UnitedHealth Group požaduje po poskytovatelích zdravotní péče splacení půjček, které od společnosti obdrželi po loňském kybernetickém útoku na její technologickou jednotku Change Healthcare (NASDAQ:CHNG), uvedli v pátek dva poskytovatelé.

Největší americká zdravotní pojišťovna půjčila 9 miliard dolarů poskytovatelům, kteří se potýkali s problémy po masivním útoku ransomwaru v únoru loňského roku, kdy došlo k odstavení platebních a zpracovatelských systémů, přičemž obnovení některých z nich trvalo několik měsíců.

Poskytovatelé zdravotní péče uvedli, že v posledních měsících obdrželi e-maily od jednotky Optum společnosti UnitedHealth (NYSE:UNH), která požadovala splacení celé částky a hrozila zadržením úhrad.

Jako první o tom informoval deník Wall Street Journal.

Jednotka Change Healthcare společnosti UnitedHealth ve svém prohlášení uvedla, že plánuje „spolupracovat s poskytovateli“ na možnostech splácení.

„Nyní, více než rok po události a po obnovení služeb, jsme zahájili proces navrácení bezúročného financování, které jsme poskytovatelům poskytli,“ uvedl mluvčí společnosti Change Healthcare.

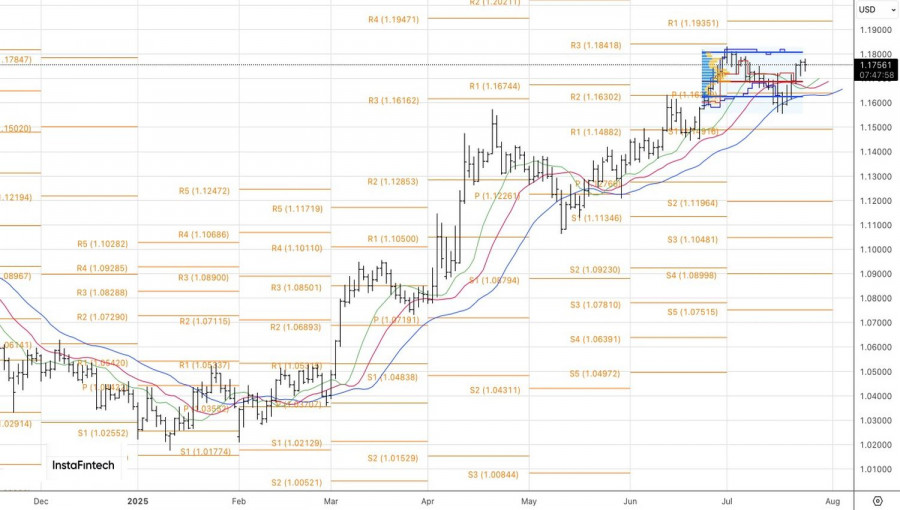

There was no "sell the fact" reaction. One of the reasons behind the recent EUR/USD rally was the expectation that the deposit rate would be held at 2% following the European Central Bank's July meeting. The idea was that the ECB is nearing the end of its monetary easing cycle, while the Federal Reserve is ready to resume it. However, Christine Lagarde's rhetoric brought euro sellers back down to earth.

Things initially looked promising for the EUR/USD bears. Lagarde pointed out that higher actual and expected tariffs, a stronger euro, and ongoing geopolitical uncertainty are making companies hesitant to make investment decisions. If trade and geopolitical risks were eliminated, it would boost economic activity.

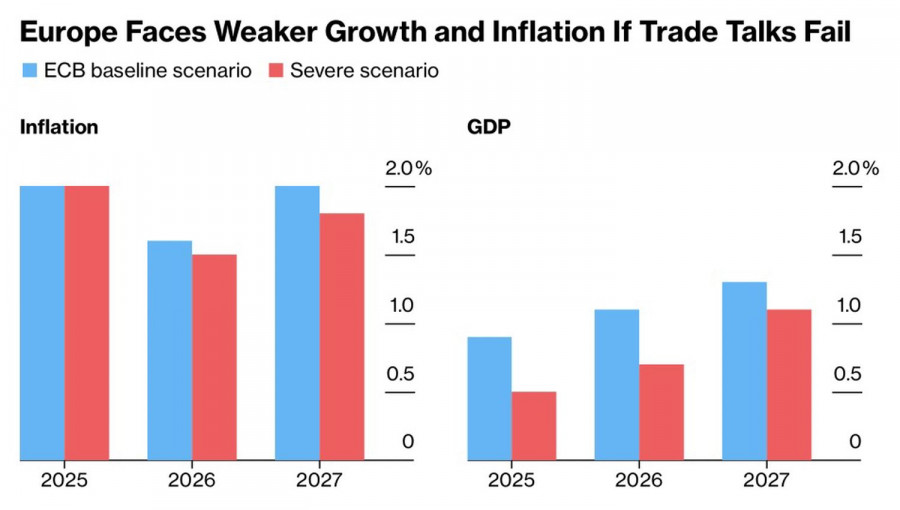

And then it got even more interesting. According to Lagarde, falling demand for European exports and the redirection of goods from countries with excess capacity risk slowing inflation. This combination of slower GDP growth and continued disinflationary pressure could compel the ECB to resume its monetary easing cycle. Unsurprisingly, EUR/USD initially reacted to the ECB president's press conference with a decline.

However, the music didn't play long for the EUR/USD bears. Lagarde emphasized that the ECB does not target exchange rates. It merely takes EUR/USD dynamics into account when forecasting inflation. Judging by her comments, the high euro exchange rate is not a concern for the central bank. Wages are moving in the right direction, corporate profits are offsetting rising labor costs, and the ECB sees relatively favorable economic growth.

She repeated the familiar mantra that the ECB is in a comfortable position, which renewed interest in buying the euro. Not even the sixth consecutive drop in US jobless claims over the past six weeks helped the dollar. Such dynamics suggest the US labor market remains strong, allowing the Fed to be in no rush to cut rates.

On the other hand, the US reaching trade agreements with Japan, the Philippines, and Indonesia, as well as the EU's willingness to backtrack on 15% tariffs, reduces trade uncertainty. This boosts global risk appetite and increases demand for the euro as a risk-on currency. At the same time, it gives the Fed room to return to monetary easing, which puts pressure on the US dollar.

Under these conditions, the EUR/USD uptrend appears solid, and traders have an opportunity to buy dips.

Technically, the daily EUR/USD chart is showing two candlesticks with long lower shadows. This signals weakness among the bears and provides justification to increase long positions initiated from the 1.1640 level.

QUICK LINKS