The EUR/USD currency pair maintained its movement pattern on Thursday, continuing to trade within a sideways channel on the hourly timeframe for most of the day. Even the news that many traders had hoped would influence the market had little impact on trading. The euro remains in a sideways movement, not only on the hourly timeframe but also on the daily one, hovering near the upper boundary. We still expect a decline in the value of the European currency, as the bulls have had sufficient time but lack compelling reasons to drive significant growth.

The main news of the day was Donald Trump's announcement of a 25% tariff on goods from the European Union. This statement was accompanied by his usual accusations of unfair treatment toward the United States. According to Trump, the EU was created to deceive and profit from the U.S. It is important to note that the 25% tariffs will apply to all goods imported from the European Union.

In his typical style, Trump stated that he loves the EU countries but emphasized that he is now the President of the United States, and no one will be allowed to take advantage of America. There is no doubt that the EU will soon introduce tariffs on American imports in response. However, the European Union will likely lose in this trade war. For Brussels, reaching an agreement with Washington would be the better option. At the same time, it is clear what Trump is aiming for—a deal that fully satisfies him personally. Naturally, the terms of this deal will not be favorable for the European Union or at least not as beneficial as the EU would like.

The US exports far fewer goods to the EU than the EU exports to the US, which explains the trade deficit for America. But who is to blame for this? Is it Europe's fault that American products are of lower quality than European ones and that US consumers prefer European goods? Regardless, the European Union cannot simply ignore this situation, as failing to respond would risk its status as a key geopolitical player.

Despite his claims of "sincere love," Trump has consistently shown a deep disrespect for EU countries. He believes that the fate of Ukraine should be determined solely by the US and Russia. While the US President is entitled to his opinion, the EU has also played a role (albeit indirectly) in this conflict and has much stronger connections to both Russia and Ukraine than the US does. However, Trump does not think that EU nations should have a voice in these matters; he insists they should only spend more money on American goods, NATO, defense, and support for Ukraine, while he makes all the decisions. Unsurprisingly, protests against Trump began in the US just a month after his announcements. Four years from now, American voters might be so eager to see Trump leave office that they would consider voting for Batman.

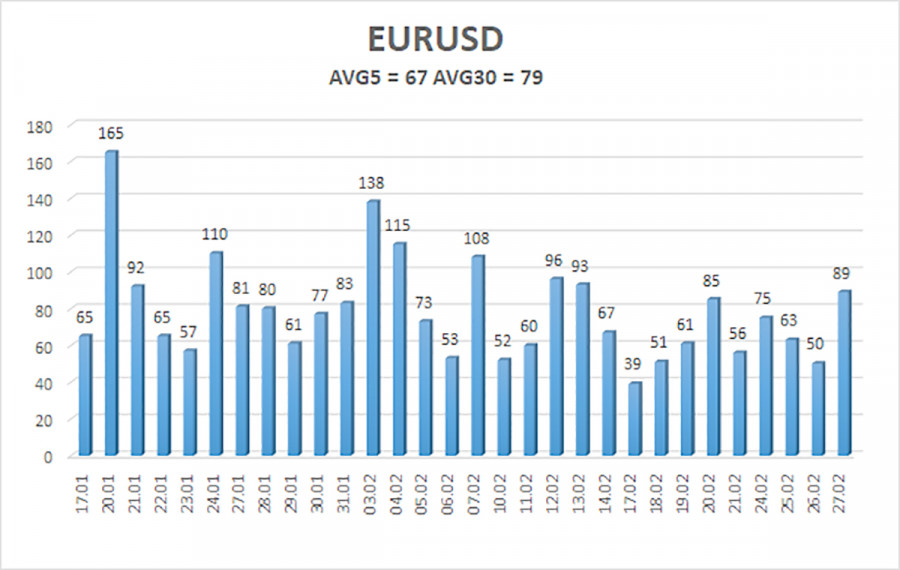

The average volatility of the EUR/USD currency pair over the last five trading days, as of February 28, is 67 pips, which is classified as "average." We expect the pair to move between the levels of 1.0348 and 1.0482 on Friday. The long-term regression channel remains downward, and the bearish trend persists. The CCI indicator last entered the oversold area, after which a new upward movement started but has already ended.

S1 – 1.0376

S2 – 1.0315

S3 – 1.0254

R1 – 1.0437

R2 – 1.0498

R3 – 1.0559

The EUR/USD pair continues its upward correction. For months, we have consistently stated that we expect the euro to decline in the medium term, and nothing has changed. The dollar still has no fundamental reason for a medium-term decline, except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0376 and 1.0348. If you trade based solely on technical analysis, long positions can be considered if the price is above the moving average, with targets at 1.0559 and 1.0582. However, as we can see, the price has not even managed to break out of the flat range on the daily timeframe. Any upward movement is still classified as a correction on the daily chart.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

RYCHLÉ ODKAZY