Despite the ongoing decline in government bond yields, the dollar strengthened slightly during the Asian trading session.

The US Dollar Index (USDX) is climbing, approaching the 98.00 mark ahead of the publication of key inflation data (PCE). USDX is recovering after recent losses, supported by positive US Q2 GDP data, which showed 3.3% annual growth—exceeding initial estimates.

*) See also: InstaForex trading indicators for USDX

Today, market participants await the release of the July Personal Consumption Expenditure (PCE) price index. The annual headline PCE is forecast to grow by 2.6%, while core PCE (excluding food and energy) is expected at 2.9%. The monthly core PCE number will likely have the greatest impact. A print of 0.5% or above could prompt further dollar strength, while a reading of 0.2% or less could put pressure on the dollar. This is the last key inflation indicator ahead of the September Fed meeting.

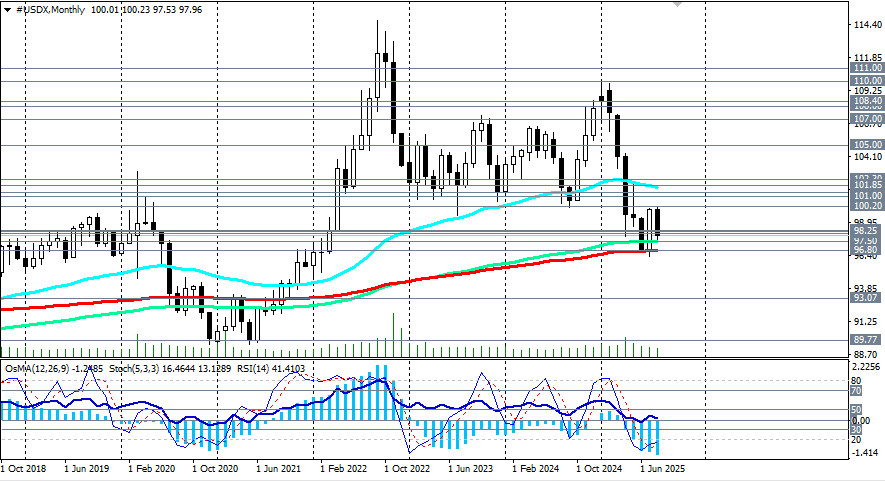

From a technical standpoint, a further decline in the USDX would look like a break below the 97.50 support level (EMA144 on the monthly chart) and a move towards the strategic support at 96.80 (EMA200 on the monthly chart). A break below this level would push the dollar and the USDX into a global bear market zone, making short dollar positions preferable in the long term.

In the alternative scenario, if PCE data is strong, today's rally may extend to the resistance zone at 98.15 (EMA200 on the 1-hour chart), 98.25 (EMA200 on the 4-hour chart), and 98.55 (EMA50 on the daily chart); a breakout above these could trigger further gains toward the "round" 100.00 mark. However, a stronger rally under the current conditions and with expectations of Fed policy easing is unlikely.

To enter a medium- and long-term bull market, the price must surpass key resistance levels at 101.00 (the EMA200 on the daily chart) and 101.85 (the EMA200 on the weekly chart).

For now, under the main scenario, short positions on the dollar remain preferable.

Positive GDP data and lower initial jobless claims in the US are supportive of the dollar. However, Powell's comments at the Jackson Hole Symposium, which recognized rising risks to the labor market and concerns about Fed independence, may limit further dollar growth. Today's PCE release will have the greatest influence on the dollar's near-term dynamics and expectations regarding the Fed's monetary policy.

QUICK LINKS