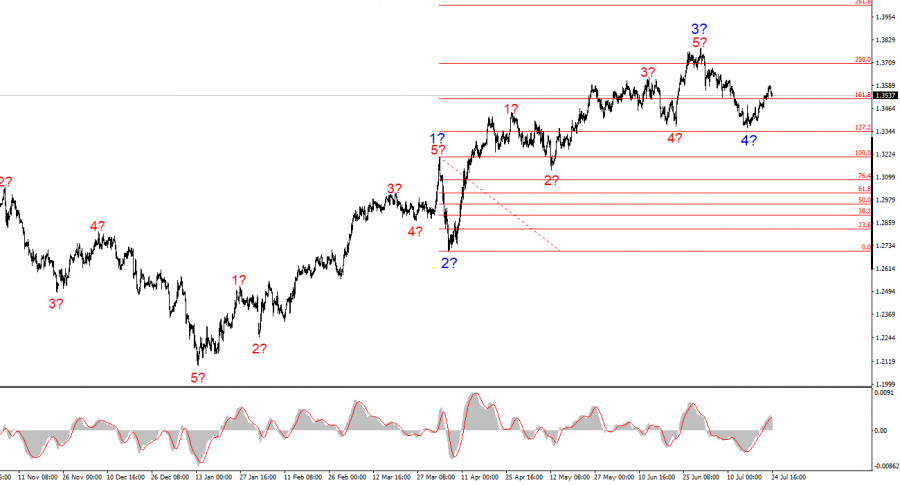

The wave pattern for the GBP/USD pair continues to indicate the formation of an upward impulsive wave pattern. The wave picture is almost identical to that of EUR/USD, as the U.S. dollar remains the sole driver of the current market trend. Demand for the dollar is falling across the board, leading many instruments to display similar dynamics. Wave 2 of the upward trend segment has taken a single-wave form. The presumed wave 3 appears convincing and complete, so I expect the formation of a corrective structure, with the first wave of that correction possibly already completed. The anticipated wave 4 may also take the form of a single wave.

It is important to remember that current developments in the currency market are heavily influenced by Donald Trump's policies—not just trade-related ones. Occasionally, positive news comes out of the U.S., but the market remains wary due to ongoing uncertainty in the economy, inconsistent decisions and statements from Trump, and the White House's hostile, protectionist stance in foreign policy. As a result, the dollar must overcome significant skepticism to convert even positive news into increased market demand.

The GBP/USD pair declined by several dozen basis points on Thursday, although the range of movement remained quite limited. This did not change even after the start of the U.S. session. In the morning, business activity indexes were published in the UK, but I can say with certainty that the decline in the pound began earlier. Once again, it seems that some market participants gain access to UK statistics before the official reports are released. The business activity indices indeed came in weaker than expected. While manufacturing activity showed a slight increase, it still missed market forecasts, and services activity fell to 51.2 versus expectations of 53. As a result, the decline in the services index became the main driver behind the modest weakening of the British currency. Still, I repeat: the decline began several hours before the statistics were released.

Does the local decline in the pound affect the wave pattern? Definitely not. Even if wave 4 ultimately develops into a three-wave structure, the upward trend segment remains intact. It's worth remembering that changes in the nature of the news background can significantly impact the wave structure, as was the case earlier this year. But at present, there is no reason for concern.

The market continues to disregard negative UK reports, the Bank of England's monetary policy easing, the Federal Reserve's status quo on rates, and the relatively strong U.S. labor market and unemployment data. The only factors it remains focused on are the global trade war and the potential resignation of Jerome Powell. Although Trump has reportedly decided to let Powell finish his term and abandoned plans to remove him, an investigation has been launched into Powell over financial misconduct related to the renovation of Federal Reserve buildings. The market remains alert and ready to resume selling the U.S. dollar at any moment.

The wave pattern for the GBP/USD pair remains unchanged. We are observing the development of an upward, impulsive trend segment. Under Donald Trump, markets may still face many shocks and reversals that could seriously alter the wave picture, but for now, the main scenario remains intact. The targets of the current upward trend are now located near the 1.4017 level, which corresponds to the 261.8% Fibonacci level of the assumed global wave 2. Currently, a corrective wave sequence is unfolding within wave 4. According to classic wave theory, it should consist of three waves, though the market could limit this to just one.

Key Principles of My Analysis:

QUICK LINKS