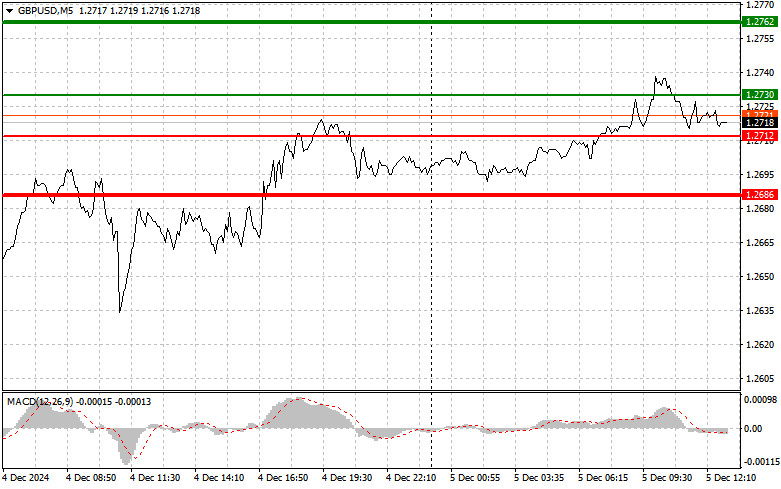

Analysis of Trades and Trading Advice for the British PoundThe test of the 1.2725 level occurred when the MACD indicator was well above the zero line; this limited the pair's upward potential. For this reason, I refrained from buying the pound. Shortly after, another test of 1.2725 occurred while the MACD was in the overbought zone. While this allowed Scenario 2 for selling to be implemented, it did not lead to a significant decline in the pound.

Strong UK construction sector data prevented the pound from falling earlier in the day. The data exceeded economists' forecasts. The construction sector, a key indicator of economic stability, showed growth due to increased investment and rising demand for housing. Surveys in the construction industry showed steady growth in new orders, offering hope for further economic recovery. However, the risk of rising interest rates in the UK could pose additional challenges for the sector. Monitoring future indicators closely will be essential.

Later, reports on initial jobless claims and the trade balance are expected. Weekly jobless claims typically have little market impact, especially with a more critical unemployment report due tomorrow. Against this backdrop, demand for the pound may persist. Although the trade balance is not a primary indicator for currency traders, its data can influence trading decisions and should not be overlooked.

Scenario 1:Buy the pound today if the price reaches 1.2730 (green line on the chart); aim for a rise to 1.2762 (thicker green line on the chart). At 1.2762, close long positions and open short positions, expecting a 30-35 point move in the opposite direction. The pound is likely to rise today only if U.S. data is very weak.Note: Before buying, ensure that the MACD indicator is above the zero line and just beginning its upward movement.

Scenario 2:Buy the pound today if there are two consecutive tests of 1.2712, and the MACD indicator is in the oversold zone. This should limit the pair's downward potential and prompt an upward market reversal, with targets at 1.2730 and 1.2762.

Scenario 1:Sell the pound today after breaking below 1.2712 (red line on the chart); aim for a decline to 1.2686. At 1.2686, close short positions and open long positions, expecting a 20-25 point move in the opposite direction. Sellers will assert themselves if the day's high is retested or broken.Note: Before selling, ensure that the MACD indicator is below the zero line and just beginning its downward movement.

Scenario 2:Sell the pound today if there are two consecutive tests of 1.2730, and the MACD indicator is in the overbought zone. This should limit the pair's upward potential and trigger a downward reversal, with targets at 1.2712 and 1.2686.

Important Note for Beginner Traders:Beginner Forex traders should exercise great caution when making market entry decisions. Avoid trading during the release of significant reports to minimize exposure to sudden price fluctuations. If you choose to trade during news events, always use stop-loss orders to limit potential losses. Trading without stop-losses or proper money management, especially with large volumes, can lead to rapid account depletion.

A clear trading plan, such as the one outlined above, is essential for success. Spontaneous trading decisions based on the current market situation often lead to losses for intraday traders.

RYCHLÉ ODKAZY