Today, the euro, pound, Australian dollar, and Canadian dollar worked well using the Mean Reversion strategy. I did not trade via Momentum.

Mixed data on services sector activity in the eurozone countries led to a surge in euro volatility, while similarly strong reports from the UK supported the pound in the first half of the day, halting the development of a bearish market. Overall, all instruments managed to recover part of their positions against the U.S. dollar during the first half of the day, after demand for the dollar rose sharply yesterday.

Traders seem to remain optimistic about the outlook for the European economy despite persistent concerns about inflation and tensions in the manufacturing sector. However, it is difficult to say that this confidence is tied to expectations of looser monetary policy from the European Central Bank. In recent days, more and more policymakers have spoken about the need for a pause in the rate-cutting cycle.

In the second half of the day, reports are expected on job openings and labor turnover from the Bureau of Labor Statistics, as well as changes in factory orders, followed by remarks from FOMC member Neel Kashkari. These events will undoubtedly influence currency market dynamics. The JOLTS report, in particular, can shed light on labor market conditions, showing how actively employers are hiring and how often workers are changing jobs. A decline in job openings could signal slowing economic growth, putting pressure on the dollar.

Meanwhile, data on changes in factory orders will provide insights into future industrial production. Rising orders typically precede increased production in the following months. Equally important will be Neel Kashkari's speech. His comments on the current economic situation and monetary policy outlook may give traders an idea of how the Federal Reserve views future developments. Recently, more policymakers have been talking about rate cuts in September, which is also negative for the dollar.

In the case of strong data, I will rely on the Momentum strategy. If there is no market reaction to the releases, I will continue to use the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

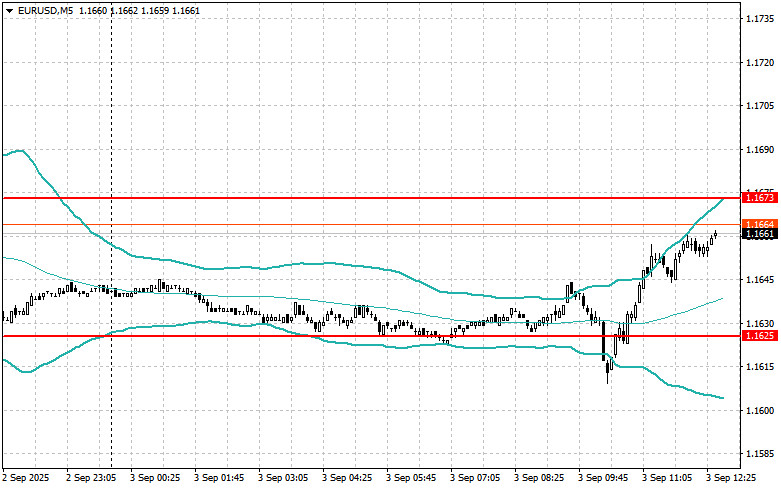

For EUR/USD

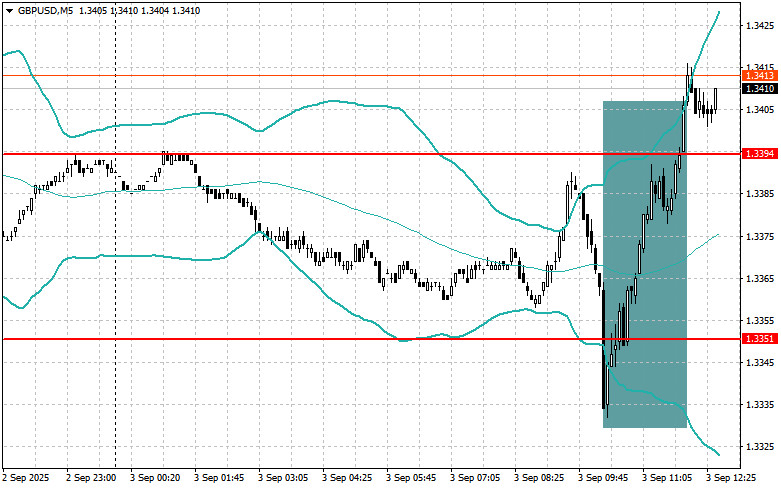

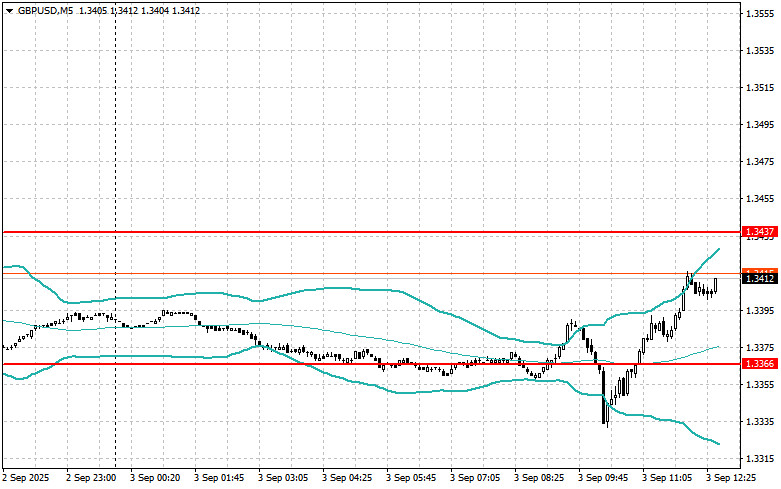

For GBP/USD

For USD/JPY

Mean Reversion Strategy (reversal) for the second half of the day:

For EUR/USD

For GBP/USD

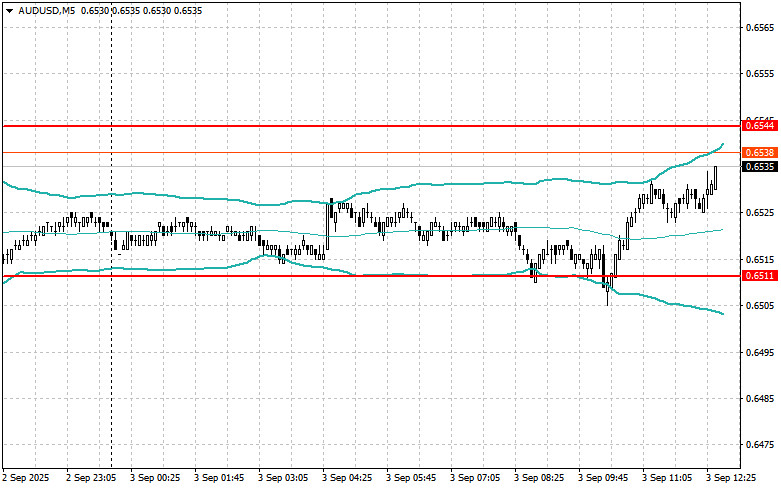

For AUD/USD

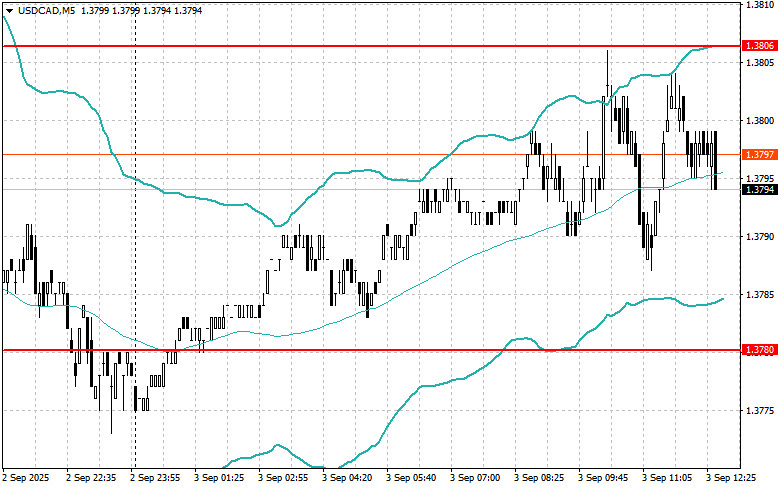

For USD/CAD

QUICK LINKS