Brusel – Spojené státy a Evropská unie si v minulých dnech vyměnily dokumenty k jednání o obchodu a clech. Uvedl to server listu Financial Times (FT) s odvoláním na čtyři informované zdroje. Dokumenty podle FT vymezují oblasti diskuse od cel po digitální obchod a investiční příležitosti.

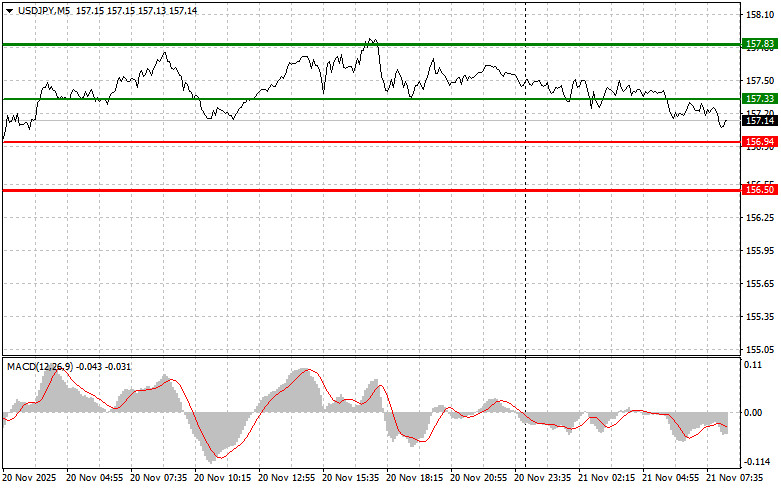

The price test at 157.45 coincided with the MACD indicator already moving significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the dollar and missed a good upward move.

After data showed the US unemployment rate rising to 4.4% in September, the dollar weakened against the Japanese yen. Weaker-than-expected unemployment data contributed to the decline in the US currency's value, as market participants became cautious about the US economy's outlook. However, the non-farm payroll report mitigated the negative impact of the unemployment rate report. The number of new jobs created in September exceeded expectations, underscoring the labor market's resilience. Such a reaction in the currency market shows the complex relationship between different economic indicators and expectations regarding monetary policy. In the short term, the yen is likely to remain under pressure due to imminent decisions by the Japanese government regarding economic stimulus.

Regarding the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

QUICK LINKS