakům, které vyplývají z revidovaných predikcí pro většinu Evropy.

Potvrzení IDR odráží silnou kapitálovou strukturu a solidní podnikatelský profil VW, který zahrnuje dobrou geografickou diversifikaci a produktové portfólio pokrývající téměř všechny subsektory automobilového a komerčního vozového parku.

Fitch odhaduje, že 25% tarif zaměřený na evropské automobily určené pro americký trh způsobí pokles EBIT marže VW o 100-150 bazických bodů v roce 2025, kromě nedávných nákladů na restrukturalizaci v Evropě. Tyto tarify ovlivňují třetinu prodeje VW v USA a méně než 4 % jeho celkového prodeje, přičemž primárně dopadají na ziskové značky Audi a Porsche.

Ačkoliv společnost může přenést tento cenový nárůst na zákazníky, může to vést ke ztrátě podílu na trhu v USA. Ratingová agentura očekává, že provozní marže se do roku 2026 zotaví na 7 %. Prodloužené obchodní diskuse mezi politickými stranami o řešení a inflace způsobená tarify by však mohla potlačit poptávku po nových autech a dále negativně ovlivnit provozní marže.

Trade Review and Tips for Trading the Japanese Yen

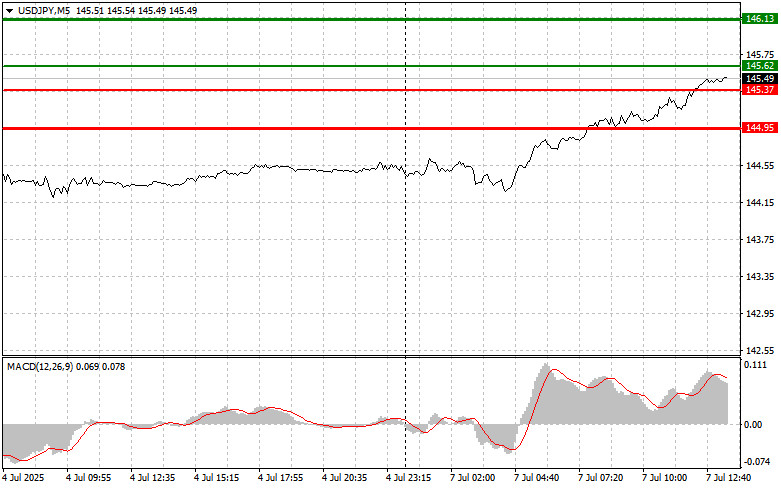

The price test at 145.10 occurred when the MACD indicator had already moved far above the zero mark, limiting the pair's upward potential. For this reason, I chose not to buy the dollar. A second test of 145.10 provided an entry point for implementing Scenario #2 for a sell trade, but the expected downward move did not materialize, resulting in a loss on the position.

No economic data from the U.S. is expected in the second half of the day, nor are there any scheduled speeches from Federal Reserve officials, so the market's primary focus will be on Trump's statements regarding trade tariffs. Investors are anxiously waiting, trying to predict which countries will face the highest tariffs and which may avoid major issues. This uncertainty traditionally weighs on markets, supporting the dollar and putting pressure on risk assets — as we are currently seeing in the USD/JPY pair. Let me remind you that Japan has not signed a trade agreement with the U.S., so the weakening trend in the yen may persist over the coming days, at least until July 9, when the new tariffs are officially announced.

As for intraday strategy, I will primarily rely on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1:Today, I plan to buy USD/JPY at the entry point around 145.62 (green line on the chart) with the target set at 146.13 (thicker green line on the chart). Around 146.13, I will close my buy position and open a short position in the opposite direction (expecting a 30–35 point move down from that level). A continued uptrend in the pair could support further gains.Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if the price tests 145.37 twice in a row, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a reversal upward. A rise to the opposite levels of 145.62 and 146.13 can then be expected.

Sell Signal

Scenario #1:Today, I plan to sell USD/JPY after a breakout below 145.37 (red line on the chart), which could lead to a quick drop in the pair. The main target for sellers would be 144.95, where I plan to close the short position and open a long trade in the opposite direction (expecting a 20–25 point bounce from that level). Downward pressure on the pair is unlikely to return today.Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2:I also plan to sell USD/JPY if the price tests 145.62 twice in a row, while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and result in a market reversal downward. A decline toward 145.37 and 144.95 can then be expected.

Chart Legend:

Important:Beginner traders in the Forex market should make entry decisions with great caution. It's best to stay out of the market before the release of major fundamental reports to avoid being caught in sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't practice proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one I've presented above. Making impulsive decisions based on the current market situation is an inherently losing strategy for any intraday trader.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RYCHLÉ ODKAZY