Akcie společnosti Baidu Inc (NASDAQ:BIDU) ve čtvrtek klesly na hongkongské burze, protože obavy ze zpomalení příjmů z reklamy převážily nad jinak silnými výsledky za první čtvrtletí, přičemž zvláštní pozornost byla věnována vyhlídkám internetového giganta v oblasti umělé inteligence.

Akcie společnosti Baidu v Hongkongu klesly do polední přestávky o 3,3 % na 83,30 HK$, zatímco index Hang Seng poklesl o 0,6 %. Ztráty společnosti Baidu přišly také v kontextu obecnějšího oslabení technologického sektoru.

Společnost zaznamenala za první čtvrtletí lepší než očekávané výsledky, přičemž celkové tržby vzrostly o 3 % na 42,45 miliardy juanů (4,50 miliardy USD), což je více než odhady agentury Reuters ve výši 30,9 miliardy juanů.

Tržby z online reklamy, která je stále největším zdrojem příjmů společnosti, však poklesly o 6 % na 17,31 miliardy juanů, čímž rovněž nedosáhly odhadů ve výši 17,39 miliardy juanů.

Very few macroeconomic reports are scheduled for Thursday. Essentially, the only report to note is the weekly jobless claims in the US, which is straightforwardly a secondary report. Recall that this week saw the release of the ADP employment report and the JOLTS open vacancies report. These are much more significant reports, but the market reacted weakly to them, as it continues to await important reports such as Non-Farm Payrolls, unemployment rates, and consumer price indexes, which will be published next week.

No fundamental events are scheduled for Thursday. However, traders will not lack information during the penultimate trading day of the week. Last night, the results of the last FOMC meeting of the year were announced. The key rate was lowered by 0.25% for the third consecutive time, and the committee's expectations did not become more dovish (according to the dot plot). Jerome Powell announced a pause in monetary easing until the inflation indicator shows a sustainable trajectory toward the target level of 2%. Thus, the outcomes of the FOMC meeting could somewhat be viewed as favorable for the dollar. However, the dollar has risen for too long and too often in recent months without a clear reason. It appears that its reserves of luck have been exhausted.

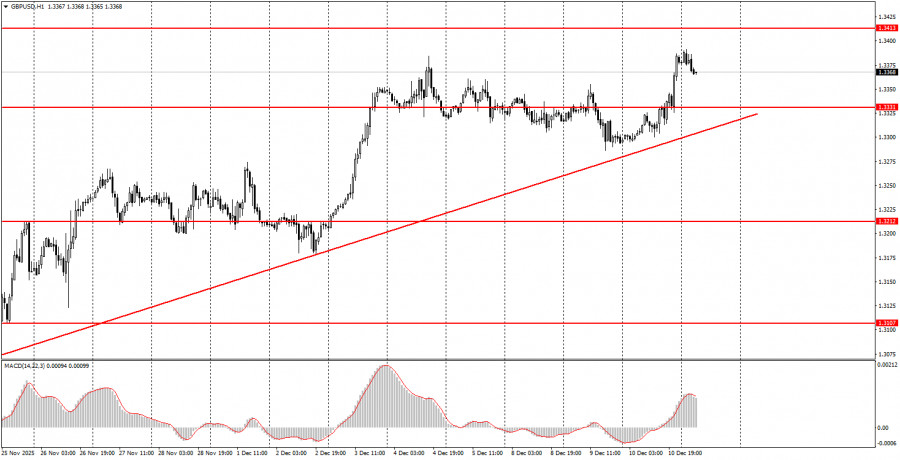

During the third trading day of the week, both currency pairs are likely to gravitate towards growth, as upward trends continue in both cases. The euro is targeting 1.1745, while the British pound is aiming for 1.3413. Volatility on Thursday may decrease, as there will be no significant events.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.

QUICK LINKS